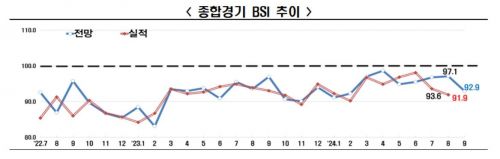

Comprehensive Business Sentiment Index BSI 92.9 'Below Baseline'

30 Consecutive Months of Sluggishness

The domestic companies' economic outlook for September has been negative for 30 consecutive months. Concerns over sluggish domestic demand have overlapped with recent forecasts of a global economic slowdown and economic sentiment instability due to the Middle East situation, leading to expectations of poor performance in both manufacturing and non-manufacturing sectors.

The Korea Economic Association (HanKyungHyup) announced on the 20th that the Business Survey Index (BSI) for 600 major companies by sales recorded a forecast value of 92.9 for next month, falling below the baseline of 100. This is a decrease of 4.2 points compared to the previous month (97.1).

A BSI above 100 indicates a positive economic outlook compared to the previous month, while a BSI below 100 indicates a negative outlook. The BSI forecast has been below the baseline of 100 for 30 consecutive months since April 2022 (99.1).

The September economic outlook showed simultaneous weakness in manufacturing (93.9) and non-manufacturing (91.9). Manufacturing (93.9) showed poor performance due to expanded domestic and international risks such as the slowdown in the U.S. real economy, sluggish Chinese economy, and weakened domestic demand capacity. Non-manufacturing (91.9) had exceeded the baseline at 105.5 in July but sharply declined due to the continued recession in construction and the end of the summer peak season.

Among the detailed manufacturing sectors (total 10) in August, ▲Pharmaceuticals (125.0), ▲General and Precision Machinery and Equipment (114.3), and ▲Food, Beverage, and Tobacco (105.3) showed favorable outlooks. Six sectors, excluding Wood, Furniture, and Paper which hovered around the baseline (100.0), are expected to experience worsening business conditions.

Among the detailed non-manufacturing sectors (total 7), ▲Wholesale and Retail (101.9) showed a favorable outlook, while five sectors, excluding Professional Science, Technology, and Business Support Services which hovered around the baseline (100.0), are expected to face poor business conditions. In particular, ▲Leisure, Accommodation, and Food Service (78.6) is expected to be the weakest among the seven sectors as the summer vacation season ends.

The BSI by sector for September showed negative outlooks across all sectors (▲Domestic demand 96.3 ▲Exports 94.5 ▲Employment 94.0 ▲Financial conditions 93.7 ▲Profitability 92.9 ▲Investment 91.4 ▲Inventory 102.6). Especially, domestic demand (96.3), exports (94.5), and investment (91.4) have been simultaneously weak for three consecutive months since July this year. Domestic demand (96.3) has been below the baseline (100.0) for 27 consecutive months since July 2022 (95.8) due to weakened household consumption capacity amid high interest rate burdens. Exports (94.5) dropped 4.7 points from the previous month (99.2), marking the largest decline in 25 months since August 2022 (5.1 points).

HanKyungHyup explained that recent export growth is mostly due to the semiconductor boom, and excluding semiconductors, export growth is weak. Added to this, external uncertainties have led to a contraction in corporate sentiment outlook.

Lee Sang-ho, head of the Economic and Industrial Division at HanKyungHyup, stated, "Recent shocks in global capital markets, deterioration of the Middle East situation, and economic instability between the U.S. and China, combined with growing concerns over sluggish domestic demand, have heightened domestic and international uncertainties." He added, "It is necessary to support companies so that they can focus on preparing for rapid changes in domestic and international conditions by stabilizing macro indicators such as interest rates and exchange rates and refraining from discussions on amendments to the Commercial Act (expanding directors' duty of loyalty) that increase management uncertainties."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.