Delinquency Rate for Individual Business Loans Falls 0.12 Percentage Points to 0.57%

"Bank Delinquency Rates Typically Decline at Quarter-End"

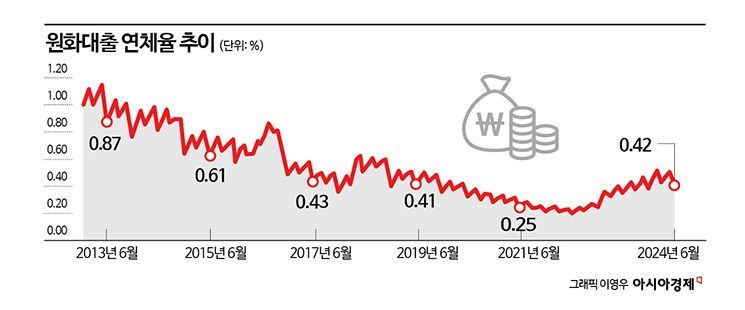

The bank delinquency rate, which had been rising for two consecutive months, has turned downward.

According to the Financial Supervisory Service on the 20th, as of the end of June, the delinquency rate on won-denominated loans by domestic banks was 0.42%, down 0.09 percentage points from the previous month (0.51%). The delinquency rate of domestic banks peaked at 0.51% in February, the highest in 4 years and 9 months, then slightly declined to 0.43% in March, followed by an upward trend from April, before reversing to a decline this time after three months.

The amount of new delinquencies in June was 2.3 trillion won, a decrease of 400 billion won compared to the previous month (2.7 trillion won). During the same period, the amount of delinquent loans resolved was 4.4 trillion won, an increase of 2.4 trillion won compared to the previous month (2 trillion won).

The delinquency rate for corporate loans was 0.46%, down 0.12 percentage points from the previous month (0.58%). During the same period, the delinquency rate for large corporations fell by 0.01 percentage points to 0.04%, and the delinquency rate for small and medium-sized enterprises (SME) loans dropped by 0.14 percentage points to 0.58%. The delinquency rate for individual business owner loans, which hit a 9-and-a-half-year high of 0.69% in May, decreased by 0.12 percentage points to 0.57% in June.

The delinquency rate for household loans was 0.36%, down 0.06 percentage points from the previous month (0.42%). During the same period, the delinquency rate for mortgage loans fell by 0.03 percentage points to 0.24%, and the delinquency rate for other household loans such as unsecured loans declined by 0.14 percentage points to 0.71%.

Generally, delinquency rates tend to rise during the quarter and fall at the end of the quarter, as banks increase the resolution of delinquent loans through sales and disposals at quarter-end.

A Financial Supervisory Service official stated, "It is necessary to prepare for the possibility of rising delinquency rates centered on vulnerable borrowers due to increased volatility in financial markets caused by domestic and external uncertainties," adding, "We will continuously encourage activation of debt restructuring for vulnerable borrowers and maintain loss absorption capacity through sufficient provisioning for loan losses."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)