Probability of Insurance Stocks Rising with Interest Rate Cuts↑

May Act as a Catalyst for Stock Price Increase

Q4 Outlook to Be Released... "Year-End Rally Coming"

With a high probability of a US interest rate cut expected this month, the market environment is showing trends similar to 2019, leading to analyses that opportunities will arise for growth stocks before and after the rate cut.

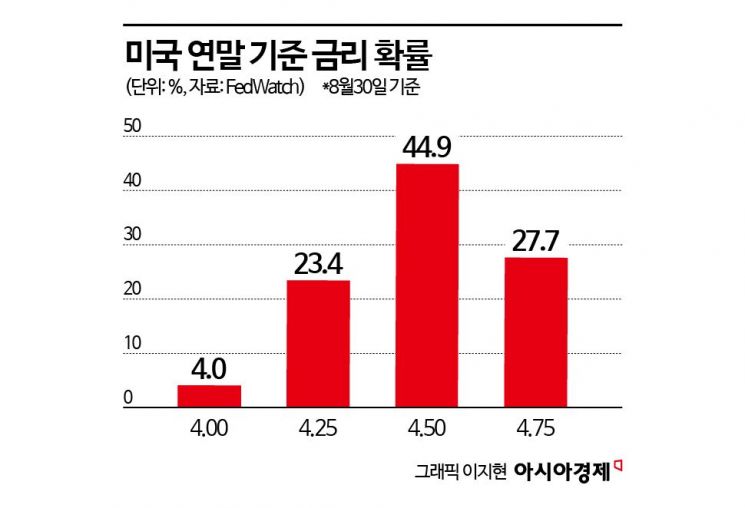

According to the Chicago Mercantile Exchange (CME) FedWatch on the 2nd, the federal funds futures market sees a 100% chance that the Federal Reserve (Fed) will cut rates this month. The probability of a 100bp (1bp=0.01 percentage point) drop by the end of the year is around 40%. This fully reflects Fed Chair Jerome Powell’s remarks at the Jackson Hole Economic Policy Symposium on the 23rd of last month, where he mentioned that inflation is slowing and the labor market is cooling, stating that "the time has come to adjust policy."

In the financial investment industry, there are opinions that the current economic and interest rate policies are similar to those in 2019. At that time, the economy was slowing down as the enthusiasm for the Fourth Industrial Revolution cooled. As the stock market showed volatility, investors demanded precautionary rate cuts, and after the Fed cut rates in July of that year, the economy experienced a soft landing and stock prices rose again.

In particular, the high likelihood that this rate cut will also be precautionary is raising expectations that profit forecasts could rebound. In fact, before the 2019 US market rate cut, 12-month forward net earnings were being adjusted downward mainly in cyclical and growth stocks, but around the time the precautionary rate cut was implemented, much of the earnings decline was recovered.

Park Sang-hyun, a researcher at iM Securities, said, "The economy, which seemed to be experiencing a soft landing this year, has raised concerns about a hard landing due to a slowdown in the labor market and an AI chasm (temporary demand slowdown), increasing demands for a 'big cut' of 0.5 percentage points in interest rates." He added, "This situation is similar to the period before and after the 2019 rate cut." He further analyzed, "At that time, the Fed’s rate cut acted as a catalyst for economic and stock market gains. The rate cut can serve as a shield against a hard landing and help alleviate concerns about the AI chasm. Moreover, it will invigorate global liquidity flows recently impacted by the yen carry trade shock."

Jung Sang-hwi, a researcher at Heungkuk Securities, also noted, "Quantitative analysis shows that the period from July 2019 to February 2020 is similar to the current situation." He pointed out, "In the early phase of such a period, economic downturns attract attention, and large-cap stocks with stable earnings expectations are more attractive compared to small- and mid-cap stocks. Additionally, rate cuts are empirically events that are absolutely favorable to growth stocks."

Ultimately, whether the stock market will rally in the second half of the year is expected to become clearer in the fourth quarter. Lee Eun-taek, head of the equity strategy team at KB Securities, said, "Strong factors will emerge in the market in the fourth quarter, such as the effects of the rate cut influencing October’s indicators and being confirmed in November." He added, "The market is likely to return to a growth stock phase next year. The current volatility in growth stocks will, conversely, become a great opportunity by the end of the year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)