KOSPI Operating Profit Surpasses 100 Trillion Won in First Half

EPS Expected to Continue Rising Supported by Semiconductor Exports

"High Probability of Interest Rate Cut Insurance... Will Amplify Stock Market Gains"

There is an analysis suggesting that the KOSPI is on an upward trajectory. This is based on the high likelihood that the trend of rising earnings will be maintained due to strong exports, and the expectation that future interest rate cuts will be more of an insurance measure. Additionally, the volatility seen earlier this month, such as the sharp drop, is interpreted as a temporary unease ahead of changes in monetary policy.

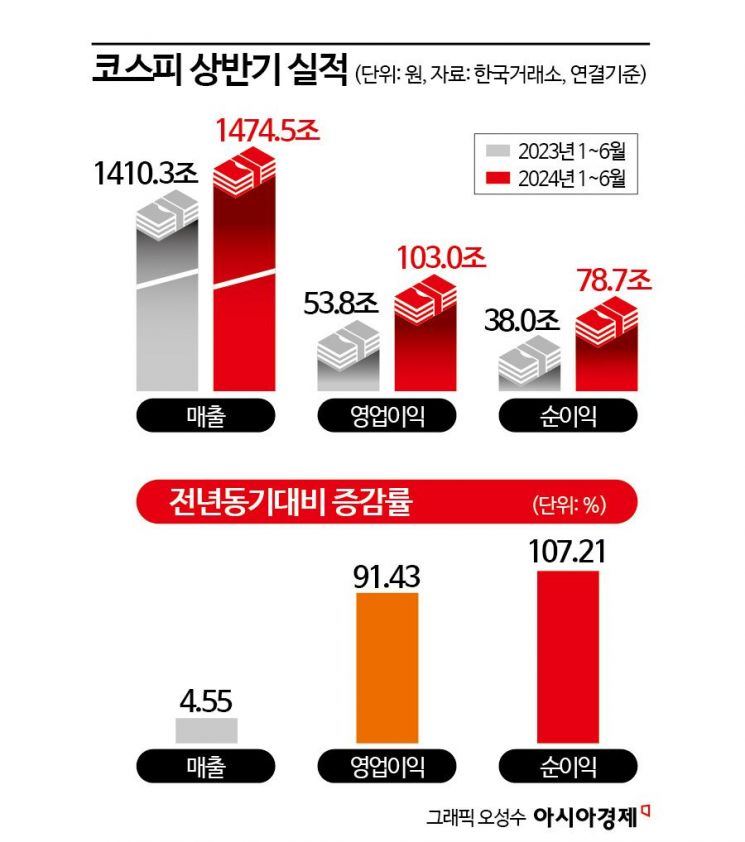

According to the financial investment industry on the 23rd, the consolidated operating profit of the KOSPI in the first half of this year reached 102 trillion won. Surpassing 100 trillion won in the first half is the second time since 2022. The individual basis operating profit was 59 trillion won, marking an all-time high.

This surprising performance of the KOSPI was largely influenced by export companies. In particular, the high level of the won-dollar exchange rate in the first half acted favorably. Semiconductors led strong performances along with shipbuilding, automobiles, and IT hardware.

Jae-eun Kim, a researcher at NH Investment & Securities, said, "If the current outlook holds, major export stocks including semiconductors will continue to lead KOSPI's earnings growth in the remaining second half of the year," adding, "There are upward revisions to next year's earnings forecasts, so the 12-month forward earnings per share (EPS) growth trend is likely to be maintained." He continued, "Especially in semiconductor exports, the benefit came more from price increases than volume, and if Samsung Electronics' high-bandwidth memory (HBM) 3E shipment certification is announced in the second half, the price increase effect could be even greater," emphasizing, "The key point to watch for KOSPI's future earnings is semiconductors."

In the securities industry, it is analyzed that the KOSPI is in an undervalued range due to stock prices not keeping pace with companies' strong earnings. Sung-no Kim, a researcher at BNK Investment & Securities, said, "Despite the 12-month forward EPS increase of the KOSPI, recent price adjustments have placed the Korean market in a historically undervalued area," adding, "The 12-month forward price-to-earnings ratio (PER) once fell to as low as 7.6 times, statistically a very low level, and is now rebounding." He further explained, "Compared to global stock markets, the PER is undervalued by 52%," and analyzed, "Despite the fastest earnings upward revisions, the Korean market is unusually undervalued for the first time in 20 years."

Meanwhile, recent stock market instability and volatility are analyzed to stem from anxiety about the new financial environment change of 'interest rate cuts.' Hae-jung Yang, a researcher at DS Investment & Securities, said, "When asset markets reach an inflection point due to interest rate cuts and other factors, volatility often accompanies it," interpreting, "This volatility may be caused by anxiety ahead of monetary policy changes."

Researcher Yang added, "Generally, volatility in bonds and exchange rates during major changes has not been significant, so it is unlikely to be a systemic crisis," and predicted, "Currently, the market is on an upward path. If interest rate cuts are insurance measures, the magnitude of the rise will increase over time."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)