Loan interest rates rise and deposit interest rates fall due to policy mismatch

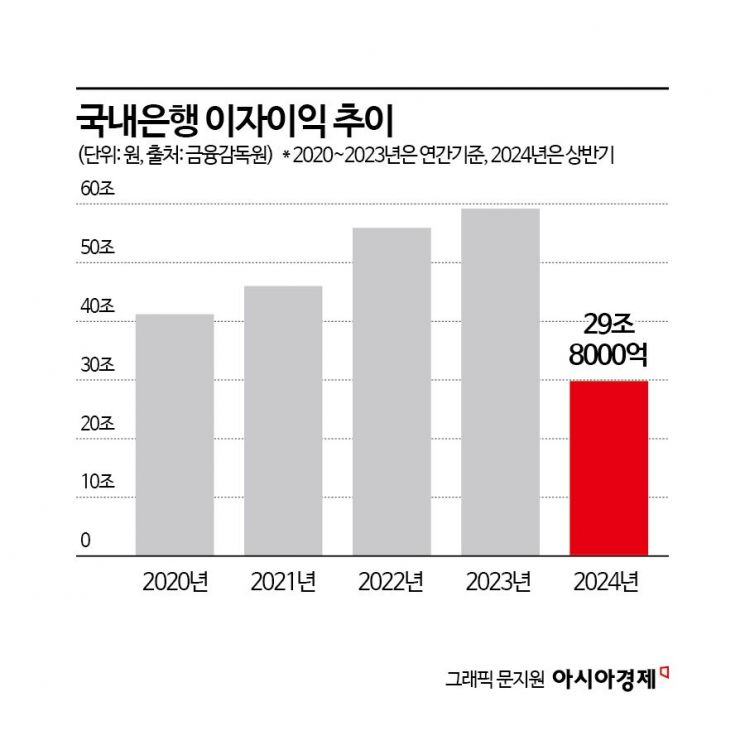

Bank interest income surges... approaching 30 trillion won in the first half

Possibility of surpassing 60 trillion won in interest income for the first time this year

As loan interest rates rise and deposit interest rates fall, banks are earning substantial net interest margin (the difference between loan and deposit interest rates) profits. There are even forecasts that domestic banks' interest income will surpass a record high of 60 trillion won this year due to conflicting government policies.

According to the financial sector on the 23rd, Shinhan Bank raised mortgage-related loan interest rates by up to 0.4 percentage points on the same day. Mortgage loans (new purchases and living stabilization funds) were increased by 0.2 to 0.4 percentage points, and jeonse (key money) loans were raised by 0.1 to 0.3 percentage points depending on the guarantee institution. This is the seventh increase in mortgage loan rates in the second half of this year alone. From the 26th, the bank plans to temporarily stop handling conditional jeonse loans. This move follows criticism that this product has been used for speculative real estate loans such as gap investments.

Woori Bank also plans to raise mortgage-related loan interest rates from the 26th. Mortgage loan rates will be increased by 0.1 to 0.4 percentage points, and jeonse loan rates will be raised by up to 0.4 percentage points. Woori Bank has raised mortgage loan rates six times in the second half of this year alone.

KB Kookmin Bank raised mortgage loan rates, including jeonse loans, by up to 0.3 percentage points starting from the 20th. The day before, it increased interest rates on some household credit loan products by 0.2 percentage points. Hana Bank also decided to reduce the discount rates on Hana OneQ mortgage loans by 0.6 percentage points and Hana OneQ jeonse loans by 0.2 percentage points starting the day before. Reducing loan discount rates effectively results in interest rate increases. KB Kookmin Bank and Hana Bank have raised mortgage loan rates six and two times respectively in the second half of this year.

While banks are continuously raising mortgage loan interest rates, deposit interest rates are gradually declining. As of the previous day, the average interest rate for 38 twelve-month fixed deposits across banks, according to the Bankers Association disclosure, is 3.38%. There is not a single product with a base interest rate exceeding the Bank of Korea's benchmark rate of 3.5% per annum. The highest interest rate product is SH Suhyup Bank's 'Hey Jeonggi Deposit,' which offers a base interest rate of 3.42% per annum. Until the first half of the year, there were fixed deposits exceeding the benchmark rate, but they have completely disappeared in the second half.

When loan interest rates rise but deposit interest rates fall, banks' net interest margins increase, boosting profitability. Domestic banks' interest income in the first half of this year reached 29.8 trillion won, a record high for the first half of the year. The annual record high was 59.2 trillion won last year. If this trend continues, banks' interest income this year is likely to surpass 60 trillion won, setting a new record.

In the financial sector, there are criticisms that conflicting government policies have fueled this situation during efforts to curb demand through interest rate-centered measures under the pretext of managing household debt. The postponement of the second phase of the stress Debt Service Ratio (DSR) regulation, which was scheduled to be introduced last month, to September triggered a surge in household loans. This created a last-chance mentality among homebuyers before the loan regulations tightened. Meanwhile, banks were pressured to raise interest rates, doubling borrowers' interest burdens. Professor Kang Sung-jin of Korea University’s Department of Economics said, "Responding to a rate cut period with rate hikes is a policy that goes against market trends," adding, "Government policies should flow in a direction predictable by the public, but patchwork measures are being implemented."

The Bank of Korea kept the benchmark interest rate steady at 3.5% as of the previous day. This is likely due to concerns that lowering the benchmark rate amid rising housing prices and household loans would stimulate the real estate market, causing side effects greater than the reduction in interest burden from the rate cut. The Presidential Office unusually expressed regret over the Bank of Korea's decision to hold the benchmark rate steady.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)