LH to Increase Government Support for Purchased Rental Housing from 65% to 95%

As of Last Year-End, Average Purchase Price 250 Million KRW with LH's 90 Million KRW Self-Funding

Recommended Debt Ratio Also Raised from 218% to 233%

100,000 Purchased Rental Units to be Supplied in the Capital Region This Year and Next

Prices for Housing with Over 100 Units in Capital Region to be Calculated Based on Construction Cost Index

Korea Land and Housing Corporation (LH) is pushing to increase the government purchase fund support rate from 65% last year to 95% by 2028 when buying purchase rental housing. LH announced plans to significantly increase purchase rental housing as part of the supply measures for the metropolitan area. However, the more purchase rental housing there is, the more funds LH has to invest, which is a problem. LH plans to request assistance from the Ministry of Economy and Finance to reduce the financial burden.

On the 2nd, LH held a 'New Construction Purchase Rental Issues Briefing' at the LH Seoul Regional Headquarters in Gangnam-gu, Seoul, covering these details. LH President Lee Han-jun said, "With private non-apartment supply shrinking recently, LH will step up to increase new construction purchase rentals and plans to buy 100,000 units this year and next year," adding, "It is necessary to raise the government support unit price to reduce the increasing financial burden." Purchase rental housing refers to public rental housing where LH buys existing houses and rents them out to youth or newlyweds at up to 80% of the surrounding market price.

LH announced it will supply a total of 100,000 new construction purchase rental units in the metropolitan area, 50,000 units each this year and next year. In Seoul, besides the 100,000 units, LH also plans to purchase an unlimited number of purchase rental houses if necessary. This target far exceeds LH's past new construction purchase rental housing acquisitions. The supply performance for new construction purchase rentals was ▲ 16,254 units in 2021 ▲ 11,830 units in 2022 ▲ 4,439 units in 2023.

So far, out of the average purchase price of 250 million KRW per unit, the Ministry of Economy and Finance provided only 160 million KRW in support funds. The remaining 90 million KRW was self-funded by LH. LH plans to increase the government support rate to supply purchase rental housing smoothly while reducing LH’s financial burden.

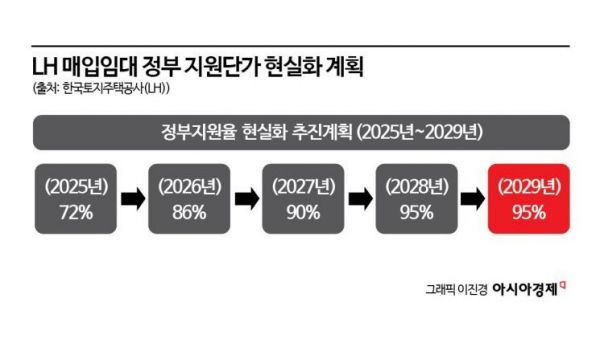

LH will negotiate with the government to raise the government support unit price. The plan is to increase the government support unit price ratio against the actual purchase price from 65% last year to 95% by 2028. The phased targets are ▲ 72% in 2025 ▲ 86% in 2026 ▲ 90% in 2027 ▲ 95% in 2028. For this year, an increase of 10 to 20 million KRW per unit in support unit price has been reflected in the government budget proposal.

To purchase purchase rental housing without delay, LH is also adjusting the recommended debt ratio level with the government. President Lee said, "LH agreed with the Ministry of Economy and Finance to lower the current debt ratio of 218% to 208% by 2027, but we are negotiating to maintain the debt ratio at 233% until 2028." He added, "This is a measure considering the increasing financial burden as LH pursues the 3rd New Towns and national industrial complexes, and we will do our best in purchase rentals through debt ratio management."

He further explained, "Unlike other public institutions, LH operates on a structure where it buys land and sells it 5 to 6 years later to acquire assets. Even if the current debt ratio is high, out of the 153 trillion KRW debt, 83 trillion KRW is financial sector debt, and 45.5 trillion KRW of that is from the National Housing Fund, so it is not a level to be concerned about."

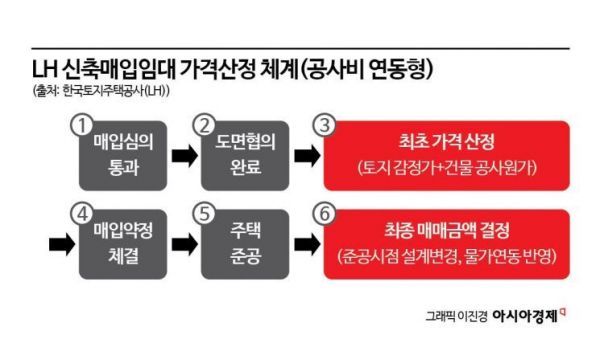

LH also disclosed the method for determining the appropriate price for new construction purchase rental housing on the same day. Some have criticized that the government is buying houses at high prices from private developers while increasing purchase rentals. In response, LH explained, "We will set appropriate prices through multiple verifications using the 'construction cost-linked' and 'appraisal evaluation' methods."

The construction cost-linked method will be applied for the first time this year. It targets houses with 100 or more units in the metropolitan area. After obtaining the land appraisal price and building construction cost, the price is calculated by reflecting inflation after completion. The government agency verifies the building construction cost through construction statements. An external expert 'Price Review Committee' reviews the appropriateness of the purchase price once again.

For appraisal evaluation, two appraisal institutions are involved. First, Institution A conducts an appraisal based on the design drawings of the houses that passed the purchase review and then signs the purchase agreement. After completion, Institution B conducts a second appraisal. The purchase price is the average of the two prices set by Institution A and Institution B.

LH will establish a 'Purchase Agreement Support Team' and an 'Early Construction Support Task Force (TF)' for each metropolitan area headquarters. They will support not only purchase applications but also permits and quality control after the agreement. Through this, the period from document submission to purchase agreement will be reduced from the existing 7 months to 4 months, and the period from agreement to completion will be shortened from 2 years to 1 year and 6 months.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.