Inix, Full Rebound Starting from the 6th

Leading Company in Secondary Battery Safety Solutions

Major Shareholder's Stake Locked for 1 Year and 6 Months

IPO Funds to Be Invested in Overseas Expansion

The stock price of Inix, a major manufacturer of key components for securing the safety of secondary batteries, has recently risen rapidly. This is due to the increased importance of safety-related parts following an electric vehicle fire in Cheongna International City, Incheon. As interest in electric vehicle fires grows not only in Korea but also in the United States and China, global demand for components is expected to increase.

According to the financial investment industry on the 26th, Inix's stock price rose 90% over 13 trading days since the 6th. Considering that the KOSDAQ index rose 12%, the return relative to the market reached 78 percentage points.

Inix was listed on the KOSDAQ market on February 1st with a public offering price of 14,000 KRW. Although the stock price rose to 51,700 KRW on the day of listing, it fell more than 80% within six months due to a flood of profit-taking sell orders. The stock price, which had been declining, began to rebound as the importance of components enhancing secondary battery safety increased following the electric vehicle fire.

Founded in 1984, Inix produces battery cell pads and tapes that can extend the life and improve the safety of pouch batteries for electric vehicles. It supplies parts to Hyundai Mobis, Hyundai Green Power, SK On, and others.

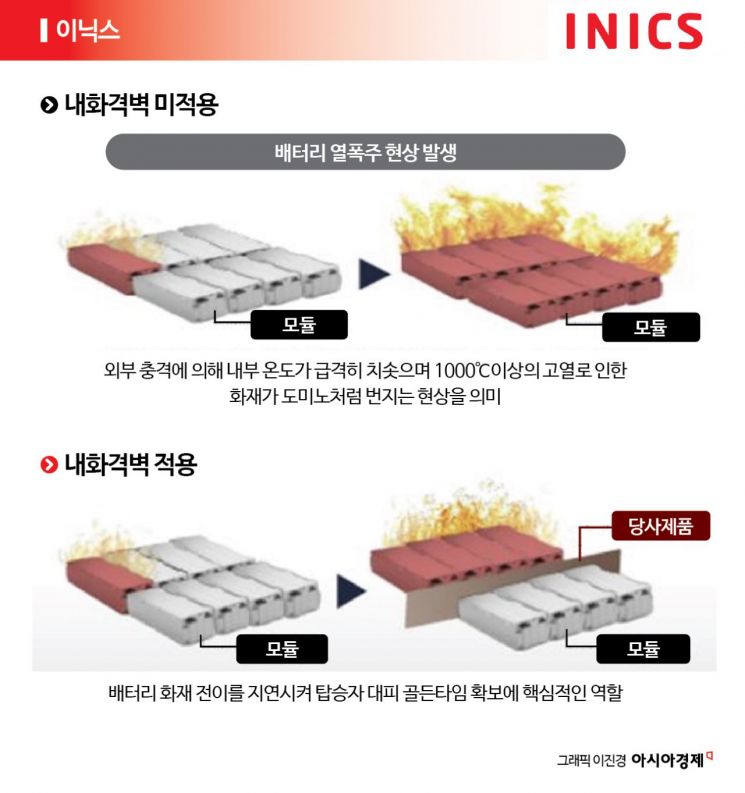

Jang Jeong-hoon, a researcher at Samsung Securities, explained, "While the main product is cell pads for pouch batteries, we expect growth in fire-resistant partition products going forward." He added, "Fire-resistant partitions are products that prevent heat and flame transfer between cell modules regardless of cell format such as pouch or prismatic, delay fire-type explosions, and enhance safety." He continued, "Following the Kia EV9, we expect to expand the application to more vehicle models in the second half of the year," and added, "Demand for fire-resistant partitions is increasing, which is expected to boost sales and improve profitability."

Inix, which raised 42 billion KRW by issuing new shares, is expanding production capacity and advancing overseas. It is targeting the U.S. market through its 100% subsidiary, Inix Battery Solutions. The factory to produce next-generation battery cell pads (TBA) is planned to be completed by next year in Auburn, Alabama. In addition to the U.S., it also plans to enter the European market. With recent moves to strengthen regulations on electric vehicle battery safety, overseas expansion is expected to gain momentum.

Inix is enhancing secondary battery safety through research and development (R&D). It developed a battery module initial fire suppression microcapsule composite sheet. Initial delivery and testing were conducted for application to D company's small electric vehicle battery modules. The developed sheet will be applied and evaluated in fire test trials for battery modules of H company and L company. In collaboration with domestic companies, it developed a continuous production process for composite sheets using UV ultraviolet rays. It has also been developing fire-resistant insulating tape and fire-blocking fire-resistant pressure pads for battery cell thermal runaway since last year.

As of the end of June, the largest shareholder is CEO Kang Dong-ho, holding 61.41% of the shares. Including related parties, the shareholding ratio reaches 66.14%. Before the initial public offering (IPO), the largest shareholder and related parties held 100% of the shares. Through the IPO, 3 million new shares were issued. The largest shareholder agreed to a mandatory holding period of 1 year and 6 months after listing.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.