Samyang Foods Achieves Record High Performance... Operating Profit Soars Over 100%

Meanwhile, Nongshim's Operating Profit Drops 20%, Previously Export-Driven

Ultimately, Exports Are the Only Way... Establishing Export-Only Factory

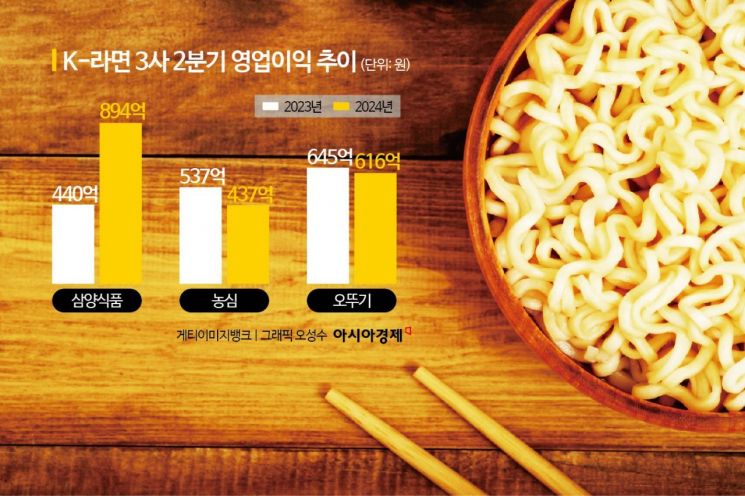

Samyang Foods achieved record-breaking performance again in the second quarter of this year, riding the global 'Buldak Bokkeum Myun syndrome.' Due to explosive export growth, the operating profit growth rate exceeded 100% once more. On the other hand, Nongshim, once the leading representative of K-Ramen, received a disappointing report card with operating profit plunging nearly 20%. While the three major K-Ramen companies?Samyang Foods, Nongshim, and Ottogi?are all growing in size thanks to strong K-Ramen exports, their expressions differ depending on their operating profits.

Samyang Foods 'Excellent'?The Only One to Achieve Both Sales and Operating Profit Growth... Nongshim Wept Over Plummeting Operating Profit

The three domestic ramen companies?Samyang Foods, Nongshim, and Ottogi?announced their second-quarter results on the 14th. Samyang Foods is the only company that succeeded in achieving growth in both sales and operating profit.

Samyang Foods once again set a new record for its best-ever performance. On a consolidated basis, it recorded sales of 424.4 billion KRW and operating profit of 89.4 billion KRW. Compared to the same period last year, sales increased by 48.7%, and operating profit rose by 103.2%. Even compared to the earnings surprise in the first quarter, sales and operating profit increased by 10% and 11.6%, respectively.

The explosive growth came from exports. Overseas sales in the second quarter reached 332.1 billion KRW, surpassing 300 billion KRW for the first time. This is a 74.9% increase compared to a year ago. As a result, the proportion of overseas sales in Samyang Foods' total sales expanded to 78%. In particular, Samyang America, the U.S. subsidiary, achieved sales of 71.4 million USD (approximately 97.2 billion KRW), a 125% increase compared to the same period last year, thanks to the popularity of Carbo Buldak Bokkeum Myun.

A Samyang Foods official said, “Unlike the early export phase centered on Asia, recently the U.S. and Europe have been leading the growth in overseas sectors. With the recent establishment of a European subsidiary, we now have sales bases in all major export regions. Based on this, we will further accelerate our efforts to penetrate local markets.”

On the other hand, Nongshim, which initially led K-Ramen overseas sales, posted sales of 860.7 billion KRW, a 2.8% increase from a year ago, but operating profit sharply declined. Operating profit in the second quarter was 43.7 billion KRW, down 18.6% from the same period last year. Although exports grew significantly and drove sales growth, operating profit decreased due to the impact of last year's price reductions for Shin Ramyun and Saewookkang, as well as increased costs of goods sold and management expenses. A Nongshim official explained, “The burden of raw material prices contracted last year continued through the first half of this year,” adding, “Operating profit worsened due to the strong dollar, increased costs of imported goods purchases, and export expenses.”

Ottogi's second-quarter sales slightly increased to 859.2 billion KRW from 854.2 billion KRW a year earlier, but operating profit decreased by 4.5% to 61.6 billion KRW. Among the three ramen companies, Ottogi has the smallest export ratio but has recently been expanding its overseas business mainly in the U.S. and Vietnam. Ottogi explained, “Sales grew thanks to ramen, convenience foods, and sauce/dressing sales, but operating profit declined due to increased advertising expenses and fees.”

With Domestic Market Saturation, 'Exports' Will Remain Key... Samyang to Complete New Factory in 2025, Nongshim Likely to Build Export Factory

With the domestic market saturated and Korean ramen enjoying a boom thanks to the popularity of K-content, the performance of the three ramen companies is likely to continue to hinge on 'exports.' Korean ramen exports have been breaking records for six consecutive quarters since the first quarter of last year, expanding their global influence.

Accordingly, Samyang Foods has decided to further expand the production line at its second factory in Miryang, scheduled to be completed in 2025. By 2026, Samyang Foods' annual production capacity will exceed 2.5 billion units. Nongshim is also highly likely to announce plans to establish an export-only factory within this year.

Additionally, with the new expansion line in operation at its second U.S. factory, Nongshim plans to accelerate external growth through product diversification. Ottogi operates both a local factory and sales subsidiary in Vietnam. Recently, it has been implementing localization strategies to expand market influence, such as launching new products that reflect the characteristics of Korean and Vietnamese ramen.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)