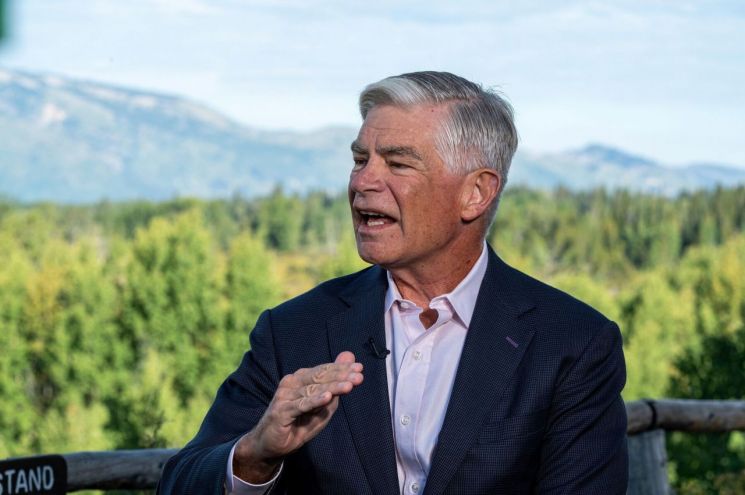

Philadelphia and Boston Fed Presidents

"Systematic and Gradual Cuts" Advocated

Focus on Powell's Speech on the 23rd

Officials from the U.S. Federal Reserve (Fed) attending the Jackson Hole meeting, which opened on the 22nd (local time), have consecutively made remarks suggesting a rate cut in September. However, the prevailing view is that monetary policy easing should be carried out gradually based on data, lending weight to the possibility of a 'baby cut' of 0.25 percentage points next month.

Patrick Harker, President of the Philadelphia Federal Reserve Bank, said in an interview with CNBC on the same day, "We need to start the process of cutting rates in September," adding, "The Fed should ease policy systematically and send sufficient signals in advance." He emphasized, "Our job is to look at the data and respond appropriately," and "When looking at the data, it is time to start cutting rates."

The market is confident about the Fed's rate cut in September and is paying attention to whether the cut will be 25 basis points (1bp=0.01 percentage points) or 50 basis points.

Regarding this, President Harker explained, "I am currently not leaning toward either 25bp or 50bp," and "We need to see more incoming data over the next few weeks."

Susan Collins, President of the Boston Federal Reserve Bank, also made remarks weighing in favor of a September rate cut in interviews with Bloomberg News and Fox Business on the same day.

President Collins said, "We are focused on continuing to lower inflation while maintaining a healthy labor market," and "In this context, it seems appropriate to soon begin policy easing."

Regarding the current labor market situation, she diagnosed that although employment is slowing, layoffs have not increased, indicating an orderly cooling. She also said she has not found any 'major warning signs' in the economy and believes that policy easing should be gradual.

President Collins stated, "The need for (monetary policy) recalibration has started to become important, but it should be done gradually," and "There is no predetermined path."

Following the release of the July Federal Open Market Committee (FOMC) minutes the previous day, the remarks of these two Fed officials have reinforced investors' confidence in a September rate cut. According to the minutes, the majority of Fed officials viewed a September rate cut as appropriate, and many had already advocated for a cut in July. However, since both President Harker and President Collins mentioned systematic and gradual easing, the possibility of a 'baby cut' of 0.25 percentage points next month is expected rather than a 'big cut' of 0.5 percentage points. According to the Chicago Mercantile Exchange (CME) FedWatch, the federal funds futures market on the same day reflected a 75.5% chance that the Fed will cut rates by 0.25 percentage points in September. The probability of a 0.5 percentage point big cut fell from 38% the previous day to 24.5%.

Investors are focusing on the speech by Fed Chair Jerome Powell scheduled for the 23rd. Chair Powell is expected to signal a rate cut in September along with clues about the pace of cuts. However, the likelihood of him indicating a big cut, as some in the market expect, is low. Considering the Fed's data-dependent style of policy decision-making, it is unlikely that he will move ahead before confirming the inflation and employment data expected before the FOMC meeting on the 17th-18th of next month. Jeffrey Schmid, President of the Kansas City Federal Reserve Bank, known as a hawk (favoring monetary tightening) within the Fed, also said on the same day that he is not yet ready to support a rate cut and emphasized the importance of the data to come in the next few weeks. The August employment report, which will influence the Fed's policy judgment, will be released on the 5th of next month, and the August Consumer Price Index (CPI) data will be released on the 11th of next month.

Chris Senyek, Chief Investment Strategist at Wolfe Research, said, "Chair Powell will maintain a dovish tone and signal the start of a rate-cutting cycle at the September meeting," but "unlike the pricing in the rate futures market, he is unlikely to signal a cut exceeding 25 basis points."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)