Government Unveils Loan Regulations Following Supply Measures to Curb Soaring Seoul Apartment Prices

Real Estate Experts Predict

"Transaction Volume Will Decline, Gap Investments Will Be Difficult"

"Sales Prices Will Remain Upward, Jeonse Prices Will Rise Further"

The financial authorities are set to reduce the loan limits for mortgage loans in the Seoul metropolitan area starting next month to curb the rapid rise in apartment prices in Seoul. However, the market is already assessing this measure as insufficient. It is analyzed that it will be difficult to dampen the buying sentiment of demanders who follow the 'smart one house' strategy, purchasing newly built apartments in areas where prices are expected to rise and where they will reside themselves.

In particular, if the U.S. lowers its benchmark interest rate within this year, South Korea is likely to follow suit, which will inevitably diminish the effect of the loan limit reduction. There is also concern that if this measure causes purchase demand to shift to jeonse (long-term lease) demand, it could raise jeonse prices and destabilize the housing ecosystem for ordinary citizens.

Transaction volume will drop, and gap investment will be difficult, but

According to the KB Real Estate Weekly KB Apartment Market Trend report, last week Seoul apartment sale prices surged by 0.22% in just one week, with apartment sale and jeonse prices listed on May 5th in Mapo-gu, Seoul. Photo by Jinhyung Kang aymsdream@

According to the KB Real Estate Weekly KB Apartment Market Trend report, last week Seoul apartment sale prices surged by 0.22% in just one week, with apartment sale and jeonse prices listed on May 5th in Mapo-gu, Seoul. Photo by Jinhyung Kang aymsdream@

On the 21st, the Financial Services Commission held a 'Household Debt Inspection Meeting' to review the second phase of the Stress Debt Service Ratio (DSR) system, which will be implemented from the 1st of next month. Once this system starts, people buying houses in the metropolitan area will be subject to an additional spread interest rate when obtaining mortgage loans from banks. The Stress DSR is a system that calculates loan limits by applying a stress interest rate spread to the loan interest rate, reflecting future interest rate fluctuation risks. As the spread interest rate increases, it affects the DSR, which determines loan limits based on income levels. Consequently, the mortgage loan limit available from banks will decrease accordingly.

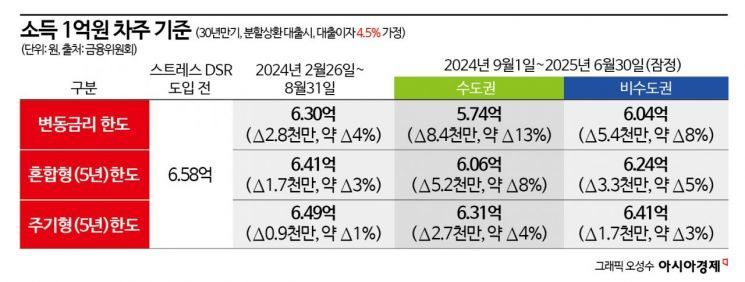

According to the Financial Services Commission, for a borrower with an annual income of 50 million KRW taking out a 30-year variable-rate loan (assuming a loan interest rate of 4.5%), the loan limit will decrease by 42 million KRW (from 329 million KRW to 287 million KRW) compared to before the introduction of the Stress DSR. For a borrower with an annual income of 100 million KRW under the same conditions, the limit will decrease by 84 million KRW (from 658 million KRW to 574 million KRW). However, if the mortgage loan is taken with fixed-rate types such as mixed or periodic, the loan limit will be somewhat higher than this.

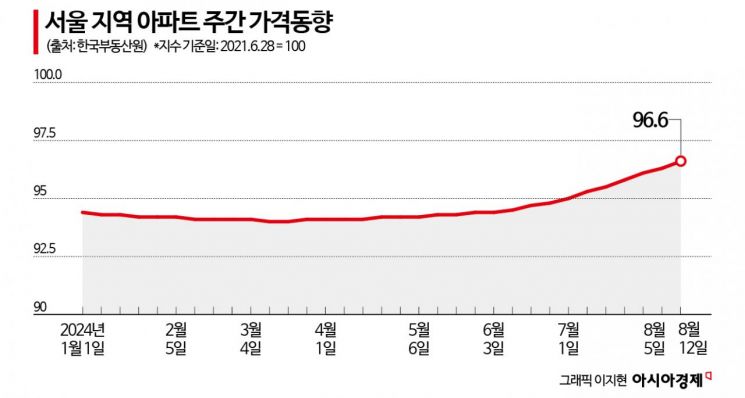

This measure is expected to be effective in calming down apartment transaction volumes in Seoul. According to the Seoul Real Estate Information Plaza, from January this year to the 20th of this month, the total number of apartment sales transactions in Seoul was 36,115, already surpassing last year's annual transaction volume of 35,538, indicating an overheated real estate market.

Kwon Young-sun, a real estate specialist at Shinhan Bank, said, "The Stress DSR will restrict funding, leading to a reduction in the number of properties traded." He added, "However, the Gangnam area will not be significantly affected. The Gangnam 3 districts have already risen so much that the market is now dominated by people with assets. Transactions in areas like Seongdong, Mapo, and Gwangjin districts, where actual demand is concentrated, are expected to slow down."

Kim Seong-hwan, a senior researcher at the Korea Construction Industry Research Institute, said, "People who want to buy apartments for actual residence will feel burdened if they suddenly cannot get loans worth several tens of millions of won." He continued, "There were many gap investments in places like Seongdong, but those who already own a house and try to secure one more with jeonse this time may lack funds, making gap investment difficult."

Prices will continue to rise, and jeonse prices may rise further

ㅏ

Buying sentiment has already risen significantly, and if interest rates are lowered within this year, apartment prices are likely to continue rising regardless of this policy. Specialist Kwon said, "Since buying sentiment is already high, considering demand that does not necessarily need to take out loans, the upward trend is unlikely to subside until the first half of next year."

Kim Hyo-seon, chief real estate specialist at NH Nonghyup Bank, said, "Even if bank mortgage interest rates are currently set somewhat high, if the U.S. Federal Reserve starts lowering rates and the Bank of Korea follows in a chain reaction, the reduction in loan limits due to the application of the second phase of Stress DSR could be offset," adding, "Loan limit regulations are unlikely to affect apartment prices."

There is also a forecast that jeonse prices may rise further after the system is implemented. Chief specialist Kim added, "If people who want to buy houses switch to jeonse demand, which is relatively easier to finance due to regulations, jeonse prices could rise further." Professor Kwon Dae-jung of Sogang University's Department of Real Estate also said, "Currently, due to supply shortages and the concentration on apartments, demand is rushing to purchase. If jeonse prices rise, house prices will inevitably rise further, so it is difficult to expect real estate stabilization effects from the Stress DSR."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.