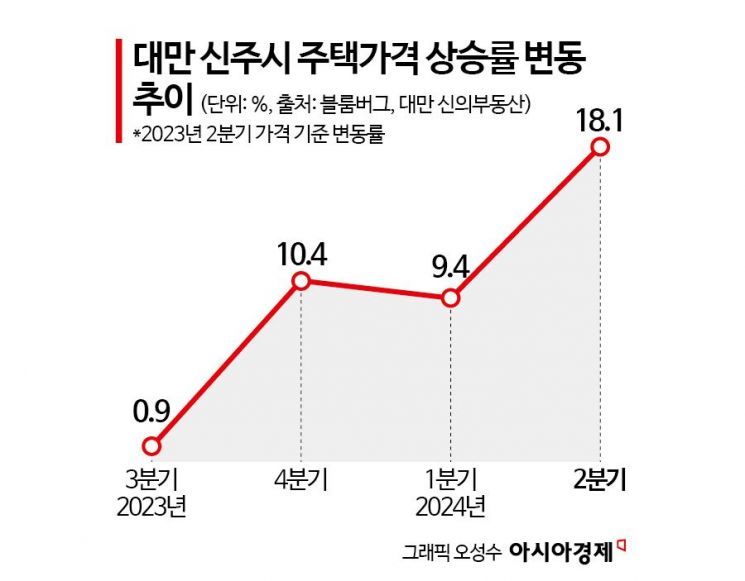

Shinju Soars 18% Compared to Q2 Last Year

Loan Interest Rates at 2% Range with 40-Year Terms

Taiwan Government Decides to Halt Loan Easing and Tighten Controls

The Taiwanese real estate market is heating up despite the risk of a military invasion by China. In particular, housing prices are soaring around Hsinchu City, where the headquarters of TSMC, the world's largest foundry (semiconductor contract manufacturer), is located. Until last year, the government, concerned about rising military tensions across the Taiwan Strait, implemented various real estate stimulus measures, but it is now tightening loans amid fears of speculative overheating. With the global surge in semiconductor demand driven by the generative artificial intelligence (AI) boom, Taiwan's economy has grown significantly, and market funds are flowing into real estate, suggesting that the real estate fever will continue for some time.

Housing Prices in Hsinchu City, Home to TSMC, Soar 18% Since Q2 Last Year

According to Bloomberg News, in the housing price increase index for major Taiwanese cities in the second quarter of this year compiled by Taiwanese real estate company Sinyi Realty, Hsinchu City, where TSMC's headquarters is located, saw housing prices rise by 18.1% compared to the second quarter of last year. During the same period, housing prices in major Taiwanese cities rose by 12.1%, and the capital Taipei also increased by 7.9%.

As housing prices in Taiwan rise sharply, it is becoming increasingly difficult for ordinary workers to own homes. According to statistics from Taiwan's Ministry of the Interior, the median housing sale price in Taipei is 16.1 times the median household annual income. This means that a middle-class family would have to save money for more than 16 years without spending a penny to buy a house. This figure is considerably higher compared to other expensive cities such as New York (7.1 times) and Singapore (3.8 times).

The rise in Taiwan's real estate prices is occurring amid increasing military tensions across the Taiwan Strait. Bloomberg News reported, "In June, dozens of Chinese fighter jets conducted threatening flights over the Taiwan Strait, heightening tensions, yet a house priced at $1 million (about 1.34 billion KRW) in a Taipei neighborhood sold within 10 minutes," adding, "Even real estate agents said in their 15 years of work, they have never seen such demand."

A buyer who purchased an apartment worth 24 million New Taiwan dollars (about 100 million KRW) in March told Bloomberg News in an interview, "If I don't buy now, I don't think the opportunity will come again," and added, "I worry about the (China-Taiwan) war, but my priority is to provide better opportunities for my children."

Taiwan Government, Which Had Greatly Eased Mortgage Loan Conditions, Begins 'Loan Tightening'

The Taiwanese government, which had implemented various mortgage loan (housing loan) easing measures to stimulate the real estate market until last year, now appears flustered by the sudden real estate boom. As so-called 'young people borrowing to the limit' investments intensify among those in their 30s and 40s and household loans surge sharply, the government has abruptly shifted to policies restricting loans.

As of March this year, the Central Bank of Taiwan raised the base interest rate by 12.5 basis points (1bp=0.01%) to 2.0%, and in June, it also increased the reserve requirement ratio for all bank deposits by 25 basis points, continuing a tight monetary policy. Loan tightening began after mortgage loan volumes hit a record high in May. Considering that last March the government extended mortgage loan terms from 30 to 40 years, allowed a 5-year principal and interest repayment deferral, and increased loan limits by 25%, the policy has reversed 180 degrees in a short time.

The main driver of this real estate boom is analyzed to be the AI semiconductor investment fever centered on TSMC. Recently, the Taiwan Institute of Economic Research (TIER) raised its forecast for Taiwan's GDP growth rate this year to 3.85%, 0.56 percentage points higher than the 3.29% forecast in April. This figure more than doubles the 1.4% economic growth rate of 2023. Bloomberg News reported, "With TSMC's sales surging and stock prices rising, the Taiwanese stock market has increased by more than 24% this year, and private consumption is also expected to grow by 3%."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.