Semiconductor Companies' Inventory at 5-6 Weeks Level

Past Peak Inventory at 10-12 Weeks

Concerns Over Industry Peak-Out Are Overblown

Samsung Electronics' stock price has been hovering in the 70,000 won range even in the third quarter. As foreigners and institutions simultaneously engaged in selling over the past month, weakening supply and demand, the stock price has remained in the 70,000 won range. Securities firms evaluate that the decline in Samsung Electronics' stock price due to concerns about the semiconductor industry's peak is premature.

According to the Korea Exchange on the 25th, Samsung Electronics closed at 77,700 won on the 23rd, down 0.77% (600 won) from the previous day. Since the beginning of August, Samsung Electronics has closed in the 70,000 won range every day except for one day (August 16). Over the past month (July 23 to August 23), foreigners and institutions have net sold 1.0767 trillion won and 1.7788 trillion won respectively, putting downward pressure on the stock price.

Samsung Electronics showed an upward trend in the second half of this year, but after the delay in delivering HBM to Nvidia, it peaked at 88,800 won on July 11 and has been declining steadily. In particular, on the 5th, the stock price fell intraday to 70,200 won, barely defending the 70,000 won level.

One reason Samsung Electronics' stock price is lackluster is the semiconductor outlook. On the 20th, Morgan Stanley released a report titled "Prepare for the Peak of the Semiconductor Industry," forecasting that the revenue growth rate of global semiconductor companies will peak in the third quarter (21%). The report analyzed, "Investors will worry more about the peak-out of the semiconductor industry cycle than the boom in the AI market," and predicted that the revenue growth rate will decline by 18% starting from the fourth quarter of this year.

However, the market generally views concerns about the semiconductor industry's peak as excessive. Currently, in the third quarter of this year, the inventory levels, capital expenditure growth rates, and operating profit margins of memory semiconductor companies are about half compared to the past.

In the past, signals of a peak in the semiconductor cycle included a significant increase in memory companies' inventory to 10-12 weeks, the ignition of market share expansion competition due to large-scale capital expenditures, and margin pressure following the peak of memory semiconductor operating profit margins.

Dongwon Kim, a researcher at KB Securities, explained, "As of the third quarter of 2024, memory semiconductor companies' inventory is 5-6 weeks, about 40% compared to the past peak cycle (inventory 12-14 weeks), and capital expenditure increases by memory companies are focused on customized semiconductors (HBM) and advanced processes rather than general-purpose products, with timely investments being made."

Researcher Kim emphasized, "The profitability of DRAM and NAND is only about half compared to the peak cycle margins in 2017-2018 (operating profit margin: DRAM 70%, NAND 50%)," adding, "In fact, there are no signs of a peak in the semiconductor cycle."

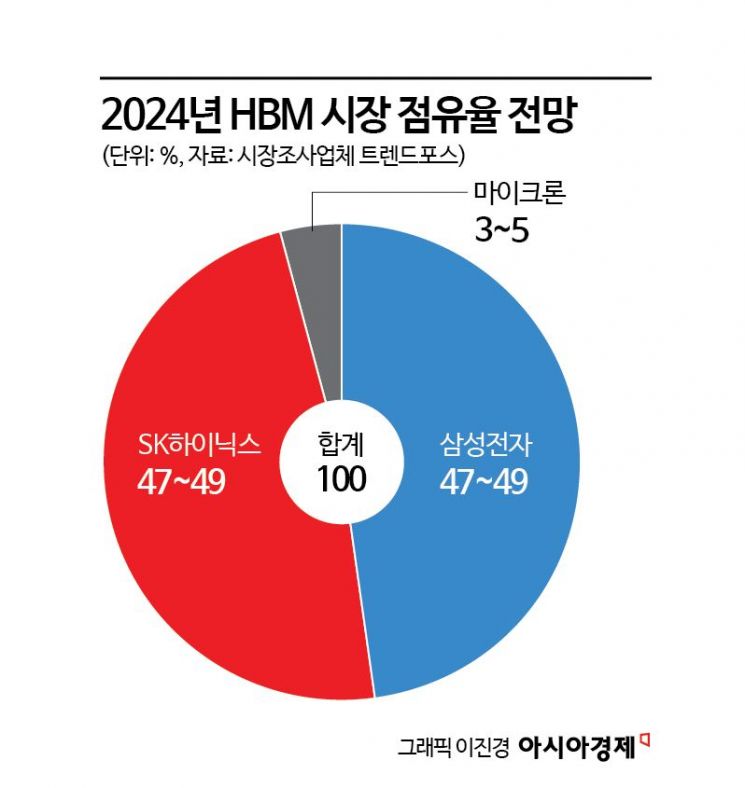

Additionally, the concentrated investment in AI data centers by big tech companies is highly likely to drive demand for mobile DRAM such as HBM and LPDDR5X. Considering this, the possibility of semiconductor oversupply is expected to be limited at least until next year. Min-sook Chae, a researcher at Korea Investment & Securities, analyzed, "The supply model for HBM, calculated based on Through-Silicon Via (TSV) production capacity, shows oversupply only because it assumes Samsung Electronics' capacity utilization rate at 100%," adding, "Considering the delay in certification and the postponed ramp-up of Samsung Electronics' HBM production and sales, the actual utilization rate is likely not 100%."

She further explained, "We estimate that Samsung Electronics' HBM production and sales will get on track after the first half of 2025," and "From the perspective of customers like Nvidia, until the first half of 2025, they are essentially procuring HBM only through SK Hynix."

Researcher Chae also argues that the fact that HBM prices are fixed annually supports the notion that there is no oversupply yet. Unlike general DRAM, which negotiates prices quarterly, HBM prices are fixed annually. This means the time for customers to adjust purchases due to perceived oversupply of HBM has not yet arrived.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)