Raised 21.5 Billion KRW Through Rights Offering to Secure Funds for New Drug Development

Developing Treatments for Idiopathic Pulmonary Fibrosis and Non-Small Cell Lung Cancer

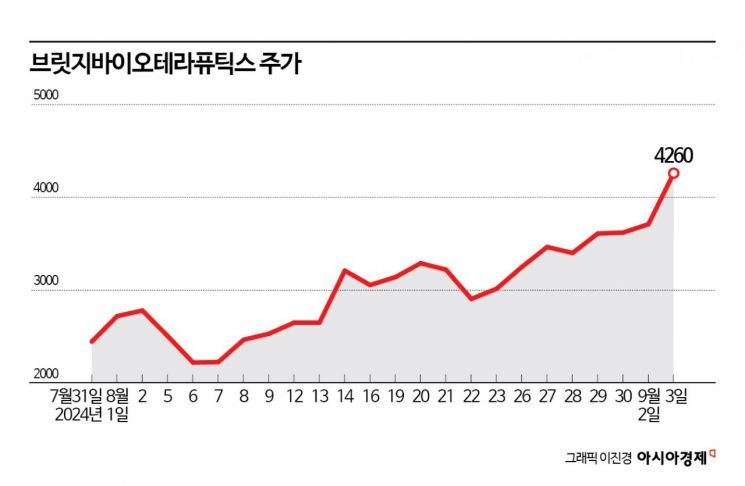

The stock price of Bridge Biotherapeutics, which raised funds for new drug pipeline research and development (R&D) through a rights offering, has been rising continuously. Expectations for the candidate substances currently undergoing Phase 2 clinical trials are driving the stock price increase.

According to the financial investment industry on the 4th, Bridge Bio's stock price rose 74% compared to the end of July. During the same period, the KOSDAQ index fell by about 5%.

Bridge Biotherapeutics is a company specializing in the research and development of new drugs to treat diseases with high unmet medical needs. Its main pipelines include the next-generation non-small cell lung cancer treatment candidate (BBT-207) and the idiopathic pulmonary fibrosis treatment candidate (BBT-877).

The non-small cell lung cancer treatment market is led by the British pharmaceutical company AstraZeneca's 'Tagrisso' (active ingredient Osimertinib). BBT-207 is one of the new drug candidates for patients resistant to Tagrisso. In April last year, it received approval for clinical trial plans from the U.S. Food and Drug Administration (FDA). In August last year, it also received approval for clinical trial plans from the Korean Ministry of Food and Drug Safety (MFDS) and is currently conducting clinical trials.

In July 2022, the U.S. FDA approved the Phase 2 clinical trial plan (IND) for BBT-877. Following the first independent data monitoring committee (IDMC) review in October last year, the second and third IDMC reviews were conducted in January and April this year, respectively, which reviewed drug safety and efficacy and recommended continuing the clinical trials as planned.

Bridge Biotherapeutics raised 21.5 billion KRW by issuing 0.499 new shares per existing share in July. Most of the raised funds will be invested in developing BBT-207 and BBT-877.

They plan to complete patient recruitment for the BBT-877 Phase 2 trial in the third quarter of this year. The dosing period will last six months. Afterward, clinical data organization, statistical analysis, final report writing, and revisions will follow, with the entire clinical trial expected to conclude by the end of next year. If the clinical trials prove superior efficacy compared to existing treatments, technology export will also be possible.

Researcher Park Jae-kyung of Hana Securities explained, "Ofev, an idiopathic pulmonary fibrosis treatment from Boehringer Ingelheim, recorded sales of $3.8 billion last year." He added, "It is time to pay attention to the potential of BBT-877 as a second-generation treatment that can not only delay lung function decline like Ofev but also restore lung capacity."

Bridge Biotherapeutics stated that an internal analysis of the safety and efficacy data collected during the BBT-877 Phase 2 clinical trial process suggests that in the best-case scenario, BBT-877 could be a 'game changer' capable of changing the existing paradigm.

They also expect efficacy not only for idiopathic pulmonary fibrosis but also for aortic heart valve stenosis, recurrent ovarian cancer, and immune checkpoint inhibitor-resistant cancers. If it can meet unmet medical needs, the value of the new drug is expected to increase.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.