KRW 350 Billion from National Pension, KRW 90 Billion from Military Mutual Aid Association Planned for Investment

Reasons Include Stable Returns and Diversification of Alternative Investments

Competition Expected Among Specialized Asset Managers and Mid-sized PEFs

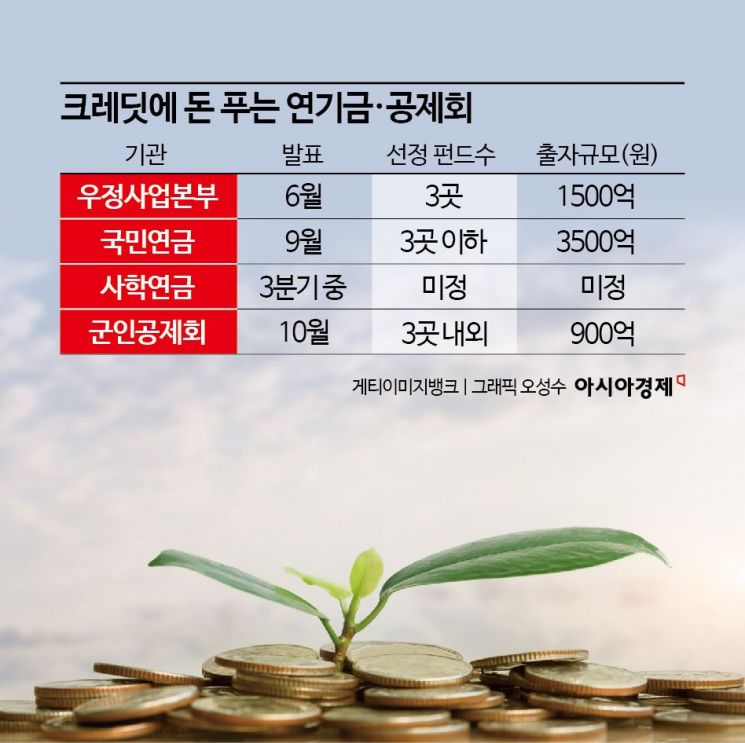

Credit funds are emerging as attractive alternative investment assets for major players in the capital market. Following the Korea Post's signal shot in May by investing 150 billion KRW in three asset management companies, the combined investment scale from pension funds and mutual aid associations is expected to approach 500 billion KRW in the second half of the year alone.

According to the Military Mutual Aid Association on the 12th, it recently announced the recruitment of a domestic credit sector blind fund (raising funds without predetermined investment targets). It plans to select around three asset management companies and invest a total of 90 billion KRW. The National Pension Service plans to finalize the selection of credit and distressed asset fund managers in September, with an investment scale of 350 billion KRW (around three companies). The Teachers' Pension is also reportedly pushing for investment in credit funds in the third quarter.

Military Mutual Aid Association's First Credit Fund Investment... National Pension Service Also Establishes New Fund

Credit funds refer to funds that generate returns by receiving interim dividends or interest through instruments such as loan receivables, convertible bonds (CB), and bonds with warrants (BW). They are classified as medium-risk, medium-return investments. Rather than aiming for high returns, they represent a stable investment strategy with a "downside" floor. For example, in the case of convertible bonds, there is a safety mechanism that allows the principal to be returned if the stock price falls below the conversion price. A representative from a mutual aid association said, "Because it is closely related to credit, it is an attractive product during periods of high interest rates," adding, "Even if interest rates are lowered from September, it is believed that rates will not drop to a fully low-interest level, and investments are being made with this expectation."

This is the first time the Military Mutual Aid Association has invested in credit funds. With an alternative investment ratio reaching 77.1% as of last year, the association appears to have chosen credit funds as part of its asset diversification strategy. Since July, the association has expanded membership eligibility from only non-commissioned officers and above to include enlisted soldiers, which is expected to significantly increase membership. Therefore, there is a need for "new sources of income" to continuously generate stable returns. This is also the first investment project since the appointment of Park Hwajae as the new Chief Investment Officer (CIO) of the Financial Investment Division. Proposals will be accepted until the 21st of this month, with final results to be announced in October.

The National Pension Service has newly established a credit and distressed asset sector within its private investment allocation projects this year, following its existing private equity funds (PEF) and venture capital (VC) sectors. It received proposals from asset managers in July and plans to complete the selection by September. The National Pension Service is continuously seeking investment destinations capable of handling the growing scale of alternative investments. It plans to increase the alternative investment ratio from 13.8% as of last year to around 15% by 2029. The inclusion of distressed assets as well as credit reflects the recent increase in distressed assets, particularly in domestic project financing (PF) and overseas commercial real estate, where values have declined.

Credit Fund Managers to Face Competition from Mid-sized PEFs

Credit funds were previously a domain inaccessible to management participation-type PEF managers. Only specialized investment-type PEFs, so-called "hedge funds," could handle these investment products. With the 2021 revision of the Capital Markets Act, PEFs were classified into institution-only PEFs and general PEFs, allowing institution-only PEFs to form credit funds. Large PEF managers have consecutively established affiliates dedicated to credit funds. Representative examples include IMM Credit & Solution by IMM Private Equity (PE), Glenwood Credit by Glenwood PE, and VIG Alternative Credit by VIG Partners.

These firms are expected to fiercely compete in the credit fund investment projects in the second half of the year, and considering mid-sized PEF managers who faced setbacks in the first half's investment projects, competition is expected to be intense. The PEF industry is currently experiencing a more severe "rich get richer, poor get poorer" phenomenon between large and small firms due to the recent downturn in the market making fundraising (fund raising) more difficult. Since last year, large firms with substantial assets under management (AUM) and strong track records have continued to dominate investment projects.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)