In the first half of this year, major domestic non-life insurance companies recorded the highest half-year performance ever. Following strong results in the first quarter, these insurers continued their good performance in the second quarter, benefiting significantly from the introduction of the new accounting standard IFRS17. However, with the possibility of interest rate cuts in the second half of the year, performance volatility is also expected to increase.

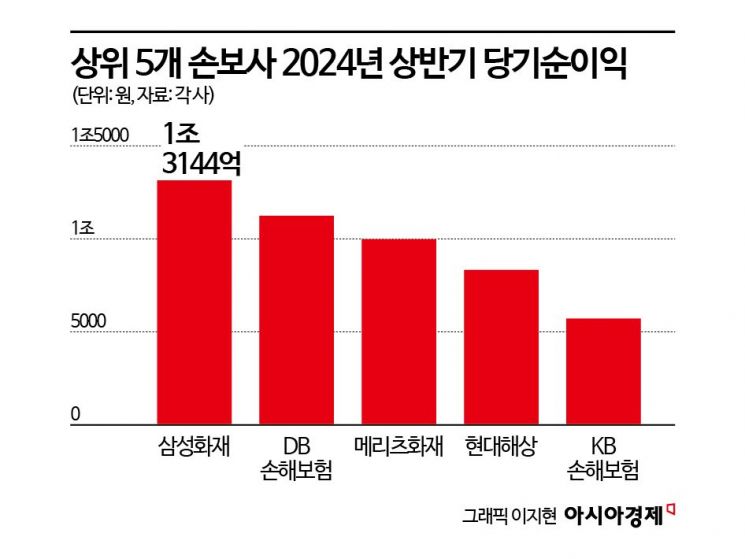

Top 5 Companies' Net Profit Approaches 5 Trillion KRW... Samsung, DB, Meritz Fire Around 1 Trillion KRW Each

According to the insurance industry on the 16th, the combined net profit of the top 5 non-life insurance companies that announced their first half results this year reached 4.8412 trillion KRW. In particular, Samsung Fire & Marine Insurance and DB Insurance achieved net profits of 1.3144 trillion KRW and 1.1241 trillion KRW respectively, recording results exceeding 1 trillion KRW.

Meritz Fire & Marine Insurance also posted a net profit of 997.7 billion KRW on a separate basis in the first half, achieving results close to 1 trillion KRW. This is the highest performance ever, up 22.3% compared to the same period last year. Notably, long-term insurance profits increased by more than 150 billion KRW compared to the previous year.

Hyundai Marine & Fire Insurance's net profit (833 billion KRW) increased by 67.6% compared to the same period last year, marking the highest half-year performance ever, and KB Insurance also achieved a record high first half performance with 572 billion KRW, up 8.9% year-on-year.

Success of Protection Insurance-Focused Strategy... How Long Will the IFRS17 Effect Last?

The strong performance is largely attributed to the introduction of the new international accounting standard IFRS17. IFRS17 requires insurance liabilities to be measured at fair value reflecting market interest rates rather than at the original cost at contract inception.

As a result, insurers have come to place great importance on the Contractual Service Margin (CSM), a future profit indicator, which directly impacts their performance. Insurers focusing on protection insurance appear to have benefited from this regulatory change. Protection insurance refers to products that contrast with savings-type insurance, such as automobile insurance, where early cancellation or maturity refunds do not exceed the premiums paid.

Protection insurance, which tends to be more profitable, generally has a higher CSM and is considered advantageous under the IFRS17 framework. Therefore, the insurers' strategy of concentrating on protection insurance sales has been interpreted as a key factor behind the improved performance.

However, some voices suggest that the first half of this year may remain a 'golden period' for the non-life insurance industry. The main reason cited is the expected interest rate cuts starting in the second half. Lower interest rates reduce insurers' asset profitability, negatively affecting their financial condition. This also disadvantages the solvency ratio (K-ICS), an indicator of financial soundness.

Accordingly, the non-life insurance industry faces the challenge of not resting on short-term performance improvements but building a long-term and sustainable growth model. In particular, digital transformation, new market development, and customer-centric product development have emerged as key tasks.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.