Expansion to 10 Types of Currency-Linked ETNs

Meritz Securities, which holds the largest number of domestic ETN (Exchange Traded Note) products with a total of 75 types, is launching new currency-type ETN products.

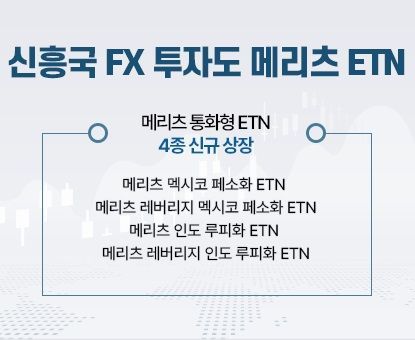

On the 13th, Meritz Securities announced that it will list four ETN products on the Korea Exchange on the 14th, tracking the Mexican Peso and Indian Rupee respectively, with up to 2x leverage investment possible.

This product is the first in the domestic Exchange Traded Product (ETP) market to invest in the currencies of emerging countries Mexico and India. The products include ▲Meritz Mexico Peso ETN and ▲Meritz Leverage Mexico Peso ETN, which track the KAP Mexico Peso Total Return (TR) Index, and ▲Meritz India Rupee ETN and ▲Meritz Leverage India Rupee ETN, which track the KAP India Rupee Total Return (TR) Index. The indices are calculated by Korea Asset Pricing (KAP).

Meritz Securities’ currency-type ETNs have expanded their emerging market lineup by adding these to the existing Japanese Yen and Chinese Yuan products, increasing the total to 10 types.

The newly listed ETNs, like the existing Japanese Yen and Chinese Yuan products, track total return (TR) indices, designed so that both the interest income from the invested countries and domestic interest income are reflected in the index. Unlike the total return (TR) index tracking method, the excess return (ER) index method, which tracks futures, collects interest income from the invested country but deducts domestic interest income. Therefore, ETNs tracking total return (TR) indices, which include and reinvest both the invested country’s and domestic interest income, are advantageous in terms of yield compared to the excess return (ER) index method.

Currently, Mexico’s benchmark interest rate is 10.75%, and India’s benchmark interest rate is 6.5%, providing relatively high short-term interest income, which is reflected in the prices of Meritz Mexico Peso ETN and Meritz India Rupee ETN respectively. However, currency-type products are fundamentally affected by exchange rate directions, and short-term exchange rate volatility can be significant, so caution is advised.

Kwon Dong-chan, Head of Trading at Meritz Securities, said, “Domestic ETF and ETN investors are rapidly diversifying their investments from mainly stocks to various bond-related products,” adding, “Just as interest in the Japanese Yen has recently increased significantly, demand for diversifying risk and increasing expected returns through emerging market and currency-related investments is also expected to grow.”

He further explained, “Unlike other companies’ excess return (ER) index tracking products, Meritz Securities’ bond-type and currency-type ETNs provide investors with total return (TR), which is a distinctive feature and strength.”

For more details, visit the Meritz Securities ETN dedicated website, and information related to the underlying indices can be found on the KAP Korea Asset Pricing website.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.