As 'Car AI' Gets Smarter, Demand for High-Performance 'Car Semiconductors' Increases

'On-Device ADAS' Led by AI Company Tesla from Design Stage

SoCs Dominated by Nvidia and Qualcomm... Horizon and MediaTek in Pursuit

Industry experts predict that the era when memory semiconductors such as High Bandwidth Memory (HBM) and Solid State Drives (SSD) are installed not only in servers but also in autonomous vehicles could begin as early as five years from now. Just as SK Hynix has emerged as a leader in the server AI semiconductor market with HBM used alongside Nvidia graphics processing units (GPUs), it is highly likely to benefit in the autonomous vehicle HBM market as well.

SK Group Chairman Chey Tae-won visited SK Hynix's Icheon Campus in Icheon, Gyeonggi Province on the 5th and inspected the HBM production site with key SK Hynix executives.

SK Group Chairman Chey Tae-won visited SK Hynix's Icheon Campus in Icheon, Gyeonggi Province on the 5th and inspected the HBM production site with key SK Hynix executives. [Photo by Yonhap News]

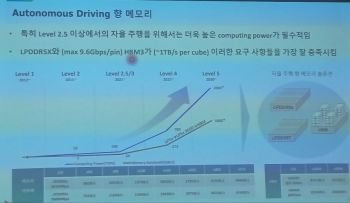

On the 14th, Kang Wook-sung, Vice President in charge of next-generation product planning at SK Hynix, forecasted at the '7th AI Semiconductor Forum Breakfast Lecture' held by the AI Semiconductor Forum at JW Marriott Seoul in Seocho-gu, Seoul, that HBM and SSD will emerge as mainstream memory semiconductors for autonomous vehicles in the future.

According to Vice President Kang, among the vehicle DRAM semiconductors currently used by automakers, Low Power Double Data Rate (LPDDR) 4 is the most widely adopted. The share of LPDDR5 is increasing, and LPDDR is expected to remain the main vehicle DRAM chip for the next five years. On the NAND flash side, Universal Flash Storage (UFS) was introduced about 3 to 4 years ago, and signs of a shift to SSD have begun to appear over the past 1 to 2 years.

In 3 to 5 years, HBM could also rise as a key player in vehicle memory semiconductors. Although automakers currently prefer LPDDR, as autonomous driving levels increase, a transition to HBM is possible. Vice President Kang said, "HBM is gradually being introduced mainly in high-end vehicles, but it is not yet mainstream. For it to become mainstream, autonomous driving must become widespread."

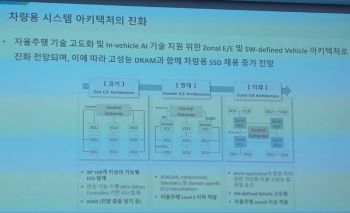

Kang Wook-sung, Vice President in charge of Next-Generation Product Planning at SK Hynix, presented materials explaining the evolution process of vehicle architecture at the "7th AI Semiconductor Forum Breakfast Lecture" hosted by the AI Semiconductor Forum on the 14th at JW Marriott Seoul in Seocho-gu, Seoul.

Kang Wook-sung, Vice President in charge of Next-Generation Product Planning at SK Hynix, presented materials explaining the evolution process of vehicle architecture at the "7th AI Semiconductor Forum Breakfast Lecture" hosted by the AI Semiconductor Forum on the 14th at JW Marriott Seoul in Seocho-gu, Seoul. [Photo by Moon Chae-seok]

Until now, vehicle semiconductors have been perceived as relatively low-performance chips. However, as automakers strengthen three functions?infotainment, telematics, and advanced driver-assistance systems (ADAS)?this has become a significant opportunity for vehicle semiconductor manufacturers.

Tesla changed the trend by adopting a 'zonal architecture' strategy focused on software-defined vehicles (SDV) from the early stages of vehicle design. Tesla's zonal architecture does not list 30 to 100 electronic control units (ECUs) per vehicle but places four zonal ECUs around a central computer. This shift has increased demand for high-capacity, high-performance semiconductors that act like a PC's central processing unit (CPU).

Tesla is regarded as effectively implementing 'on-device ADAS.' This means the vehicle's chip performance is high and intelligent enough to operate ADAS autonomously, similar to 'on-device AI,' where devices perform AI model computations without separate network connections. Tesla's secret lies in having advanced AI by introducing large language models (LLM) as early as five years ago.

Vice President Kang said, "While the LLM craze has made AI known to the public, the true AI leader is the automotive market. Server AI is used to operate servers, but servers themselves do not move. In contrast, cars are high-speed moving objects, so the technical difficulty of vehicle semiconductors is much higher."

Kang Wook-sung, Vice President in charge of Next-Generation Product Planning at SK Hynix, explained trends in automotive memory semiconductors including HBM at the "7th AI Semiconductor Forum Breakfast Lecture" hosted by the AI Semiconductor Forum on the 14th at JW Marriott Seoul in Seocho-gu, Seoul. Photo by Moon Chae-seok

Kang Wook-sung, Vice President in charge of Next-Generation Product Planning at SK Hynix, explained trends in automotive memory semiconductors including HBM at the "7th AI Semiconductor Forum Breakfast Lecture" hosted by the AI Semiconductor Forum on the 14th at JW Marriott Seoul in Seocho-gu, Seoul. Photo by Moon Chae-seok

HBM has drawbacks such as being more expensive and harder to commercialize than LPDDR. HBM must be integrated closely with the system-on-chip (SoC) to perform optimally. Just as in server AI semiconductors where HBM chips are tightly coupled next to Nvidia GPUs (SoCs), compatibility with SoCs is crucial for vehicle AI semiconductors as well.

Like servers, vehicle AI semiconductors must overcome issues of heat generation and power consumption. Vehicle semiconductors have much stricter safety standards than server semiconductors. According to Vice President Kang, they must withstand temperatures ranging from -45 to 125 degrees Celsius.

Since server AI semiconductors used in data centers have already been verified for safety, Vice President Kang is optimistic that vehicle semiconductors can be sufficiently supplied as well.

He said, "HBM is made from the same silicon as data center HBM, and the requirements for data center HBM are very stringent, so there is not much difference for vehicle applications. There is no problem applying it to vehicles."

Vice President Kang also predicted that Nvidia will dominate the vehicle SoC semiconductor market. The vehicle SoC market is broadly divided into advanced driver-assistance systems (ADAS) and cockpit segments.

In ADAS, Nvidia is the absolute leader, with Chinese autonomous driving solution company Horizon chasing closely. In the cockpit segment, Qualcomm is the number one player, followed by Taiwanese fabless design company MediaTek.

He said, "In the ADAS SoC market, traditional server companies and GPU firms show strong performance, while mobile application processor (AP) companies stand out in the cockpit SoC market."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.