Q2 Food Service Industry Index Declines Compared to Q1

Stable Sales Maintained in Cafeterias and Cafes

Increased Challenges for Pubs and Catering Services

The prolonged freeze in consumer sentiment due to the economic downturn and rising prices is casting a deep shadow over the dining-out industry. Relatively affordable options such as company cafeterias and cafes are faring somewhat better, but sectors like pubs, which offer luxury consumables, are experiencing particularly severe impacts.

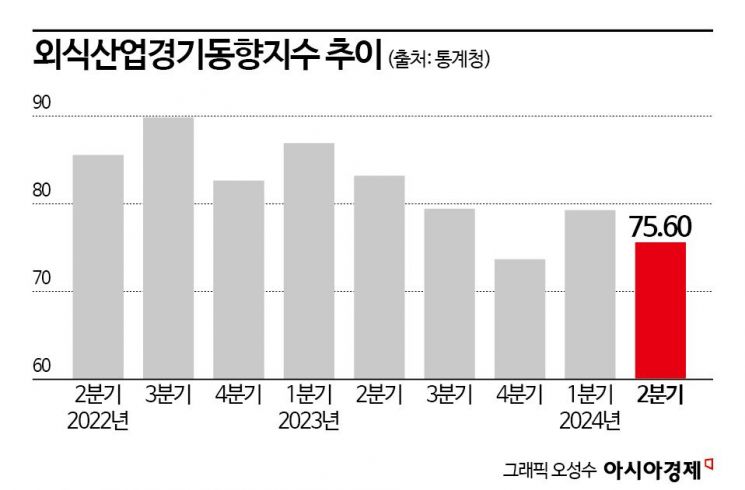

According to Statistics Korea on the 29th, the dining-out industry business condition index for the second quarter of this year was 75.6, down 3.68 points from 79.28 in the first quarter. Despite the first quarter recording the highest economic growth rate increase and the consumer price inflation rate being the lowest in 11 months, the accumulated high prices have kept the perceived inflation among the public still high. The dining-out industry business condition index is an indicator that gauges the economic situation of the domestic dining-out industry. An index below 100 means that the number of businesses experiencing a decrease in sales compared to the same period last year exceeds those with increased sales.

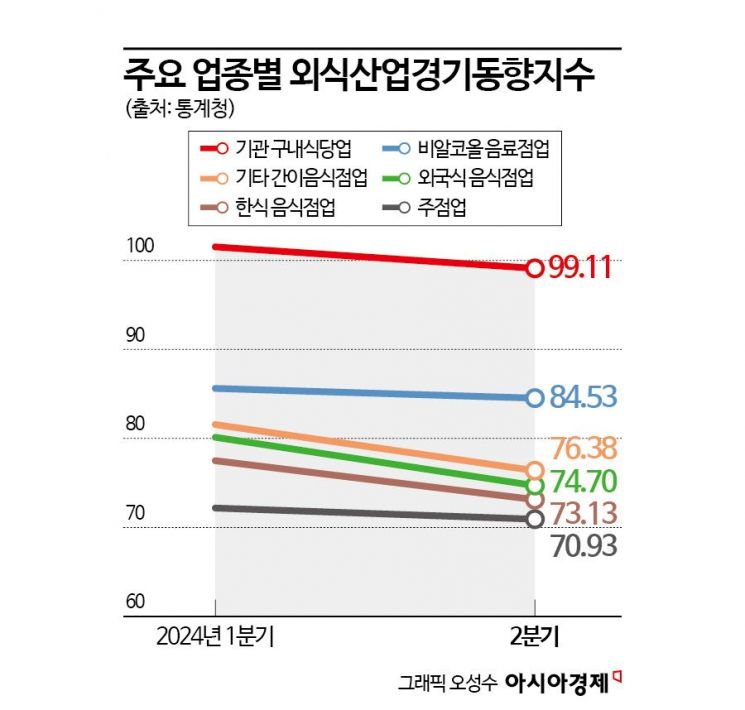

The institutional cafeteria sector recorded an index of 99.11 in the second quarter, down 2.41 points from the first quarter, but still maintained the highest index level. Institutional cafeterias, mainly operated in companies, schools, and hospitals, generally have stable demand, resulting in relatively small fluctuations in sales. They continued operating during the COVID-19 pandemic and maintained steady demand. Since many institutional cafeterias operate under long-term contracts, uncertainty is reduced, and the recent rise in dining prices has led office workers and students to increasingly dine at cafeterias, helping maintain stable sales.

The non-alcoholic beverage sector, which includes cafes, also performed relatively well with an index of 84.53, down 1.09 points from the first quarter. Despite high prices, consumer demand for low-priced coffee increased, resulting in a relatively higher index compared to other sectors. Jin Hyun-jung, a professor in the Department of Economics at Chung-Ang University, explained, "Coffee shops serve not only as places to provide beverages but also as social spaces. Consumers continue to use coffee shops for meetings or work, and franchise cafes have strong brand loyalty, which helps maintain a steady customer base regardless of economic conditions."

On the other hand, the pub sector recorded the lowest index among related industries at 70.93 in the second quarter, down 1.25 points from the first quarter. This reflects a tendency to reduce non-essential spending such as visiting bars due to increased economic burdens on companies and individuals caused by the economic recession and rising prices. Factors such as the prolonged high-price phenomenon leading to burdensome company dinners and rising taxi fares suggest that the low index level will continue for the time being.

The decline in the index across most sectors may be a result of weakened consumer sentiment, prompting calls for strategies to restore it. Kim Young-gap, a professor at Hanyang Cyber University's Graduate School of Business, advised, "To revive consumer sentiment, promotions and events should be strengthened, and consumption should be stimulated through the development of seasonal menus and price discount events. To enhance competitiveness, it is necessary to differentiate menus, improve service quality, and conduct marketing by segmenting customer groups."

Meanwhile, the business outlook index for the third quarter also appeared lower compared to the second quarter, suggesting a further decline in the dining-out industry index. This is because the fundamental trend of export recovery and domestic demand sluggishness has not significantly changed despite the summer peak season and increased demand for seasonal menus. Additionally, weather factors such as early heatwaves and monsoons make it difficult to expect an index increase in the next quarter.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)