KTHRI and Next Biomedical Plunge Below IPO Price on First Day

Difficult to Profit from IPO Stocks on Listing Day

Ice Cream Media Sets IPO Price at Lower End of Expected Range

The stock prices of newly listed companies on the domestic stock market fell below their initial public offering (IPO) prices on their first day. Amid ongoing controversies over IPO price overvaluation and increased market volatility, the IPO market is being affected.

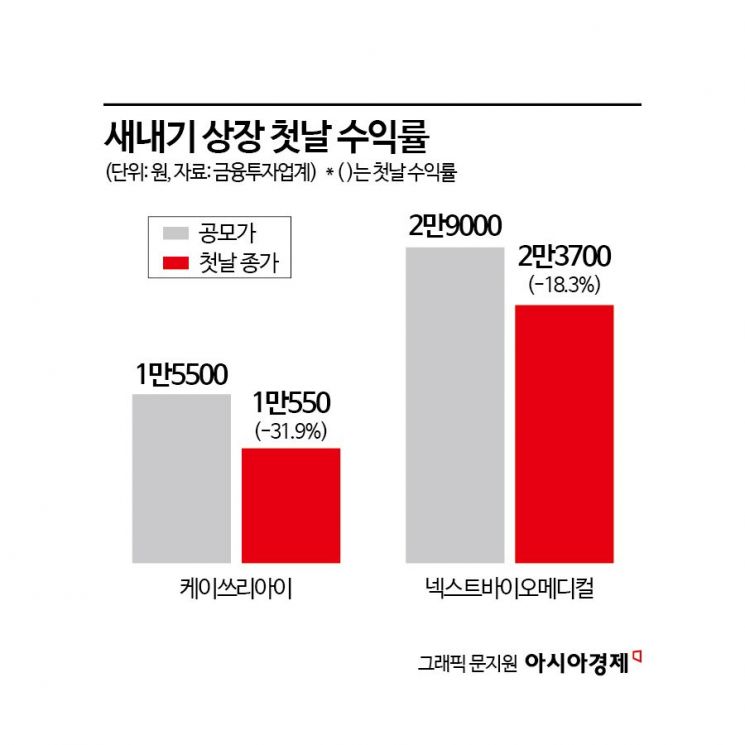

According to the financial investment industry on the 21st, K3RI on the KOSDAQ market closed at 10,650 KRW, down 31.9% from its IPO price the previous day. NexBioMedical, which was also listed on the same day, saw its stock price drop by 18.3%.

K3RI, a developer of extended reality (XR) middleware solutions, and NexBioMedical, an innovative therapeutic agent developer, showed unstable performances in demand forecasting and IPO subscription.

K3RI and NexBioMedical recorded demand forecast competition ratios of 239:1 and 357:1, respectively. In comparison, iBeam Technology, which was listed on the 6th, had a competition ratio exceeding 1000:1. Although the demand forecast competition ratios have relatively decreased, each underwriter set the IPO price at the upper end of the expected range, emphasizing that the majority of participating institutions wished to purchase at prices above the upper limit.

The subscription competition ratio among general investors also declined compared to before. K3RI recorded a ratio of 34:1, with subscription deposits amounting to only 93 billion KRW. NexBioMedical attracted subscription deposits of 238.6 billion KRW, with a competition ratio of 65.8:1.

The average demand forecast competition ratio for six companies listed on the domestic stock market last month was 734:1. The average subscription competition ratio among general investors last month was 1024:1. All six companies set their IPO prices above the upper limit of their expected ranges.

Park Jong-sun, a researcher at Eugene Investment & Securities, explained, "The average subscription competition ratio last month was about half of that in July 2021, when the IPO market was booming," adding, "General investors' interest in the IPO market has significantly decreased compared to before."

Although the enthusiasm for IPO subscriptions among general investors has cooled compared to the first half of this year, IPO prices were set above the expected range. High IPO prices also influence stock price movements on the first day of listing.

The previous day, K3RI was listed at an IPO price of 15,500 KRW but closed at 10,550 KRW. Although it briefly rose to 15,950 KRW during the day, it ultimately closed at the lowest price. NexBioMedical also ended its first day at 23,700 KRW, lower than its IPO price of 29,000 KRW. The closing price was the lowest during the trading session.

It is highly likely that the IPO market will face a cold spell for the time being. Icecream Media, an AI and edutech company scheduled to be listed at the end of this month, set its IPO price at the lower end of the expected range, 22,000 KRW. Demand forecasting was conducted from the 9th to the 16th, with a competition ratio of only 31:1. Samsung Securities, the lead underwriter, had proposed an IPO price range of 32,000 to 40,200 KRW.

Jo Dae-hyung, a researcher at DS Investment & Securities, said, "About 10 new stocks are expected to be listed in August," adding, "Some companies have started to set IPO prices at the lower end of the expected range." He further explained, "The short-term profit-taking returns of newly listed companies are generally decreasing," and added, "A mid- to long-term post-IPO strategy based on earnings growth potential is effective."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.