Financial Supervisory Service Launches Campaign to Recover Long-Unclaimed Refunds by October

Standardizing Procedures for Unfair Surcharge Insurance Premium Refunds

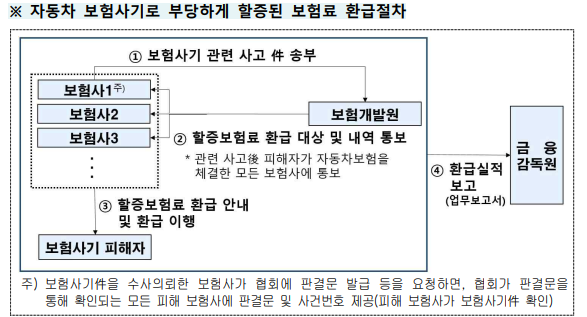

On the 26th, the Financial Supervisory Service (FSS) announced that it is seeking 1,312 victims whose insurance premiums were unfairly increased due to automobile insurance fraud. This is in accordance with the automobile insurance fraud relief system codified by the enforcement of the Special Act on the Prevention of Insurance Fraud amendment on the 14th. The FSS is strengthening victim relief following the legal obligation to notify victims of automobile insurance fraud and will conduct a long-term unclaimed refund recovery campaign until October.

According to the FSS, since 2009, 19,482 victims of automobile insurance fraud have been refunded a total of 8.6 billion KRW in surcharge premiums (97.2% of the total). However, 1,312 victims are still owed a total of 240 billion KRW in unclaimed refunds, due to reasons such as changes in contact information, refusal to answer calls, or death. Accordingly, the FSS will carry out the unclaimed surcharge premium recovery campaign for about two months until October 31.

Refund notifications will proceed by expanding contact attempts to long-term unclaimed victims (via text message, phone calls, and email) → verifying updated addresses through the Ministry of the Interior and Safety if contact is lost. The refund process involves confirming the account to be refunded after obtaining the victim’s consent to receive the unfair surcharge premium once contact is made with the policyholder, followed by the deposit.

Additionally, the FSS will shorten the notification period for the occurrence of damage due to automobile insurance fraud surcharge premiums and standardize the notification methods and refund procedures.

First, the notification period, which could be up to 30 days depending on each company’s voluntary practice, will be shortened to within 15 business days. The occurrence of damage will be notified at least four times, and notification methods will be expanded to include text messages, phone calls, and emails. If notification of the damage could not be made due to an address change, the updated address of the victim will be confirmed and re-notified.

Also, whereas previously insurance companies refunded victims at their discretion without a set deadline after obtaining the victim’s consent, from now on, once the victim agrees to the refund, the amount must be deposited into the refund account without delay.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.