Corporate Bankruptcy Filings Surge, Outpacing Rehabilitation

Companies Missing Rehabilitation Golden Time Say "Better to Declare Bankruptcy"

Rehabilitation M&A Faces Difficulties Despite Second and Third Attempts

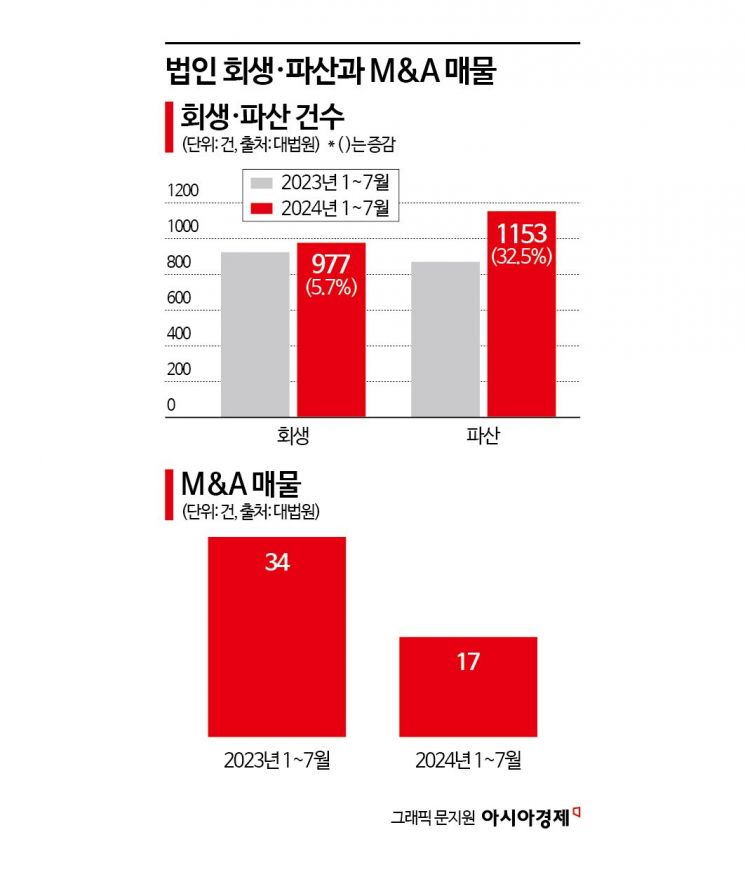

The number of companies choosing bankruptcy is overwhelmingly increasing compared to those aiming for recovery. The number of distressed companies listed for sale in the merger and acquisition (M&A) market has also sharply decreased to about half.

According to the Supreme Court's monthly statistics report on the 28th, the number of corporate bankruptcy filings from January to July reached 1,153, a 32.5% increase compared to 870 filings during the same period last year. During the same period, the number of rehabilitation cases was 977. Although rehabilitation cases also increased by 5.7% from 924 cases last year, this figure is about 15% lower than bankruptcies. The number of distressed company M&A cases announced by the court during the same period dropped from 34 to 17, halving.

Rather than struggling to recover... "Let's just close"

On an annual basis, last year marked the first time bankruptcy filings (1,657 cases) surpassed rehabilitation filings (1,602 cases). At that time, the difference was a narrow margin of about 3%. However, this year, bankruptcies have surged overwhelmingly, widening the gap further. Generally, companies choose rehabilitation when continuing the business is judged to be more beneficial than liquidation; otherwise, they opt for bankruptcy. This indicates that many companies have lost hope of making a comeback.

No Hyuncheon, head of the Fast-track Corporate Rehabilitation Research Institute at law firm Win&Win, said, "For self-employed individuals and small businesses, securing loans through financial institutions or raising funds via the stock market is much more difficult than in the past, reflecting a clearly depressed bottom-line economy." He added, "Many hesitate to pursue rehabilitation and end up missing the 'golden time,' leading to closures." He cited, "Just look at the cries of small companies and self-employed people involved in the construction company's project financing (PF) crisis and the Tmon and Wemakeprice (Timep) incidents. It seems there is quite a strong sentiment of 'let's just close' rather than struggling to recover."

Even after multiple attempts, M&A remains difficult

The sluggish atmosphere is also reflected in the M&A market. The number of distressed company M&A listings, halved compared to last year, is facing difficulties in finding 'new owners,' resulting in many cases undergoing multiple bidding rounds, becoming 'repeat bidders.' For example, J3, which was listed on the 22nd, is making its second attempt after failing to sell in April. J3, a semiconductor-related company that once received investments from venture capital (VC), banks, and securities firms, entered rehabilitation due to management difficulties during the COVID-19 pandemic. Financial investors (FI) still have their funds tied up, with BNK Investment & Securities and DB Financial Investment holding 4.2% and 3.2% stakes, respectively.

Three companies under the Daewoo Winia Group?Winia, Winia Electronics, and Winia Electronics Manufacturing?are also struggling to attract M&A investors. All three were listed for sale this year but have yet to find buyers. As the situation failed to improve, labor and management, who had been in conflict over unpaid wages, joined forces. The labor union announced a joint resolution on the 27th stating they would cooperate with wage cuts and restructuring to expedite the M&A process. Industries with relatively better conditions are faring somewhat better. After multiple attempts, the low-cost carrier (LCC) Fly Gangwon, acquired by Winix, the 'dehumidifier master,' has rebranded as 'Parata Airlines' and is aiming for a comeback.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.