Ingledwood Lab and Cosmax Stock Prices Drop 22% and 14% Respectively After Earnings Fall Short of Market Expectations

Some View Oversold Zone as a Buying Opportunity

Cosmetics stocks, which led the stock market in the first half of the year, have collapsed. This is due to a flood of sell-offs caused by disappointing earnings. As investment sentiment toward cosmetics stocks deteriorated and spread throughout the industry, major cosmetics stocks closed lower across the board on the 13th. The securities industry advised that for some stocks with confirmed poor earnings, short-term price adjustments are inevitable, and investors should consider buying opportunities afterward.

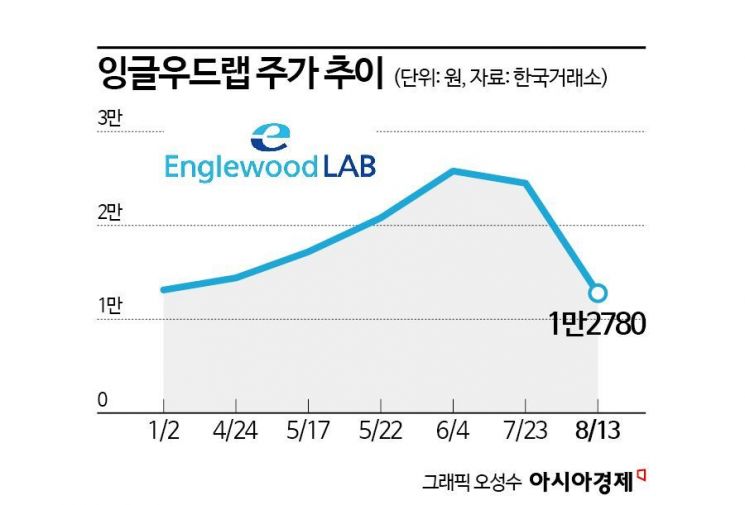

According to the Korea Exchange on the 14th, Ingledwood Lab closed at 12,780 won, down 22.07% (3,620 won) from the previous day. This is a stark contrast to the rising trend at the end of last month ahead of the Q2 earnings announcement. The company's stock price, which was 12,030 won (closing price on January 2) earlier this year, rose to 24,500 won on July 23, just before the earnings release, marking an increase of approximately 103%.

Headquartered in New Jersey, USA, Ingledwood Lab produces basic cosmetics as well as color cosmetics and sunscreens. It emerged as a representative beneficiary stock as the sunscreen market grew in North America. However, disappointment selling surged following the Q2 earnings announcement. Ingledwood Lab disclosed that its consolidated operating profit for Q2 was preliminarily estimated at 4.3 billion won, a 30.8% decrease compared to the same period last year. This figure also fell short of market expectations by about 36.6%. Sales revenue decreased by 6.7% to 56 billion won.

Cosmax's stock price has also declined after its earnings announcement. In early January, Cosmax maintained a stock price in the 110,000 to 120,000 won range, broke through 130,000 won in March, and touched 190,000 won by the end of June. The stock price began to decline gradually from mid-July.

Cosmax's Q2 operating profit recorded 46.7 billion won, a 1.5% increase year-on-year, but it missed consensus estimates by 18.08%. Following the earnings release, securities firms lowered Cosmax's target price one after another. Mirae Asset Securities cut it from 240,000 won to 180,000 won, and Korea Investment & Securities lowered it from 250,000 won to 200,000 won. Huh Jena, a researcher at DB Financial Investment, said, "The risk of debt collection from the US subsidiary and some domestic clients is expected to persist in the second half of the year. Accordingly, we have revised down the 2024 earnings estimates by 12% and lowered the target price to 170,000 won." On the 13th, Cosmax closed at 117,700 won, down 14.59% (21,000 won) from the previous day.

However, some view the situation as a buying opportunity rather than a deterioration of investment points. Kim Hyemi, a researcher at Sangsangin Securities, said, "Although the Q2 operating profit fell short of expectations, the existing investment points have not been damaged. In the US, it is necessary to wait for the relatively long lead time and the effect of the planned opening of the LA sales office in Q3. Although the Chinese market recovery should precede, the recent stock price decline was excessive, so I recommend it as a buying opportunity."

Kim Myungju, a researcher at Korea Investment & Securities, also said, "Over the past month, Cosmax has been oversold due to concerns about its China business. The valuation attractiveness is high, so the stock price is expected to gradually recover."

Meanwhile, the weakening investment sentiment toward cosmetics stocks, triggered by these two companies, is spreading throughout the industry. Korean Cosmetics Manufacturing, an ODM (Original Design Manufacturer) stock considered one of the biggest beneficiaries alongside small and medium-sized brands expanding overseas, also fell more than 5% (-5.71%), and Cosmecca Korea closed lower by 0.14%.

Industry leaders Amorepacific and LG Household & Health Care fell 3.07% and 3.08%, respectively, on the day. Korea Kolmar (-7.09%) and Tony Moly (-4.07%) also could not escape the downward trend amid frozen investment sentiment.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)