Penalty Clauses Exceeding 2 Billion Won Violate Public Order and Are Invalid

IA Must Return Approximately 2.5 Billion Won and Interest, Excluding 600 Million Won Penalty

IEA, a semiconductor and module specialist listed on KOSDAQ, has received a final ruling confirming partial loss in a civil lawsuit related to the 'contract deposit forfeiture case' that occurred four years ago when the sale of an affiliate failed. The court's final judgment is that taking all penalty fees according to the contract forfeiture clause violates public order.

This lawsuit involved IEA terminating the contract due to non-payment of the balance by the Quad Pioneer No.1 consortium, which attempted to acquire the affiliate, and forfeiting the payment according to the contract clause. The court ruled that "the penalty seems excessively heavy" and "it violates good morals and public order, so part of the forfeited amount must be returned to the consortium."

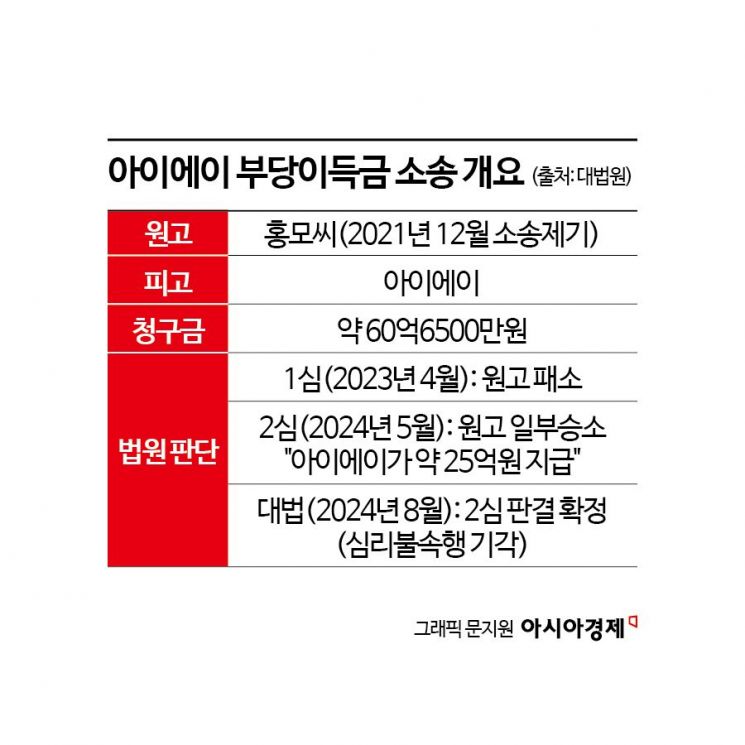

According to the legal community on the 27th, the Supreme Court Civil Division 2 recently dismissed the appeal without oral argument, confirming the second trial ruling that partially ruled in favor of the plaintiff (Mr. Hong) in the unjust enrichment claim lawsuit filed by Mr. Hong of the Quad Pioneer No.1 consortium against IEA. Dismissal without oral argument is a system that rejects an appeal without substantive review when there is no significant legal violation or special reason in the lower court's decision.

The case began in 2020 when the Quad Pioneer No.1 consortium attempted to acquire Se-Won, an affiliate of IEA at the time. In July of that year, IEA and the consortium agreed to sell approximately 6.48 million shares of Se-Won for 28 billion KRW, and the consortium initially paid a deposit of 2.8 billion KRW. Subsequently, an additional 3.2 billion KRW was deposited, but the remaining balance of about 22 billion KRW was not paid, causing the deal to fall through. IEA forfeited the deposit of 2.8 billion KRW and the additional 3.2 billion KRW paid by the consortium.

The following year, the consortium filed an unjust enrichment claim lawsuit against IEA for about 6 billion KRW, demanding the return of the deposit and the subsequently paid money. During the trial, the consortium argued that the contract itself was invalid. They claimed, "The former representative member had neither the intention nor the ability to pay the balance but abused their authority to conclude the contract," and "As a result, the consortium was burdened with the obligation to pay the balance and lost the deposit paid in advance due to forfeiture."

On the other hand, IEA countered, "According to the contract, there is a clause for deposit forfeiture in case of contract failure and a penalty claim clause of 20 billion KRW."

The first trial court did not accept the consortium's claims. The court stated, "IEA seemed to believe that the consortium would pay the balance normally," and "There is insufficient evidence to recognize the consortium's claim that the representative member abused authority for personal gain or that IEA knew this and still entered into the contract."

However, the second trial court's judgment was different. It found no problem with the 2.8 billion KRW deposit forfeited by IEA but judged the penalty amount exceeding 2 billion KRW to be excessive. The appellate court stated, "Compared to the benefit IEA gains by enforcing the penalty obligation on the consortium, the penalty seems excessively heavy," and "The penalty agreement under the contract is valid up to 2 billion KRW, and the excess amount is invalid as it violates good morals and other social order." The court ordered IEA to pay Mr. Hong 2,491,770,000 KRW, which is the balance of the 3.2 billion KRW minus the penalty portion, along with delayed interest.

IEA appealed, but the Supreme Court upheld the second trial's judgment. The Supreme Court also ordered IEA to bear the appeal costs.

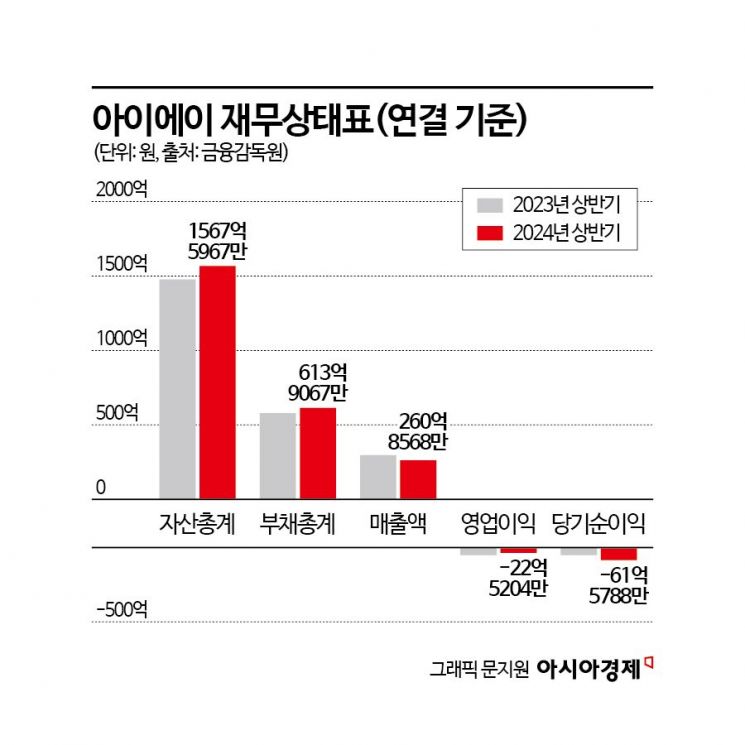

Meanwhile, IEA recorded operating losses for two consecutive years last year on a consolidated basis. In the first half of this year, it posted sales of 61.39067 billion KRW, operating loss of 2.25204 billion KRW, and net loss of 6.15788 billion KRW, showing challenging performance. The debt ratio was about 64%.

After the ruling was finalized, an IEA official said, "We will comply with the final court ruling (payment)," adding, "Since the amount lost has already been reflected as a liability, this ruling will have little impact on the profit and loss of the financial statements."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)