Fidelity, BlackRock, and GIC Net Buyers of Domestic Defense Stocks

Defense Industry Full of Positive Factors 'Record-Breaking Performance'

BlackRock's Increased Stake in Woori Financial Sparks Major Shareholder Shift

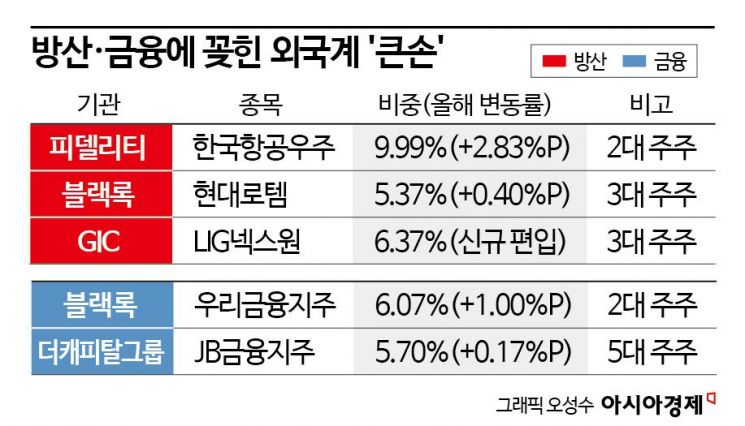

This year, foreign 'big players' have been intensively buying defense stocks in the domestic stock market.

According to financial information company FnGuide on the 30th, as of the 29th, there were a total of 150 stocks with overseas institutions holding more than 5% of shares. Among them, 66 stocks experienced changes in shareholding this year, with major foreign asset management firms notably increasing their stakes in LIG Nex1, Hyundai Rotem, and Korea Aerospace Industries. These three companies, along with Hanwha Aerospace, are considered the 'big four' in the domestic defense industry.

Both Asset Management Firms and Sovereign Wealth Funds Are 'Buying' Defense Stocks

Specifically, Fidelity, a US-based asset management firm, increased its stake in Korea Aerospace Industries from 7.16% to 9.99%, a rise of 2.83 percentage points. According to the Sovereign Wealth Fund Institute, a research organization specializing in sovereign wealth funds, Fidelity ranks third globally by assets under management (AUM) with $3.888 trillion (approximately 5,173 trillion KRW). Fidelity is the second-largest shareholder of Korea Aerospace Industries, with the largest shareholder being the Export-Import Bank of Korea at 26.41%.

The defense stock chosen by BlackRock, the world's largest asset management firm, was Hyundai Rotem. It holds a 5.37% stake, up 0.40 percentage points from the beginning of the year. BlackRock's AUM is $10.65 trillion (approximately 1,419.3 quadrillion KRW). Not only asset management firms but also sovereign wealth funds have been actively buying defense stocks. Singapore's sovereign wealth fund GIC newly included LIG Nex1 as a major holding this year, with a 6.37% stake. Singapore's AUM exceeds 1,000 trillion KRW, standing at $800.8 billion (1,067 trillion KRW). Although the three 'trillion-KRW big players' often have different sector preferences, they consistently chose to 'buy' defense stocks. It is also notable that the defense 'leader' Hanwha Aerospace was left untouched.

Defense has been one of the most spotlighted sectors in the domestic stock market this year. The combined operating profit of the four major domestic defense companies in the second quarter of this year more than tripled compared to the same period last year, resulting in a significant rise in stock prices. Dongheon Lee, a researcher at Shinhan Investment Corp., said, "The ongoing Russia-Ukraine war, the spread of conflicts in the Middle East, and the increasing possibility of Donald Trump winning the US presidential election are creating unstable international conditions," adding, "These are positive factors for K-defense."

BlackRock Surpasses National Pension Service to Become Second-Largest Shareholder of Woori Financial Group

Outside of defense, financial holding companies, regarded as beneficiaries of 'value-up' strategies, were popular. BlackRock increased its stake in Woori Financial Group from 5.07% to 6.07%, a 1 percentage point rise. During the same period, the National Pension Service's stake decreased from 6.31% to 6.03%, making BlackRock the second-largest shareholder. The largest shareholder is the employee stock ownership association with 8.72%. Among the four major financial holding companies, except for Woori, the other three (KB, Shinhan, Hana) have the National Pension Service as the largest shareholder and BlackRock as the second-largest. Until last year, BlackRock held fewer shares than the National Pension Service in Woori Financial Group, but this year it expanded its stake, changing the major shareholder landscape.

Meanwhile, The Capital Group, a US-based asset management firm that has long been interested in domestic financial stocks, showed mixed moves by increasing its stake in JB Financial Group (from 5.53% to 5.70%) and decreasing its stake in Hana Financial Group (from 5.55% to 5.44%). The Capital Group ranks fourth globally with an AUM of $2.5 trillion (approximately 3,335 trillion KRW). It is the fifth-largest shareholder of JB Financial Group and the third-largest shareholder of Hana Financial Group.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.