AI Cycle Peak-Out Still Early

Additional Observation Needed for Monetization

Keep Watching SK Hynix and Samsung Electronics

Amid a recent sharp decline in the stock market, semiconductor stocks have rebounded, leaving investors who have not included semiconductors in their portfolios contemplating whether to buy. This is because the controversy over the 'Artificial Intelligence (AI) bubble' persists, and there are assessments that semiconductors have lost their 'leading stock' status in this recent downturn. However, the securities industry analyzes that monetizing AI will take more time, and it is still too early to say that the AI cycle has reached its peak.

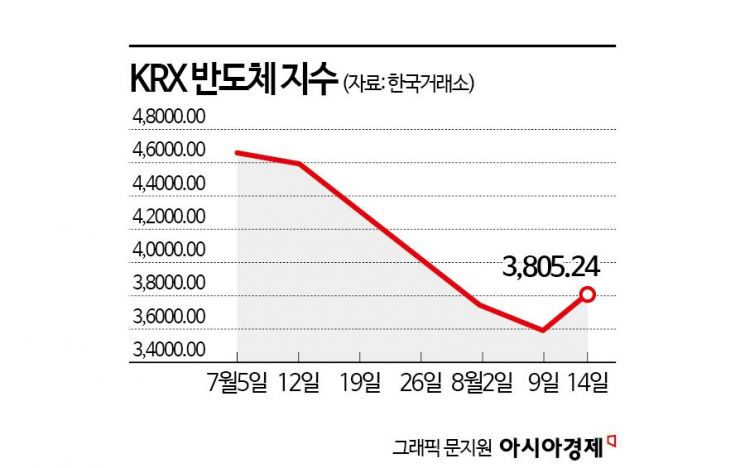

According to the Korea Exchange on the 16th, the KRX Semiconductor Index recorded 3805.24 based on the previous trading day's closing price, rising 15.17% from its recent low. During the same period, SK Hynix (19.60%), Samsung Electronics (8.12%), Hanmi Semiconductor (15.50%), and Lino Industrial (25.15%), which make up the index, all rose together, showing signs of recovering from the recent sharp decline.

Now, investors' attention is focused on whether semiconductor stock prices can fully recover the recent losses. Furthermore, if the AI cycle continues, there is even anticipation that the recovery could surpass previous highs. However, concerns about the AI bubble and AI profitability, which were raised even before the sharp decline, still persist, causing confusion among market participants.

In the securities industry, considering the nature of past semiconductor cycles, it is analyzed that it is still too early to worry about the peak out of the AI cycle. Kim Kwang-jin, a researcher at Hanwha Investment & Securities, explained, "The memory big cycle usually lasts for 9 to 10 quarters, and at the end of the cycle, quarterly operating profits decline and memory prices fall." He added, "At this time, stock prices typically peak about 1 to 2 quarters before the cycle ends." He continued, "The full-scale turnaround in earnings for memory companies due to the current AI cycle began in the fourth quarter of last year. Considering the strong willingness of big tech companies to expand investments despite recent concerns about AI overinvestment, it is still too early to worry about the peak of the cycle."

On the other hand, some remain concerned that, compared to the scale of AI investments, there have been no outstanding results, and that the expenditures poured into AI may not be recovered. In response, Lim Ji-yong, a researcher at NH Investment & Securities, said, "At least as of now, big tech companies are not seeing significant profits from AI investments," but added, "However, a long payback period does not mean the AI cycle will stop." He further explained, "Historically, most bubbles ended when capital costs changed sharply or final demand decreased, affecting companies' capital allocation abilities. They did not disappear because investments in technology took longer than expected." He pointed out, "Currently, big tech companies leading AI have enough capital and large distribution networks to experiment with how to monetize their investments." He concluded, "I do not think AI is a bubble now. It just needs time for monetization."

Ultimately, as long as the AI cycle continues, the benefits for major domestic semiconductor companies are expected to persist. Seo Seung-yeon, a researcher at DB Financial Investment, said, "SK Hynix, which has secured the HBM3 market in this AI cycle, plans to supply HBM3E 12-layer memory to major large graphics processing unit (GPU) customers starting in the fourth quarter." He added, "Although there have been recent controversies over shipment delays of products from major GPU customers in the market, SK Hynix's schedule for supplying HBM to its customers is expected to proceed without disruption." Regarding Samsung Electronics, he said, "Based on memory demand related to AI servers, memory prices have risen compared to the previous quarter, and quarterly profit growth is expected to continue." He also noted, "Although Samsung has been a latecomer so far, it has a strong will to recover starting with HBM3E 12-layer memory and will actively enter the HBM market going forward."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![From Bar Hostess to Organ Seller to High Society... The Grotesque Con of a "Human Counterfeit" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)