FSS Reassesses Real Estate PF of All Financial Firms

Todamdae 12.9 Trillion KRW, Main PF 4.1 Trillion KRW, Bridge Loan 4 Trillion KRW Scale

FSS: "Limited Impact on Financial Firms and Construction Companies"

Financial authorities' reassessment of real estate project financing (PF) sites managed by financial companies revealed that the exposure to watchlist and potential default risks amounts to approximately 21 trillion won. Among this, mutual finance institutions and savings banks account for 69%. Going forward, financial authorities plan to actively encourage financial companies to implement restructuring and liquidation plans for real estate PFs and minimize market shocks to construction companies and project developers.

According to the financial sector on the 29th, the Financial Supervisory Service (FSS) established improved evaluation criteria for real estate PF project viability in June. The criteria were objectified and specified by reflecting key risk factors for bridge loans and main PFs. The project viability evaluation system was also subdivided from the current three stages to four stages (Good, Normal, Watchlist, Potential Default).

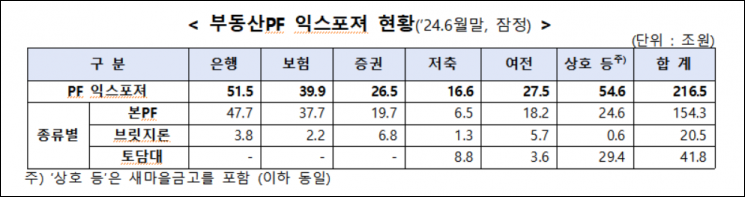

Based on the improved evaluation criteria, the FSS reassessed the viability of projects with a high likelihood of default as of the end of June. The first evaluation covered projects worth 33.7 trillion won (15.6%) out of the total PF exposure of 216.5 trillion won across the entire financial sector, focusing on projects with overdue payments, overdue payment deferrals, or more than three maturity extensions. As a result, the exposure to watchlist and potential default risks was estimated at 21 trillion won, accounting for 9.7% of the total PF exposure.

By PF type, the exposure was 4.1 trillion won for main PFs, 4 trillion won for bridge loans, and 12.9 trillion won for land-secured loans.

By financial sector, mutual finance institutions accounted for 9.9 trillion won, savings banks 4.5 trillion won, securities 3.2 trillion won, specialized credit finance companies 2.4 trillion won, insurance 0.5 trillion won, and banks 0.4 trillion won. Mutual finance institutions and savings banks together accounted for 69%. Park Sang-won, Deputy Director of the FSS's Small and Low-Income Finance Division, stated, "Although financial companies have increased capital ratios across most sectors compared to the end of March through capital increases and additional provisions following this project viability evaluation, the overall impact is not significant. However, the fixed overdue loan ratio for PFs rose sharply by 6.1 percentage points compared to the end of last year, necessitating active management of non-performing loans and delinquency rates for a smooth PF landing."

As of the end of June, the first evaluation showed that financial companies had set aside 6.7 trillion won in loan loss provisions. The largest amounts were for land-secured loans (3.2 trillion won), bridge loans (2 trillion won), and main PFs (1.4 trillion won). By sector, mutual finance institutions accounted for 2.3 trillion won, securities 1.7 trillion won, savings banks 1.6 trillion won, specialized credit finance companies 0.7 trillion won, banks 0.2 trillion won, and insurance 0.1 trillion won.

The fixed overdue loan ratio rose from 5.1% at the end of last year to 11.2% at the end of June this year, an increase of 6.1 percentage points, due to the increase in watchlist and potential default loans. However, the overall fixed overdue loan ratio for total loan receivables increased by only 0.2 percentage points compared to the end of last year, indicating a limited impact.

Capital ratios mostly increased compared to the previous quarter-end due to capital increases despite additional loan loss provisions following this project viability evaluation. No financial company was found to have failed to meet the minimum regulatory capital ratio due to this evaluation.

The FSS expects the impact of non-performing real estate PFs on construction companies and project developers to be limited. For construction companies, most of the watchlist and potential default loans held by financial companies are bridge loans and land-secured loans, and the scale of main PFs under construction is not large. Among watchlist and potential default projects, the PF exposure of projects in which construction companies are participating by providing completion guarantees or credit enhancements (debt assumption, joint guarantees, capital supplementation) amounts to 5.1 trillion won. Most of this is main PFs (4.1 trillion won), with bridge loans (0.1 trillion won) being relatively small. Most project developers involved in watchlist and potential default projects (93.1%) hold only one such project, so the market impact is expected to be limited. Most are small-scale, micro-enterprises, and many had already become non-performing before this project viability evaluation, so there is no concern about systemic risk.

The FSS plans to supervise financial companies' restructuring and liquidation plans for real estate PFs going forward. Financial companies are to finalize restructuring and liquidation plans by September 6, and the FSS will begin monthly monitoring of implementation performance from the end of September. For normal projects (Good, Normal), financial companies will be actively guided to ensure smooth funding support such as maturity extensions so that the PF projects can proceed normally.

For all projects outside the first evaluation target (182.8 trillion won, 84.4%), project viability evaluations will be conducted by November based on the end of September data, and from December, a continuous evaluation system will be implemented. Deputy Director Park Sang-won said, "If watchlist and potential default projects are smoothly restructured and liquidated in the future, the soundness of financial companies will improve, and the real estate PF market will achieve a virtuous cycle of funds and restore trust. We also plan to continue encouraging soundness management, including minimizing market shocks to construction companies and project developers and enhancing financial companies' loss absorption capacity."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)