Exemption from Total Compensation Reporting When Submitting Simplified Payment Statement

Bottom 30% Income Group, Medical Expense Out-of-Pocket Limit Frozen

The out-of-pocket rate for outpatient medical expenses for chronic disease patients receiving integrated hypertension and diabetes management services at local clinics will be reduced from the existing 30% to 20%.

The Ministry of Health and Welfare announced on the 13th that the partial amendment to the Enforcement Decree of the National Health Insurance Act containing this content was approved at the Cabinet meeting.

According to the main amendments, a legal basis was established to reduce the out-of-pocket rate from 30% to 20% for chronic disease patients who apply for integrated hypertension and diabetes management services and meet certain requirements such as establishing a customized management plan when receiving treatment at clinics.

The Ministry of Health and Welfare expects this to encourage chronic disease patients to receive comprehensive and continuous care at local clinics, while also contributing to rational medical use, including the improvement of the medical delivery system.

The amendment also includes a plan to exempt employers, such as companies, from reporting the total amount of wages to the National Health Insurance Corporation when submitting payroll details of their employees to tax authorities starting from the 2025 health insurance premium year-end settlement (for income earned in 2024).

Until now, employers had to report the total wages of their employees for the previous year to the National Health Insurance Corporation by March 10 every year for the health insurance premium year-end settlement. At the same time, employers had to report the previous year's salary and other details to the tax authorities for the year-end income tax settlement, causing inconvenience due to duplicate reporting of the same information to both the tax authorities and the National Health Insurance Corporation.

The Ministry of Health and Welfare will consider the submission of simplified payment statements to the tax authorities as having reported the total wages to the National Health Insurance Corporation, and the Corporation will perform the premium year-end settlement through data linkage with the National Tax Service.

A plan was also prepared to expand the income items used as the basis for adjusting the monthly income amount, which is the standard for imposing health insurance premiums, from the existing two items (business and employment) to six items (business, employment, interest, dividends, pension, and others). Currently, the National Health Insurance has introduced and operates a monthly income adjustment system to allow subscribers to pay premiums based on their current income, and this measure aims to activate that system.

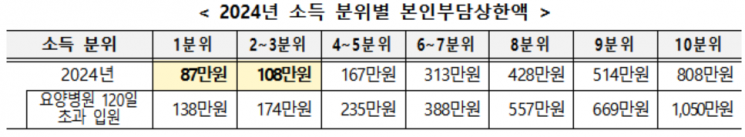

Additionally, to reduce the medical expense burden for low-income health insurance subscribers, the out-of-pocket maximum amount for the bottom 30% income group will be maintained at the same level as last year.

Lee Jung-gyu, Director of the Health Insurance Policy Bureau at the Ministry of Health and Welfare, said, "This amendment to the Enforcement Decree is a follow-up measure to the '2nd Comprehensive Plan for National Health Insurance' announced in February," adding, "It will contribute to easing the medical expense burden for chronic disease patients receiving comprehensive care and low-income subscribers by enhancing convenience in premium payment through unified year-end settlement reporting and expanding the scope of monthly income adjustment applications."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.