High Dividend Stocks and Defensive Stocks Gain Attraction

Second Half Outlook: Growth in E-Cigarette and Cigarette Performance

Increased Shareholder Return Expectations to Achieve 'ROE 15%'

Amid recent increased volatility in the stock market, KT&G is showing strength due to stable earnings and growing expectations for enhanced shareholder returns. Analysts in the securities industry suggest that its appeal as a high-dividend stock to maintain returns in an uncertain market will gradually expand.

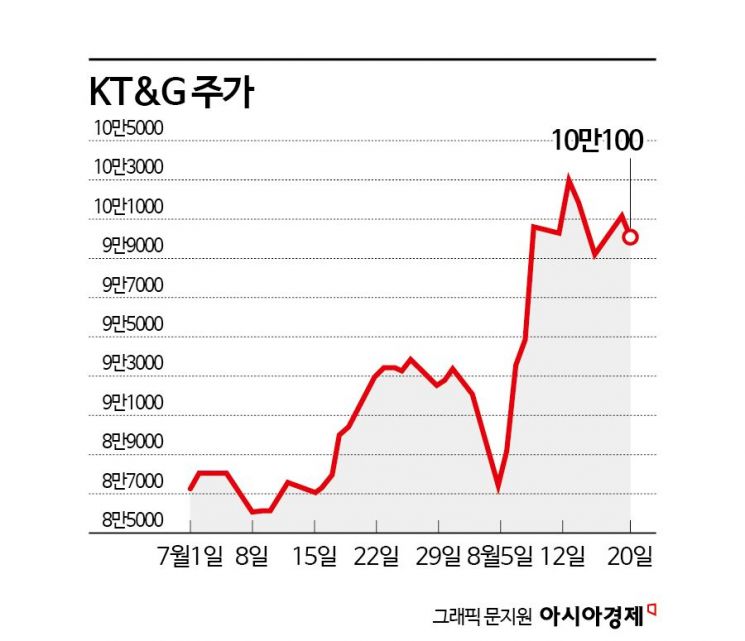

According to the Korea Exchange on the 21st, KT&G closed at 100,100 KRW (-0.99%) the previous day. Although it has been trading sideways after hitting a 52-week high of 104,300 KRW intraday on the 13th, its returns since the early-month 'Black Monday' have reached 14.66%. This marks a strong performance, different from its usual stable price movement as a representative defensive stock in the domestic market.

KT&G's recent strength is interpreted as influenced by its strong second-quarter earnings. KT&G reported consolidated sales of 1.4238 trillion KRW and operating profit of 321.5 billion KRW for Q2, representing increases of 6.6% and 30.6% respectively compared to the same period last year. This was a 'surprise earnings' that exceeded market expectations.

Kim Taehyun, a researcher at IBK Investment & Securities, said, "In the cigarette segment, domestic market share increased, and overseas sales performed well in key subsidiaries such as the Middle East and Indonesia." He added, "The electronic cigarette (NGP) segment also saw improved operating margins due to expanded domestic market penetration and recovery in high-priced duty-free channel sales." He further analyzed, "Health functional foods saw increased overseas sales, including China, and the operating loss was significantly reduced through restructuring of low-profit channels."

Performance growth centered on electronic cigarettes and cigarettes is expected in the second half as well. Kang Eunji, a researcher at Korea Investment & Securities, stated, "In the second half, nationwide sales of the Lil Able 2.0, launched at the end of June, will secure additional market share." Regarding overseas sales, she predicted, "There will be an increase in average selling price (ASP) through price hikes and an increase in sales volume due to portfolio diversification."

Along with improvements in the core tobacco business, active shareholder return policies are also anticipated. KT&G announced at the end of last year that it would repurchase 1 trillion KRW worth of treasury shares and pay dividends totaling 1.8 trillion KRW by 2026. The total amount of treasury shares to be repurchased corresponds to 7.5% of issued shares and will be canceled annually.

Sim Eunju, a researcher at Hana Securities, said, "With the inauguration of a new CEO this year, it is expected that an enhanced shareholder return plan will be re-announced in the second half." She added, "By selling non-operating assets and expanding profits through strengthened cooperation with Philip Morris, visibility toward the goal of '15% return on equity (ROE) by 2027' will be increased."

Park Sangjun, a researcher at Kiwoom Securities, also analyzed, "Expectations for dividend increases are once again attracting market attention." He noted, "Especially as expectations for interest rate cuts expand, the attractiveness as a high-dividend stock could gradually grow."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)