Real Estate Information Platform Dabang Survey

Among 10 young people who took out loans, 7 used the loans for housing expenses such as paying jeonse/wolse rent or mortgage loans. Concerns are rising that the housing cost burden for the 20s and 30s generation is increasing.

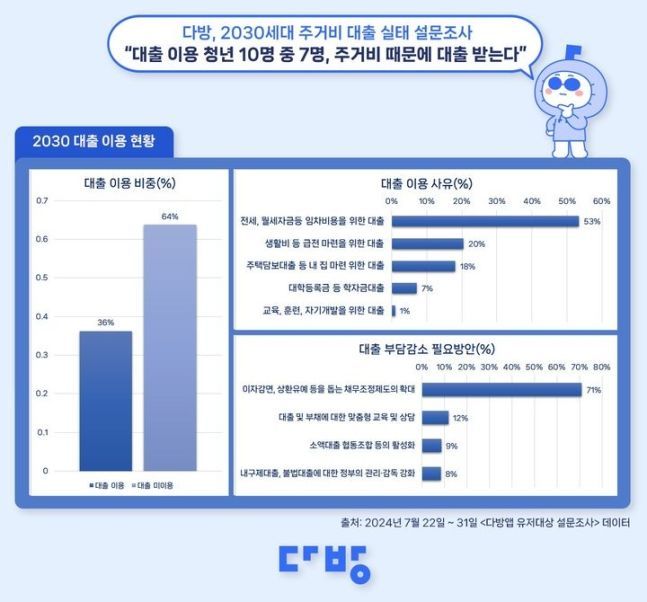

Real estate information platform Dabang conducted a housing cost loan survey targeting users of its application for ten days from the 22nd to the 31st of last month. Among the 579 young respondents in their 20s and 30s, 210 (36%) answered that they had taken out loans.

Regarding the reasons for the loans, 53% said "rental costs such as jeonse/wolse funds," 18% said "mortgage loans or home purchase," accounting for 71% of loans related to housing expenses. This was followed by "urgent living expenses" at 20%, "student loans" at 7%, and "education, training, self-development, etc." at 1%.

It was found that young people living in wolse pay up to twice as much loan interest as those living in jeonse. Regarding the current loan interest rates, 44% of jeonse residents responded "below 3%," the highest proportion, while 33% of wolse residents responded "6% or higher," the highest among them.

As for the reasons for taking out loans, 84% of jeonse residents answered "rental costs such as jeonse/wolse funds," but among wolse residents, "loans for urgent living expenses" accounted for the highest response at 44%. This is interpreted as wolse residents, who cannot use relatively low-interest jeonse loans, resorting to living expense loans to cover rent and other living costs.

When asked about the loan channels, 61% of jeonse residents said they used "jeonse loans" for youth, small and medium-sized enterprise employees, newlyweds, etc., but the majority (62%) of wolse residents were found to use loan products from the 1st, 2nd, and 3rd financial sectors, which have relatively higher interest rates.

Among young people in their 20s and 30s currently using loans, 7 out of 10 felt the need for a debt adjustment system to reduce loan burdens. When asked about necessary measures to reduce loan burdens, "expansion of debt adjustment systems that help with interest reduction and repayment deferral" accounted for an overwhelming 71%.

Dabang stated, "The survey results show that most young people use loans for housing costs and strongly feel the need for debt adjustment systems. Especially, young people who chose wolse due to the jeonse phobia phenomenon face a double burden of relatively high interest rates and rent, so it seems necessary to establish a separate wolse loan system for them."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.