5.8%↑ Compared to 1 Year Ago... 98% of GDP

"Faster Than Economic Growth Rate"

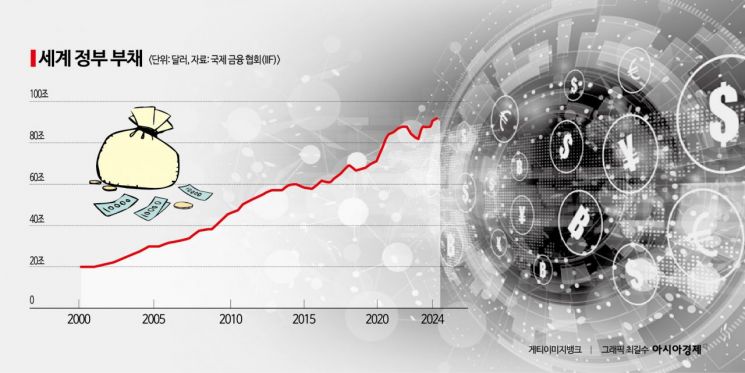

Global government debt surpassed 1,200 trillion won earlier this year, marking an all-time high. The scale has increased about threefold compared to 20 years ago. Concerns are mounting that debt is growing faster than economic growth.

According to the Institute of International Finance (IIF) on the 13th, as of the end of March this year, the total global government debt amounted to $91.4 trillion (approximately 12,532.7 trillion won), a 5.8% increase from the previous year. This is the largest ever recorded, about three times the level of 20 years ago.

The global government debt-to-GDP ratio stood at 98.1%, up 2.2 percentage points from a year ago. The Nihon Keizai Shimbun, citing IIF figures, reported, "This shows that debt is increasing faster than economic growth," adding, "This is clearly higher than the average annual increase of 0.9 percentage points from late 2014 to late 2019, before the COVID-19 pandemic."

By country, the United States saw the fastest increase in government debt. It rose by a staggering $2.9 trillion (9.5%, approximately 3,976 trillion won) in just one year. Earlier, the Congressional Budget Office (CBO) raised the fiscal deficit forecast for the 2024 fiscal year (October 2023 to September 2024), including support for Ukraine, to $1.9 trillion (about 2,605 trillion won), 1.3 times the previous estimate. Interest burdens resulting from this are also increasing. Due to expansionary fiscal policies and high interest rates, the annualized interest payment cost in the U.S., which was around $500 billion (approximately 686 trillion won) until the COVID-19 period, surpassed $1 trillion by the end of last year and continues to rise.

During the same period, government debt in the Eurozone (20 countries using the euro) also increased by $450 billion (3.4%, approximately 611 trillion won). In particular, concerns over government debt have grown in France, where a left-wing coalition that has promised expanded fiscal spending gained power in recent elections. According to the Montaigne Institute, a French think tank, policies proposed by the left-wing coalition New Popular Front (NFP), which secured the largest number of seats in the lower house, such as withdrawing pension reforms and capping prices of essential goods, are estimated to cause an annual fiscal deficit of €179 billion (approximately 268 trillion won). Moreover, seven countries within the Eurozone, including France and Italy, have received warnings from the European Union (EU) due to excessive fiscal deficits.

Japan is also considered a country with serious fiscal debt issues. Although the debt amount decreased by $1 trillion (9.8%, approximately 1,371 trillion won) compared to the previous year, experts diagnose this as an optical illusion caused by the weak yen and strong dollar. When calculating the government debt-to-GDP ratio, Japan ranks second in the world at 254.5%, following Sudan at 280.3%. The Nikkei stated, "Japan's fiscal deficit continues, and debt converted into yen is still increasing." China, where concerns about economic slowdown are growing, saw government debt increase by $1.4 trillion (10.3%, approximately 1,920 trillion won) over the past year.

Especially this year, with many elections held worldwide, there are expectations that debt will increase further. The International Monetary Fund (IMF) reviewed cases from 168 countries and found that fiscal deficits relative to GDP in election years exceed pre-election forecasts by 0.4 percentage points. This is often due to populist pledges such as economic stimulus measures aimed at winning votes.

The IMF analyzed data from the ‘Manifesto Project’ that examines political party pledges and concluded that voters are increasingly demanding fiscal support. Expansionary fiscal pledges, which accounted for just over 10% in advanced countries during the 1960s to 1990s, rose to the 20% range by 2020. Additionally, factors such as aging populations, tax cuts and subsidy policies, and geopolitical risks are also cited as contributors to increasing government debt.

The Nikkei pointed out, "The tightening monetary policy due to high inflation after COVID-19 is prompting countries to reconsider efficient fiscal spending," adding, "It is becoming increasingly important to prioritize expenditures and have the political capability to persuade voters."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)