KOSPI Reclaims 2600 Level on Joint Net Buying by Foreigners and Institutions

Foreigners Continue Net Buying of KOSPI for Second Consecutive Day

Renewed Buying Interest in Semiconductors, Heavily Sold Earlier This Month

As the stock market gradually stabilizes, there are signs that foreigners are turning back. The KOSPI recovered the 2600 level as foreigners engaged in net buying for two consecutive days. With the U.S. inflation data release scheduled for this week, it remains to be seen whether the buying momentum will continue, but it is expected that after digesting these events, the direction of foreign investors' sentiment will become clearer.

According to the Korea Exchange on the 13th, the KOSPI closed at 2,618.30, up 29.87 points (1.15%) from the previous session. It recovered the 2600 level for the first time in six trading days. The index has continued its upward trend for two consecutive days, showing signs of recovering from the shock of the plunge a week ago.

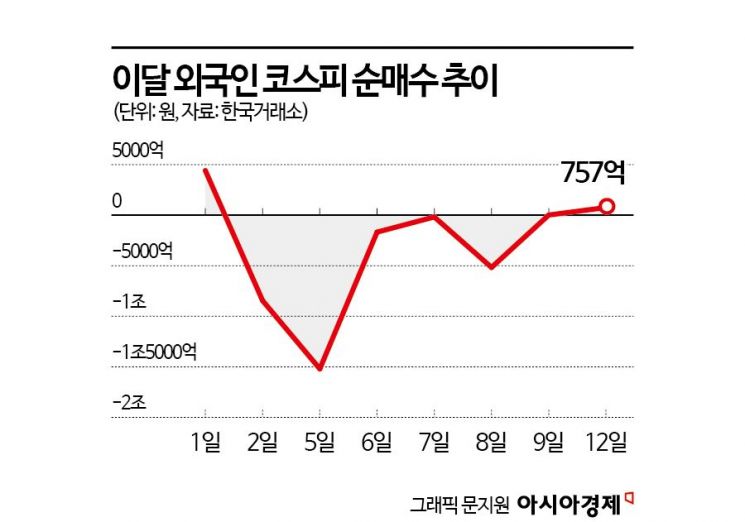

The recovery of the KOSPI above 2600 was led by foreigners and institutions. On that day, foreigners net bought 75.7 billion KRW in the KOSPI market. Following a shift to buying with 1.7 billion KRW on the 9th, they expanded their net buying scale, supporting the KOSPI's rise. Institutions net bought 147.3 billion KRW.

Foreigners, who had led the KOSPI's upward trend with net buying every month except May this year, net sold more than 2.5 trillion KRW this month. This is the largest monthly selling volume. In May, they net sold 1.3 trillion KRW. The global stock market was shaken by concerns over a U.S.-led economic recession and the unwinding of the yen carry trade, which strengthened the preference for safe assets and led to massive selling by foreigners.

However, as the concerns that caused the sharp decline gradually ease and the market regains stability, foreigners appear to be turning around.

In particular, returning foreigners have started buying semiconductors again. From the 9th to the 12th, foreigners net bought SK Hynix worth 247.4 billion KRW, the largest amount, followed by Samsung Electronics with 77.1 billion KRW net buying. Earlier this month, foreigners had focused their selling on semiconductors, net selling Samsung Electronics by 1.7596 trillion KRW and SK Hynix by 394.3 billion KRW. The fact that foreigners are net buying semiconductors again suggests a change in sentiment. In addition, they bought KT&G (59.1 billion KRW), EcoPro BM (44.0 billion KRW), Hanwha Aerospace (42.4 billion KRW), HLB (28.7 billion KRW), SK Biopharm (21.0 billion KRW), POSCO Future M (17.7 billion KRW), EcoPro (16.7 billion KRW), and L&F (15.7 billion KRW).

Ji-won Kim, a researcher at KB Securities, explained, "The KOSPI reclaimed the 2600 level in a week, supported by net buying from both foreigners and institutions," adding, "The strength of large semiconductor stocks such as SK Hynix led the index's rise."

However, it is still difficult to say that foreigners have completely returned. Even on that day, foreigners who were buying more than 400 billion KRW in the futures market turned to selling near the market close.

Nevertheless, there are opinions that the climax of foreign selling has passed. Kyung-min Lee, a researcher at Daishin Securities, said, "Considering that foreign investors net bought 2.6 billion KRW in the KOSPI market from the beginning of the year until the 11th of last month, the scale of selling was limited despite the recession shock," and added, "Since July 10, foreign investors have net sold more than 6 trillion KRW in the futures market, but this mostly cleared the buying volume from April 26 to July 9. I believe they are going through the process of absorbing the 6 trillion KRW worth of supply that has repeatedly occurred in past correction phases. Considering intraday selling, the selling climax may have already passed."

In particular, if the KRW-USD exchange rate stabilizes downward, foreign net buying is expected to resume in earnest. The researcher said, "Recently, the KRW-USD exchange rate entered the 1350 won range, and the weakness of the won against the dollar has reversed to a decline," adding, "When the KRW-USD exchange rate stabilizes downward, foreign net buying will resume."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)