400 Attendees Aged 40-70 Flock to Gangnam-gu's 'Inheritance and Gift Tax Saving Special Lecture'

Minerva Owl: "For Billion-Won Asset Holders, Pre-Gift Is the Best Method"

Tax Saving Tips, but Children Find It Hard to Bring Up First

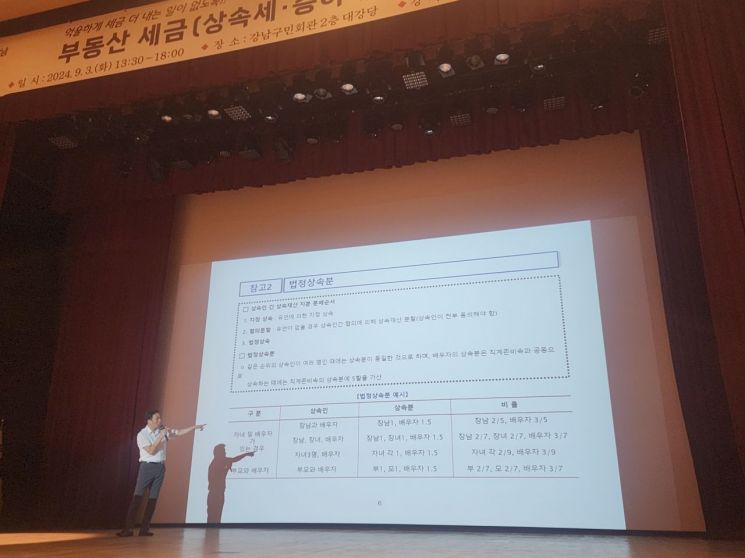

On the 3rd, about 400 residents gathered at Gangnam-gu's 'Inheritance and Gift Tax Saving Special Lecture.' Kim Hoyong, CEO of Mirjin Tax, is explaining ways to save on inheritance tax. Photo by Kim Minjin enter@

On the 3rd, about 400 residents gathered at Gangnam-gu's 'Inheritance and Gift Tax Saving Special Lecture.' Kim Hoyong, CEO of Mirjin Tax, is explaining ways to save on inheritance tax. Photo by Kim Minjin enter@

“What is the best way to reduce inheritance tax? It is advance gifting. But what would the atmosphere be like if a child visits their parents during the Chuseok holiday and asks them to do advance gifting because it has good tax-saving effects?”

When Kim Hoyong, CEO of Mirjin Tax, who served as the lecturer for the ‘Inheritance and Gift Tax Saving Special Lecture’ held on the 3rd in Gangnam-gu, Seoul, asked the audience this question, laughter erupted. About 400 residents aged 40 to 70 attended the tax-saving lecture held at the Gangnam-gu Community Center auditorium, showing high interest in ways to save on inheritance and gift taxes.

CEO Kim emphasized, “In Korea, inheritance and gift tax rates are very high, ranging from 10% to 50%. The main reason for studying inheritance and gift taxes is to save taxes, and if I had to pick the best method for tax saving, it is advance gifting.”

He explained, “If cash or real estate is gifted to children and inheritance occurs within 10 years, there is no tax-saving effect. However, if inheritance occurs after 10 years, a significant amount of tax can be saved.” He added, “If advance gifting is made to someone other than a legal heir under civil law, and inheritance occurs after 5 years, the gifted property is not added to the inheritance property, so the inheritance tax burden can also be greatly reduced.” Using grandchildren, sons-in-law, daughters-in-law, direct ascendants, or corporations is also a good method.

CEO Kim said, “Many people inquire about making urgent gifts when their parents’ health suddenly deteriorates without preparing for inheritance,” and added, “If the parents are expected to pass away within 1 to 2 years, it is difficult to expect significant tax-saving effects even if gifts are made in advance.”

In addition, CEO Kim explained various ‘tips’ related to inheritance and gift tax savings, such as joint tax liability, generation-skipping additional taxation, use of personal and unified deductions, special exemptions for inherited housing, and gift property addition amounts. He also shared sensitive precautions or common misunderstandings in the market, such as precautions when gifting cash, investigation of the source of funds, post-management of debts, and tax issues related to low-price transfers of houses to related parties.

Yoon Mira, head of the Tax Administration Team in Gangnam-gu, said, “This time, it was so popular that 500 people applied by the second day of registration.” In fact, out of 223 expert tax consultations conducted in Gangnam-gu this year, 97 were related to inheritance and gift tax consultations, showing high interest. Following the capital gains tax special lecture in April, Gangnam-gu prepared this second installment focusing on inheritance and gift tax. On the 17th of next month, the third lecture will cover major amendments to national and local tax laws and tax-saving tips for capital gains tax and comprehensive real estate tax.

CEO Kim said, “Inheritance and gift tax lectures should be attended and understood together by parents and children to avoid misunderstandings and distrust,” and added, “To reduce inheritance tax, tax-saving plans must be found in advance and a plan must be made before passing away.” CEO Kim, who served as the lecturer, is an expert in real estate tax who previously worked at the National Tax Service Investigation Bureau and the Ministry of Strategy and Finance’s Taxation Office, and is active under the nickname ‘Minerva Owl.’

Gangnam-gu will hold a special lecture on major amendments to national and local tax laws, as well as tax-saving tips for capital gains tax and comprehensive real estate tax, on October 17. The photo shows a capital gains tax lecture held last April. Provided by Gangnam-gu. Photo by Gangnam-gu.

Gangnam-gu will hold a special lecture on major amendments to national and local tax laws, as well as tax-saving tips for capital gains tax and comprehensive real estate tax, on October 17. The photo shows a capital gains tax lecture held last April. Provided by Gangnam-gu. Photo by Gangnam-gu.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.