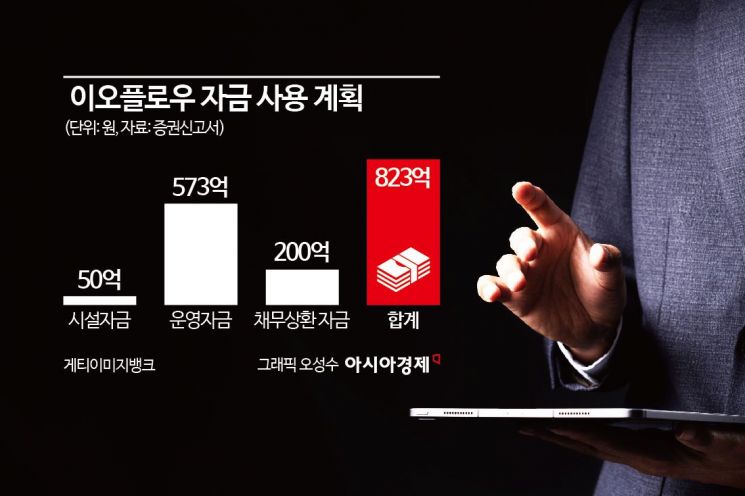

Plan to Raise 82.3 Billion KRW Through Rights Offering

Use of 57 Billion KRW for Operating Funds and 20 Billion KRW for Debt Repayment

Business Disruption Due to Competitor Patent Litigation Impact

Eoflow, a developer of patch-type insulin pumps, has launched a large-scale fundraising effort. This is due to delays in the full-scale revenue generation period while competing with Insulet, the 'Goliath' company that monopolizes the global wearable insulin pump market. Since Insulet filed a patent infringement lawsuit last year, business disruptions have caused financial difficulties. Eoflow expects to transform into a specialized drug delivery platform company if it raises funds as planned.

According to the Financial Supervisory Service's electronic disclosure system on the 23rd, Eoflow will issue 9.1 million new shares to raise 82.3 billion KRW. For every one existing share, 0.299 new shares will be allocated. The planned issue price is 9,040 KRW, and the final price will be confirmed on October 28.

Of the raised funds, 20 billion KRW will be used to repay debt, and investments will be made to develop technologies to become a leading company in the patch-type drug delivery solution market. They will develop large-capacity new products for type 2 diabetes patients and artificial pancreas solutions. They will also develop drug pre-loaded patch pump products. These will be initially applied to obesity treatments under development at their U.S. subsidiary, Sanplena. Rapid weight loss effects are expected within a short period. Additionally, funds will be used for facility investments to enable the early launch of the continuous glucose sensor-linked automatic insulin infusion patch pump 'Eopatch X', which received product approval from the Ministry of Food and Drug Safety in January.

Kim Jae-jin, the largest shareholder and CEO of Eoflow, will acquire about 30% of the allocated new shares. After the new share allocation base date, he plans to secure funds for the new share acquisition by selling some of his existing shares or through stock-backed loans. After the capital increase, Kim's shareholding ratio may decrease from 9.78% to 8.20%.

Kim Jae-jin, CEO of Eoflow, said, "We are going through a difficult time due to legal disputes and other issues," and apologized for the dilution of shareholder value caused by the capital increase.

Eoflow judged that fundraising is inevitable to pioneer the market while responding to the patent lawsuit from competitor Insulet. The global insulin pump market size is expected to grow at an average annual rate of 16%, from 4.6 billion USD in 2022 to 15.5 billion USD in 2030. The U.S. market accounted for more than 50% of the global insulin pump market, approximately 2.7 billion USD in 2022.

Insulet is blocking the emergence of competitors by filing patent lawsuits. In August last year, Insulet filed lawsuits for patent infringement and unfair competition. The U.S. federal district court issued a preliminary injunction banning business and sales. Consolidated sales for 2023 were 6.6 billion KRW, a 1.8% decrease from the previous year.

In May and June of this year, the U.S. Federal Court of Appeals lifted the preliminary injunction on business suspension, and Eoflow resumed normal business activities. Sales in the first half of this year were 3.1 billion KRW, a 26.2% increase compared to the same period last year.

Recently, Insulet filed for a preliminary injunction at the Unified Patent Court (UPC) in Europe to ban sales of the Eopatch product. Eoflow plans to cooperate closely with its distributor, Menarini, and take necessary legal actions. Sales of Eopatch in countries other than the U.S. and Europe are considered possible.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)