NVIDIA to Release Earnings After Market Close

Focus on Blackwell Timely Supply and AI Demand Outlook

PCE Inflation Rate for July to Be Announced on 30th

The three major indices of the U.S. New York stock market are showing a downward trend in early trading on the 28th (local time). The market's caution is intensifying due to concerns over Nvidia's earnings report, which will be released after the market closes that day. Investors are expected to gauge the sustainability of the technology stock rally led by artificial intelligence (AI) and the future direction of the stock market through Nvidia's earnings.

As of 9:45 a.m. in the New York stock market that day, the Dow Jones Industrial Average, centered on blue-chip stocks, was down 0.04% from the previous trading day, standing at 41,235.18. The S&P 500, focused on large-cap stocks, was down 0.12% at 5,619.1, and the Nasdaq, centered on technology stocks, was trading down 0.31% at 17,699.85.

By individual stocks, U.S. retailer Nordstrom is up 4.49% after reporting better-than-expected second-quarter earnings. Semiconductor developer Ambarella surged 14.11% following an upward revision of its third-quarter sales forecast. PVH, the parent company of Calvin Klein, is down 7.76% after issuing a disappointing earnings outlook. Bank of America (BoA) is up 0.3%. Berkshire Hathaway, led by 'investment genius' Warren Buffett, has sold an additional $981.9 million worth of BoA shares. Nvidia, which is scheduled to report earnings that day, is down 1.08%.

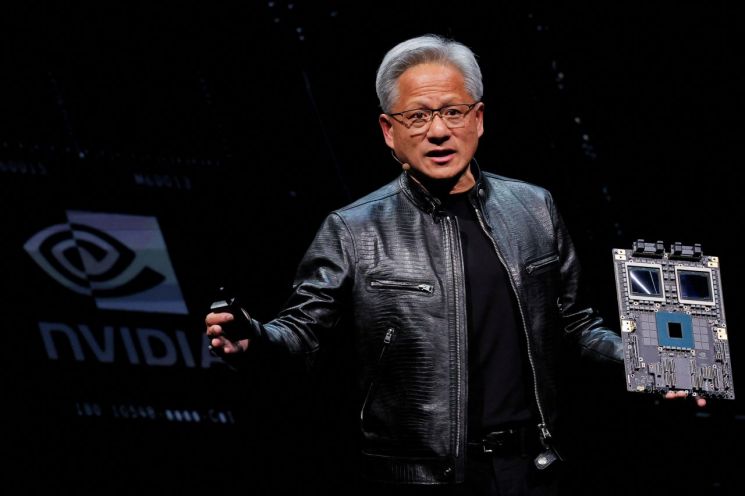

Nvidia will release its fiscal year 2025 second-quarter (May to July) earnings after the market closes that day. Revenue is expected to reach $28.6 billion, and operating profit $18.7 billion, more than doubling each. The market is expected to assess the broad sustainability of technology and AI stocks through Nvidia's earnings. However, with Nvidia's stock price having surged 159% so far this year, there remains caution about the potential for further gains. Investors are focusing on whether Nvidia can timely supply its latest AI chip, Blackwell, and whether there will be updates on AI demand following the earnings report.

Erin Brown, Managing Director and Portfolio Manager at PIMCO, the world's largest bond manager, said, "Other AI stocks are trading about 10% below their peak prices, and Nvidia's current valuation is not expensive compared to the five-year average. Although the market has priced in a lot of optimism, it can still surprise the market by continuing its upward trend."

Anthony Saglimbene, Senior Market Strategist at Ameriprise Financial, said, "Nvidia's earnings report could have a stronger impact on the overall market than Federal Reserve Chair Jerome Powell's speech at the Jackson Hole meeting last week. Now, it is Jensen Huang, Nvidia's CEO, rather than Powell, who will move the market."

This week, the Fed's most important inflation indicator, the July Personal Consumption Expenditures (PCE) price index, will also be released. The PCE price for last month, to be announced on the 30th, is estimated to have risen 0.2% month-over-month and 2.5% year-over-year. As a result, the core PCE inflation rate is expected to have slowed to 2.1% over the past three months, approaching the Fed's target of 2%. On the 29th, a day earlier, the number of new unemployment claims for the previous week will be released. Market experts expect this figure to be 234,000, slightly up from the previous week's 232,000.

Investors are increasingly confident in a rate cut in September following Powell's Jackson Hole speech. According to the Chicago Mercantile Exchange (CME) FedWatch, the federal funds futures market fully prices in a more than 0.25 percentage point rate cut by the Fed in September. The probability of a 0.25 percentage point rate cut next month is 65.5%, while the chance of a 'big cut' of 0.5 percentage points is priced at 34.5%.

U.S. Treasury yields are steady. The 10-year U.S. Treasury yield, a global bond yield benchmark, is trading at 3.84%, and the 2-year U.S. Treasury yield, sensitive to monetary policy, is at 3.86%, both unchanged from the previous day.

International oil prices are declining. West Texas Intermediate (WTI) crude oil is down $0.84 (1.11%) from the previous trading day, trading at $74.69 per barrel, and Brent crude, the global oil price benchmark, is down $0.88 (1.12%) at $77.78 per barrel.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.