The government is preparing a National Pension reform plan that emphasizes intergenerational equity and fiscal stability. It is expected to focus on structural reforms that can secure fundamental fiscal stability, going beyond the parameter reforms that have centered on raising contribution rates and lowering the income replacement rate. In particular, it is known that the plan will emphasize intergenerational equity by having younger generations pay less while middle-aged and older generations, who will soon receive pensions, bear a greater burden.

According to the Presidential Office and the government on the 16th, President Yoon Seok-yeol is scheduled to announce a National Pension reform plan that includes raising contribution rates differentially by generation and introducing an automatic stabilization mechanism. This National Pension reform plan is expected to be announced directly by President Yoon during a national briefing anticipated at the end of this month or early next month.

The newly conceived reform plan by the government focuses on fiscal stabilization. It is expected to include measures that differentiate the speed of contribution rate increases between generations to ease opposition from generations who will have to continuously pay pensions in the future. For example, if it is decided to raise the contribution rate by 13-15%, the timing of applying the contribution rate to middle-aged and young generations will differ. The young generation would see an increase of 0.5 percentage points annually, while the middle-aged generation would see an increase of 1 percentage point annually.

An automatic stabilization mechanism to secure the pension fund’s fiscal stability will also be introduced. This mechanism will automatically raise contribution amounts and reduce benefit payments if the fund faces depletion due to factors such as fund operation returns, life expectancy, and birth rates. This approach aims to quickly respond to concerns about fund exhaustion without having to revise the National Pension Act each time parameter reforms adjusting contribution rates and income replacement rates are necessary.

Additionally, the reform plan is expected to include a significant advancement in the timing of recognizing childbirth credits in the National Pension. Childbirth credits are a system where the state recognizes the childbirth period as part of the National Pension subscription period to encourage childbirth. Under the current credit system, subscribers who have given birth to a second or subsequent child after January 2008 receive an additional 12 months of subscription period for the second child and 18 months per child from the third child onward at the time they receive their pension. This benefit adds to the subscription period after the pension receipt age of 63 (current standard).

The government has decided to change the application timing of credits to be much earlier, immediately after childbirth. The insurance premiums paid by workers during the childbirth period are expected to be covered by the government’s treasury. It is also anticipated that the credits, which were previously recognized from the second child onward, will be extended to include the first child. Furthermore, the 'military service credit' for those who served in the military will be expanded. Currently, only up to six months of military service is recognized as pension subscription period, but going forward, the entire military service period will be recognized as pension subscription period.

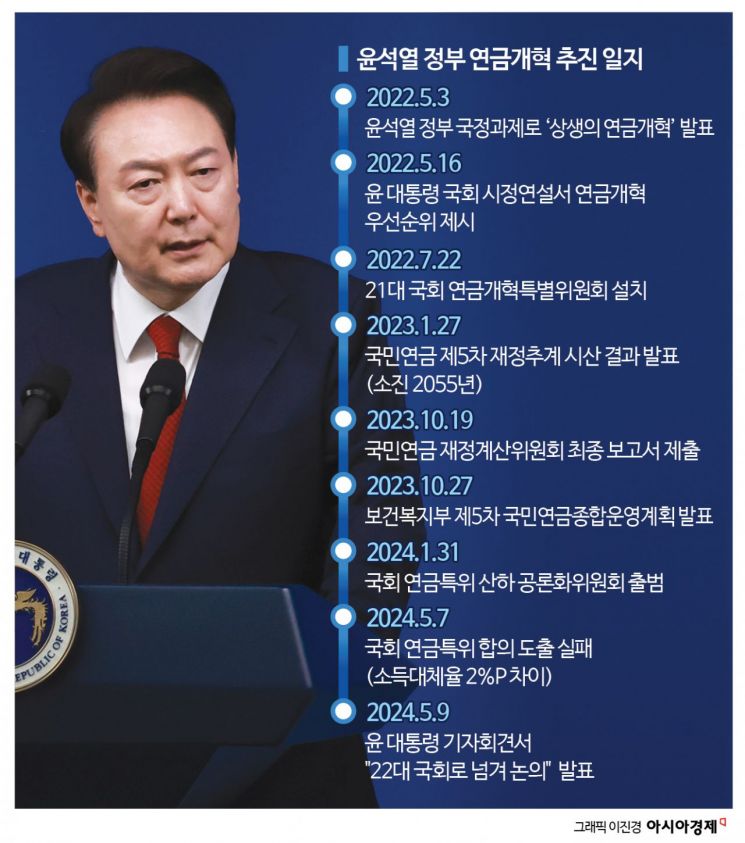

The government is preparing this pension reform plan because it judges that parameter reforms alone cannot provide a fundamental solution. According to the 5th fiscal projection by the National Pension Financial Projection Committee, the National Pension will run a deficit starting in 2041, and the pension fund will be depleted by 2055. Compared to the fiscal projection five years ago, the depletion date has been moved up by two years, and the deficit onset by one year.

Accordingly, although the ruling and opposition parties agreed in the 21st National Assembly to raise the contribution rate up to 13%, they failed to reach an agreement on the income replacement rate, which was debated between 44% and 45%. Even if they had agreed on the income replacement rate, it would have only delayed the depletion date by 7 to 8 years. The Presidential Office judged that such parameter reforms alone would not secure long-term fiscal stability. It is projected that the reform plan the government is preparing could delay the fund depletion date by about 30 years. President Yoon is expected to reveal the broad outline of this plan at the upcoming national briefing, but specific figures are unlikely to be included.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)