Life Insurers 3.5941 Trillion KRW... 9.4% Decrease YoY

Non-Life Insurers 5.7722 Trillion KRW... 12.2% Increase YoY

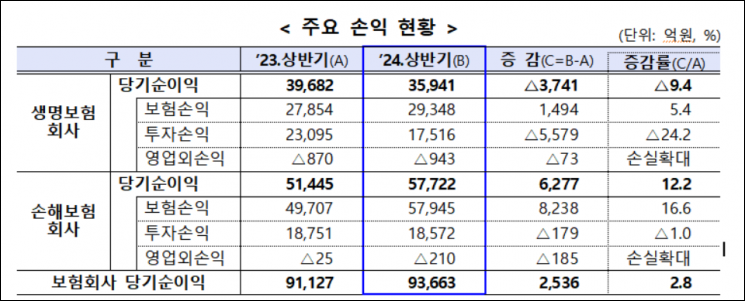

It was revealed that the net profit of insurance companies in the first half of this year reached approximately 9.4 trillion KRW. While life insurance companies saw a decline in performance, non-life insurance companies achieved record-high results.

According to the 'Insurance Company Management Performance (Preliminary)' released by the Financial Supervisory Service on the 2nd, the net profit of insurance companies (22 life insurers and 31 non-life insurers) in the first half of this year was 9.3663 trillion KRW, an increase of 2.8% (253.6 billion KRW) compared to the same period last year.

The results varied between life and non-life insurers. The net profit of life insurance companies in the first half of this year was 3.5941 trillion KRW, a decrease of 9.4% (374.1 billion KRW) compared to the same period last year. Although insurance profit improved due to increased sales of insurance products, investment profit deteriorated due to a decrease in financial asset valuation gains.

The net profit of non-life insurance companies was 5.7722 trillion KRW, an increase of 12.2% (627.7 billion KRW) compared to the same period last year. This is the highest performance on a half-year basis. Insurance profit significantly improved due to expanded sales of insurance products and a decrease in incurred claims liabilities. However, investment profit worsened due to a reduction in financial asset valuation gains.

The total premium income of insurance companies in the first half of this year was 115.6918 trillion KRW, an increase of 3.9% (4.3556 trillion KRW) compared to the same period last year. During the same period, life insurers recorded 54.4738 trillion KRW, up 3.5% (1.8471 trillion KRW). Premium income from protection-type insurance (13.2%) and savings-type insurance (0.7%) increased, but premium income from variable insurance (-2.2%) and retirement pensions (-16.2%) decreased. Non-life insurers’ premium income was 61.218 trillion KRW, up 4.3% (2.5085 trillion KRW) compared to the same period last year. Premium income from long-term insurance (5.2%), general insurance (8.7%), and retirement pensions (3.9%) increased, while premium income from automobile insurance (-1.2%) decreased.

The return on assets (ROA) of insurance companies was 1.52%, down 0.04 percentage points from the same period last year. The return on equity (ROE) was 11.79%, up 0.72 percentage points.

As of the first half of this year, the total assets of insurance companies amounted to 1,240.8 trillion KRW, an increase of 1.3% (16.2 trillion KRW) compared to the end of last year. During the same period, total liabilities increased by 3% (31.5 trillion KRW) to 1,089.6 trillion KRW. Meanwhile, equity capital decreased by 9.2% (15.3 trillion KRW) to 151.2 trillion KRW compared to the end of last year, due to total liabilities increasing more than total assets.

An official from the Financial Supervisory Service stated, "In preparation for the expansion of uncertainties in domestic and international financial markets, as well as potential losses from domestic real estate project financing (PF) and overseas commercial real estate, insurance companies need to manage financial soundness stably." He added, "The Financial Supervisory Service will thoroughly conduct continuous monitoring by closely analyzing financial soundness risk factors arising from insurance companies’ business, investment, and financial activities in response to uncertainties in the financial market."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.