Tax Reduction Benefits for Public Rental Housing

Inferior to Private Rental Housing

SH Public Rental Property Tax 47.8 Billion KRW

Reduced to 1.5 Billion KRW with Private Rental Tax Benefits

To Build More Affordable Public Rentals than Private Ones,

Distorted Tax Structure Must Be Resolved

Tax support for public rental housing supplied at low prices by Seoul Housing and Communities Corporation (SH) for low-income households without homes has been found to be less favorable than that for private rental housing. As apartment prices in Seoul rise, the role of public rental housing is growing, but only tax benefits for private rental operators are being strengthened, leading to claims of reverse discrimination.

According to data titled “Economic Effects of Property Tax Reductions on Public Rental Housing” released on the 23rd by Professor Yoon Seong-man of Seoul National University of Science and Technology, if the tax benefits for private rental housing were applied to public rental housing, SH could have reduced its taxes by more than 46 billion KRW as of last year. SH paid a total property tax of 47.8 billion KRW last year, combining property tax and comprehensive real estate tax. However, if it received property tax reduction benefits based on private rental housing standards, this property tax would decrease to 1.5 billion KRW, representing a tax saving effect of over 90%. Professor Yoon explained, “It is problematic that the tax benefits applied to public rental and private rental housing differ.”

Distorted Tax Reduction Rates, The Reason

This difference arises because the current tax structure favors private rental housing more. Among private rentals, public-supported private rentals and long-term general private rentals have higher property tax reduction rates than public rental housing.

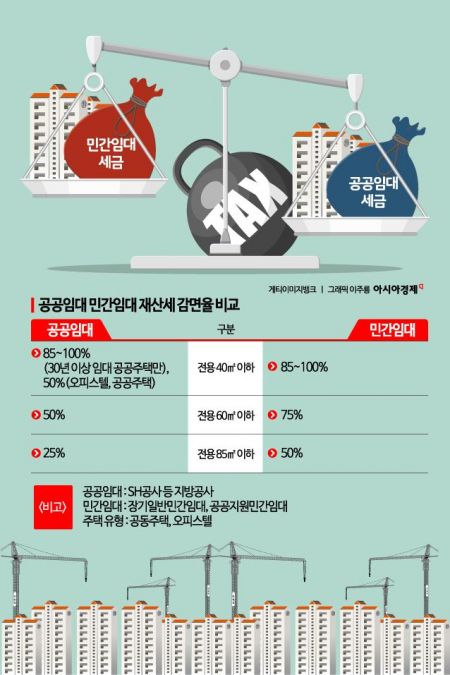

Currently, the property tax reduction rate for rental housing varies depending on the area. For rental housing with a net area of 40㎡ or less, public operators like SH can receive a 100% exemption only for apartments (multi-family housing) rented for more than 30 years. In contrast, private operators receive a 100% exemption on property tax for both apartments and officetels, meaning they pay no property tax at all. Even as the area increases, the gap remains. For rental housing with a net area of 60㎡ or less, public operators can only get a 50% reduction, while private operators can get a 75% reduction. The reduction rates applied to areas up to 85㎡ also differ, at 25% (public) and 50% (private), respectively.

Public rental housing is rental housing supplied by public institutions such as SH and Korea Land and Housing Corporation (LH). Because it targets low-income households or those without homes, the rent is cheaper compared to private rental housing. The rental period is also longer than that of public-supported private rentals and long-term general private rentals. However, the property tax, including holding tax, is paradoxically higher for public rental housing. Professor Yoon said, “The government has expanded benefits mainly for private operators to increase rental housing supply. Focusing only on private operators has left public rental housing in a blind spot, resulting in reverse discrimination.”

High Contribution to Lowering Nearby Rents and Residential Welfare... Need to Build More Public Rental Housing

A view of Godeok Gangil Complex 13 in Gangdong-gu, Seoul, supplied by SH Corporation. (Provided by SH Corporation)

A view of Godeok Gangil Complex 13 in Gangdong-gu, Seoul, supplied by SH Corporation. (Provided by SH Corporation)

System improvements are necessary to build more public rental housing, which offers lower rents than private housing. Professor Yoon argued, “Public rental housing lowers surrounding rent prices, whereas private rental housing actually raises rents.” He presented research findings showing that when one unit of public rental housing is supplied, apartment lease prices drop by 0.031%, while supplying one unit of private rental housing increases prices by 0.2%. Public rental housing is subject to the Public Housing Special Act, which restricts rent, but private rentals are structured so that operators set the rent.

With such comparatively low rents, SH provided housing cost reduction benefits amounting to 23.8105 trillion KRW based on jeonse (long-term deposit lease) and 1.2381 trillion KRW based on monthly rent last year. The average savings per household was 8.95 million KRW, with apartments saving about 10.73 million KRW and purchased rentals about 3.51 million KRW.

Professor Yoon stated, “Due to social issues such as jeonse fraud, the role and importance of public rental housing are expanding. The benefits, including lowering nearby housing rents and contributing to residential welfare, are even greater. The holding tax on public rental housing should be restructured to at least the same level as that for private rental housing operators.”

Meanwhile, the holding tax burden on public rental housing owned by SH increased from 9.3 billion KRW in 2012 to 69.7 billion KRW in 2022. The ratio of holding tax to rental income rose from 10% to 46% during the same period. This is cited as a major reason why holding tax increases deficits in public rental projects and undermines sustainability. Kim Ji-eun, senior researcher at SH Urban Research Institute, said, “In the short term, the property tax reduction criteria, which are disadvantageous compared to private rental housing, should be revised, and the system should be improved to exclude public rental housing from the comprehensive real estate tax aggregation.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.