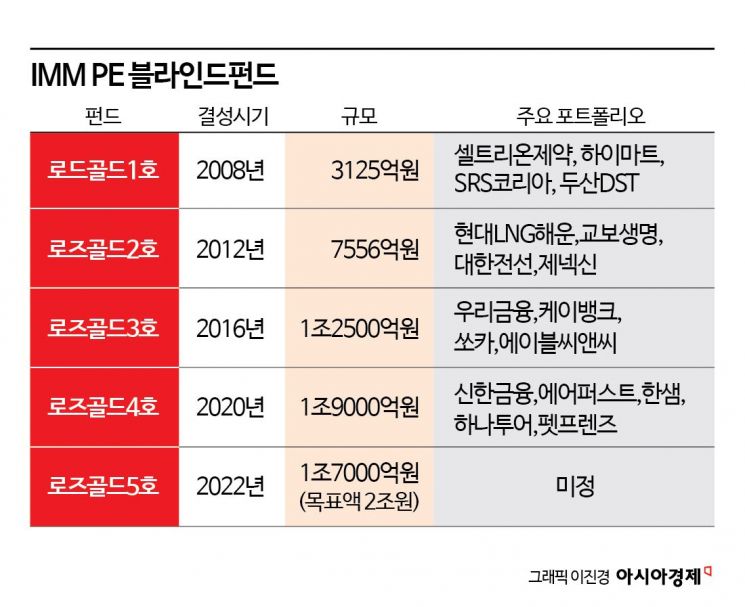

IMM Private Equity (IMM PE) has successfully raised 1.7 trillion KRW in blind fund capital from 38 institutions. It is expected that fundraising will reach 2 trillion KRW by the end of the year.

According to the investment banking (IB) industry on the 5th, IMM PE began fundraising for 'Rosegold No. 5' in the second quarter of 2022 and raised approximately 1.7 trillion KRW in about a year and a half.

The major investors include the National Pension Service, Teachers' Pension, Korea Post Finance, Private School Teachers' Pension, NongHyup Central Association, Shinhan Bank, Korea Investment & Securities, Ministry of Employment and Labor Industrial Accident Compensation Insurance Fund, Government Employees Pension Service, Military Mutual Aid Association, KB Kookmin Bank, Shinhan Innovation Growth Fund, Korea Scientists & Engineers Mutual Aid Association, Kiwoom Securities, Hana Bank, Korea Local Government Officials Mutual Aid Association, Shinhan Asset Management, NH Investment & Securities, NongHyup Bank, Samsung Securities, KB Securities, Korea Securities Finance Corporation, Korea Specialty Contractors Mutual Aid Association, SGI Seoul Guarantee, KB Insurance, KDB Capital, Shinhan Investment Corp., Mirae Asset Securities, NH Capital, NH Insurance, KB Capital, Daegu Bank, Shinhan Capital, IBK Industrial Bank of Korea, and Korea Development Bank. Additional funds are expected to be raised from major domestic insurance companies and overseas institutional investors by the end of the year.

This fundraising was conducted through a multi-closing method with several rounds of funding. The industry evaluates that IMM PE has stably raised funds amid concerns about economic recession, interest rate hikes, and a tightening of capital as LPs (limited partners) reduce their investment projects.

Recently, IMM PE surpassed 10 trillion KRW in assets under management (AUM) and has executed a total of 44 buyouts and growth capital investments to date. IMM PE is delivering results not only in fundraising but also in buyouts. Recently, IMM PE formed a consortium with IMM Investment and successfully acquired Ecobit, an environmental company with the largest landfill capacity in Korea. The acquisition, based on 100% equity, is valued at 2.7 trillion KRW and is expected to be one of the largest mergers and acquisitions (M&A) deals this year. The IMM consortium acquired Ecobit by outbidding the U.S.-based private equity firm Carlyle, which participated in the main bidding.

Previously, IMM PE sold 100% equity of Genewone Science, Korea's top synthetic drug contract development and manufacturing organization (CDMO), for 750 billion KRW. IMM PE's invested capital was approximately 520 billion KRW. The internal rate of return (IRR) is reported to be about 20%. Following the minority stake sale of Airfirst last year, the sale of Genewone Science marks smooth progress in the exit process of the portfolio companies of the 4th blind fund.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.