Hyundai Steel and Dongkuk Steel Raise Price by 30,000 KRW per Ton in September

Additional Increase Following Last Month

Prices Still Below Cost Despite Hike

Further Increase Inevitable to Restore Profitability

Domestic steelmakers are set to raise rebar prices collectively next month following this month's increase. They judged that conditions have been created to further raise prices as inventories have also decreased after production cuts. Although prices still remain below costs, it is assessed that the worst phase has been overcome. Given the current trend, there is growing weight to the possibility that steelmakers will raise prices further.

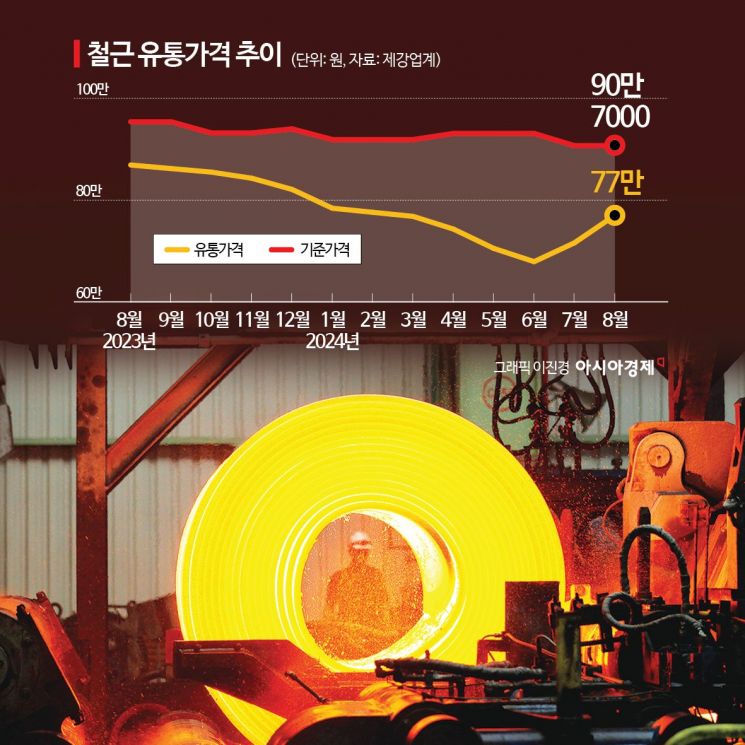

According to the industry on the 26th, Hyundai Steel will raise rebar prices by KRW 30,000 per ton starting next month on the 1st. Previously, they raised prices twice since last month by KRW 50,000 each time, and have decided to increase prices additionally. Dongkuk Steel, the second largest domestic rebar producer, also raised prices by KRW 50,000 earlier this month and plans to raise them by another KRW 30,000 starting next month. As a result, rebar prices are expected to rise from the mid-KRW 600,000s per ton to the low to mid-KRW 700,000s per ton.

The reason steelmakers are consecutively raising rebar prices is due to reduced inventories. Hyundai Steel stated during its Q2 earnings conference call, "Domestic inventory, which was about 430,000 tons at the end of last year, decreased to 320,000 tons by the end of June."

The inventory reduction is more due to production cuts than increased demand. These companies have voluntarily pursued production cuts to overcome profitability deterioration. Hyundai Steel reduced operating days at its Incheon and Dangjin plants. Additionally, special maintenance work at the Incheon plant was extended for six months. Dongkuk Steel has also been operating its electric arc furnace only during nighttime hours when electricity rates are cheaper since June. Consequently, the company's Q2 plant operating rate was only 64.5%. This is a significant drop from 97.29% in the first half of last year, and Hyundai Steel's operating rate also fell from 89.3% to 86% during the same period.

These companies explain that raising rebar prices is an unavoidable choice. Considering that the cost is around KRW 900,000 per ton, even with the price increase, they still remain below the break-even point. In Q2, Hyundai Steel recorded an operating profit of KRW 98 billion, down 78.9% year-on-year. Dongkuk Steel also posted an operating profit of KRW 40.5 billion, down 21.4%. An industry insider said, "We decided to raise prices because it was judged that profitability was absolutely impossible at this time."

Although the rebar price increase has helped escape the worst situation, the possibility of a recovery in earnings remains low. Although the U.S. Federal Reserve (Fed) hinted at a possible rate cut in September, uncertainty in the domestic construction market remains due to concerns over real estate project financing (PF) defaults, making it difficult to expect demand growth.

Moreover, even if the base interest rate is lowered, there will be a time lag between order receipt and actual construction start, so it will inevitably take time for earnings to recover. Accordingly, steelmakers are likely to continue raising prices throughout the second half of this year to secure profitability. An industry official explained, "Even now, each steelmaker is reducing inventory through production cuts," adding, "We believe the price rebound will begin."

Lee Gyu-ik, an analyst at SK Securities, said, "Recently, domestic rebar prices have successfully rebounded due to steelmakers' strong production cuts and determination to defend prices. Although no significant improvement in the construction industry has yet been observed, considering that the construction area is improving from the worst, the possibility of rebar prices falling seems low."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.