Curly "Considering Legal Action Against Baseless Rumor Spread"

Concerns Over E-commerce Companies' Financial Structure Rise After Timf Incident

First Half Operating Losses Reach 2.28 Trillion Won, Increased from Last Year

Early morning delivery company Kurly is facing difficulties due to the 'CEO Kim Seul-ah's overseas escape rumor' that started on some online communities. This coincides with the crisis rumors in the e-commerce industry triggered by the Tmon and Wemakeprice (Timep) incident, leading to worsening company financial structure and spreading rumors about related debt issues. The company has announced a strong response, stating that these are baseless falsehoods.

According to the distribution industry on the 28th, Kurly released a statement the previous afternoon saying, "Baseless rumors such as CEO Kim Seul-ah's overseas escape are spreading indiscriminately," and added, "This is completely untrue, and we will consider legal action if false information is disseminated online." They also stated, "Kurly's cash liquidity and financial structure are stable."

Kurly's official response aims to stop the indiscriminate spread of posts on online communities claiming that "CEO Kim Seul-ah fled overseas due to debt." According to Kurly, CEO Kim reportedly chaired a meeting at the headquarters the previous afternoon.

Summarizing the situation, it appears to be a kind of misunderstanding that arose as interest in the financial structure of e-commerce companies increased following the Timep incident. However, some view this as reflecting consumers' lowered trust in e-commerce companies due to the Timep incident.

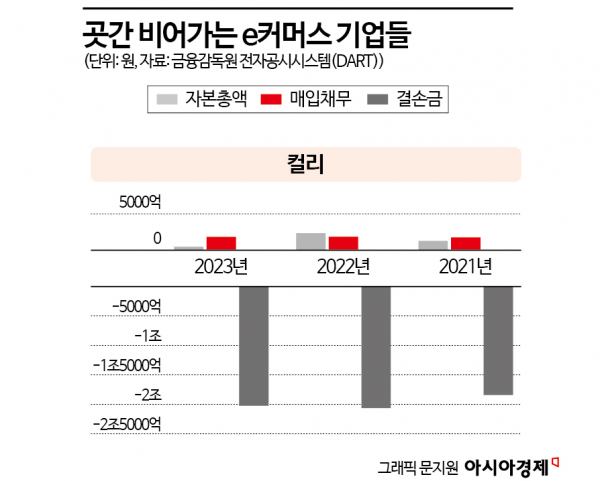

In fact, Kurly has been one of the companies most scrutinized for its financial structure since the Timep incident. Although it recorded a positive EBITDA in the first half of this year and significantly reduced its net loss from 52.4 billion KRW last year to 9.9 billion KRW, it is expected to take more time to turn a net profit. As a result, accumulated deficits continue to grow. Accumulated deficits refer to losses accumulated from business operations, which is the opposite of retained earnings. Kurly's accumulated deficit was 1.84 trillion KRW in 2021, increased to 2.2615 trillion KRW last year, and further rose to 2.2777 trillion KRW in the first half of this year.

Kurly's longer settlement cycle compared to peers is also expected to be a background for the rumors. The settlement cycle was a cause of the Timep incident, as Wemakeprice paid sellers up to 70 days late, paying on the 7th two months after the sales month. Kurly's settlement cycle is structured so that products purchased between the 1st and 10th of the month are paid at the end of the following month, while products purchased between the 11th and 20th and from the 21st to the end of the month are paid on the 10th and 20th two months later, respectively. In contrast, Oasis, another early morning delivery company, pays 60% of partner product fees within the 10th of the following month, 85% cumulatively by the 15th, and 99% by the 20th, showing differences in maximum settlement days.

Meanwhile, the interior platform 'Oneul-ui Jip' (Today's House), which was also caught up in negative rumors along with Kurly, denied rumors of unpaid seller payments. Oneul-ui Jip stated, "Baseless rumors such as withholding seller settlement payments are spreading indiscriminately, and we want to correct this," adding, "The rumors of unpaid payments are completely false." They emphasized, "We are considering strong legal action against the dissemination of false information."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.