Private Spending Drives Growth... Revised Up 0.2%P from Preliminary Estimate

Core PCE Inflation Rate Lowered to 2.8%

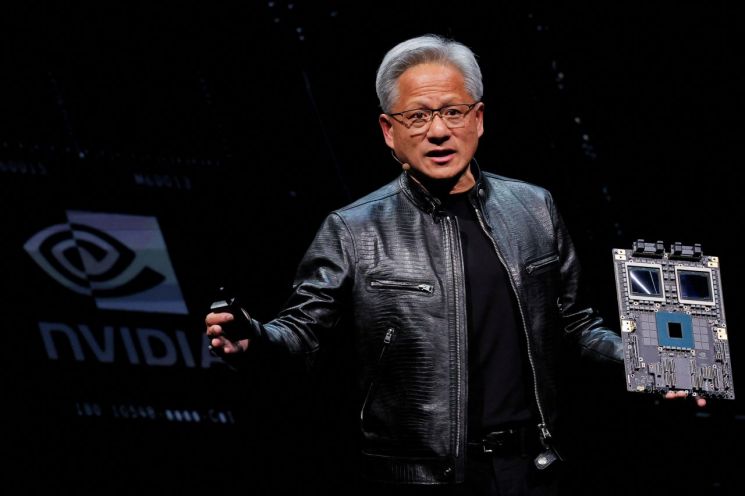

NVIDIA Falls After Missing Market Expectations

The three major indices of the U.S. New York Stock Exchange are rising in early trading on the 29th (local time). After falling the previous day due to caution over Nvidia's earnings, the market is seeking recovery on the back of an upward revision of the U.S. economic growth rate for the second quarter. Nvidia is declining as it failed to meet the already high market expectations despite its surprise earnings, but other big tech companies are showing an upward trend.

As of 10:15 a.m. in the New York stock market, the Dow Jones Industrial Average, centered on blue-chip stocks, is up 0.54% from the previous trading day, standing at 41,311.91. The S&P 500, focused on large-cap stocks, is up 0.56% at 5,623.77, and the Nasdaq, centered on technology stocks, is trading 0.94% higher at 17,721.87.

By individual stocks, Salesforce is up 0.45% following earnings that exceeded market expectations and an upward revision of its annual profit forecast. Nvidia, which reported earnings the previous day, is plunging 4.29%. Other tech stocks are rising. Microsoft (MS) is up 2.31%, Apple is up 1.92%, and Amazon is up 0.88%. Alphabet, Google's parent company, and Meta, Facebook's parent company, are up 1.48% and 0.96%, respectively.

Nvidia announced after the market closed the previous day that its revenue and net income for the second quarter of fiscal year 2025 (May to July) surged 122% and 168% year-on-year, respectively, to $30.04 billion and $16.6 billion. The third-quarter revenue guidance was set at $32.5 billion. Although both earnings and revenue guidance exceeded Wall Street forecasts, they were evaluated as falling short of the actual internal expectations of securities firms. The latest AI chip, 'Blackwell,' is scheduled for release in the fourth quarter as planned, but only expectations of generating billions of dollars in sales in that quarter were mentioned, without specific forecasts, leading to a decline in the stock price.

Despite Nvidia's stock price decline, the market is showing strength as the economic indicators released that day have strengthened expectations for a soft landing. The U.S. Department of Commerce announced that real GDP grew at an annualized rate of 3% in the second quarter compared to the previous quarter. This is 0.2 percentage points higher than the preliminary figure (2.8%) announced last month and more than double the first-quarter growth rate (1.4%). Personal spending, the engine of U.S. economic growth, increased significantly more than initially estimated, boosting the GDP growth rate. The personal spending growth rate was revised up from 2.3% to 2.9%. Spending on goods and services increased mainly in healthcare, housing, utilities, and leisure sectors.

On the other hand, inflation has decreased, further raising expectations for a soft landing. The core Personal Consumption Expenditures (PCE) price index rose 2.8% annualized in the second quarter, down 0.1 percentage points from last month's figure (2.9%). The core PCE price index, which excludes volatile energy and food prices, is the indicator most closely watched by the U.S. Federal Reserve (Fed). The second-quarter PCE price index growth rate was lowered from the previous annualized 2.6% to 2.5%.

The market is focusing on the July PCE price index to be released on the 30th. Last month's PCE price is estimated to have risen 0.2% month-over-month and 2.5% year-over-year. As a result, the core PCE price inflation rate is expected to have slowed to 2.1% over the past three months, approaching the Fed's target of 2%.

Brett Kenwell, a U.S. investment analyst at eToro, said, "Today's indicators helped instill confidence in investors that the economy is not precariously standing on a cliff," adding, "We are not out of the woods yet, but the U.S. economy is more resilient than many think." He also evaluated, "Today's report will give investors confidence that the Fed can still orchestrate a soft landing."

The U.S. labor market appears to remain robust. The U.S. Department of Labor reported that new unemployment claims for the week of August 18-24 were 231,000, down 2,000 from the previous week (233,000). This was below the expert forecast of 232,000. A clearer trend in the labor market can be confirmed through the U.S. Department of Labor's August employment report to be released on September 6.

Investors are confident about a rate cut in September. According to the Chicago Mercantile Exchange (CME) FedWatch, the federal funds futures market is fully pricing in a Fed rate cut of at least 0.25 percentage points in September. The probability of a 0.25 percentage point rate cut next month is 65.5%, while the possibility of a 'big cut' of 0.5 percentage points is priced at 34.5%.

Government bond yields are steady. The U.S. 10-year Treasury yield, a global benchmark for bond yields, rose 2 basis points (1 bp = 0.01 percentage points) from the previous trading day to 3.86%, while the 2-year Treasury yield, sensitive to monetary policy, increased 2 basis points to 3.89%.

International oil prices are rising. West Texas Intermediate (WTI) crude oil rose $1.90 (2.55%) from the previous trading day to $76.42 per barrel, and Brent crude, the global benchmark, increased $1.64 (2.11%) to $79.22 per barrel.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.