"'Pursuing Sustainable Growth through 'Selection and Concentration''

Steps to Restructure Film Business Amid Chinese Low-Price Offensive"

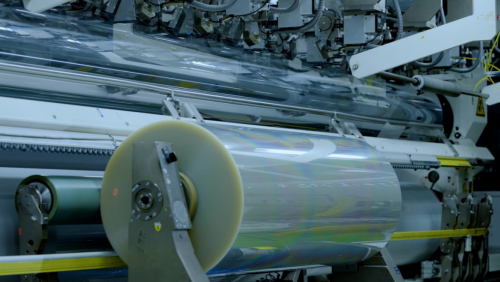

Kolon Industries, a chemical materials company under Kolon Group, is spinning off its deficit-ridden polyester (PET) film business to establish a joint venture (JV) with SK Microsystems. This will create the largest PET film company in South Korea, while also strengthening Kolon Industries' financial stability and improving its business portfolio.

On the 9th, Kolon Industries announced that it held a board meeting the previous day and signed a contract to establish a JV with SK Microsystems by splitting off its PET film business. By combining the PET film businesses of SK Microsystems, the second-largest player in the domestic PET film market as of Q1 this year, and Kolon Industries, the third-largest, the largest PET film manufacturer in South Korea will be born. The domestic market leader is Toray Advanced Materials. The market share difference among the first, second, and third ranks is only about 1 to 2 percentage points.

SK Microsystems was established after the private equity fund (PEF) operator Hahn & Company acquired SKC's PET film business division for 1.6 trillion KRW in 2022.

The JV establishment was pursued as the interests of Hahn & Company, which aims to expand the industrial film sector after acquiring the business, and Kolon Industries, which has been seeking to enhance competitiveness in the film business, aligned. Kolon Industries stated, "The new CEO of the JV is undecided," adding, "We expect to create synergy by combining the film development, production, and sales capabilities accumulated over the years with a company that was previously a competitor."

In this joint venture, Kolon Industries will hold an 18% stake, while SK Microsystems will hold 82%. Since Kolon Industries' stake is less than 20%, the JV's performance will not be reflected in Kolon Industries' consolidated financial statements. The exclusion of the deficit business's results, which has posted losses for two consecutive years, from consolidated earnings will contribute to strengthening financial soundness.

Both companies plan to contribute certain businesses such as industrial films. Kolon Industries will contribute the PET film division of its Gimcheon Plant 1 and its Ulsan-based subsidiary KF&T as in-kind contributions. The valuation is approximately 129.6 billion KRW. The in-kind contribution is scheduled to be completed by the end of December this year.

Kolon Industries and SK Microsystems manufacture PET base films from petrochemical byproducts. Depending on the coating applied, these films are used for various purposes such as packaging materials (food, pharmaceuticals, etc.), electronic devices (printed circuit boards, etc.), and optical films (display polarizing films, etc.). The industrial films that the two companies plan to focus on through the JV are used as insulation for wires and cables, surface protection for construction materials, and waterproofing treatments.

This joint venture represents a strategic partnership combining the technological capabilities and market experience of both companies to expand their presence in the global industrial film market. By separating the loss-making PET film business, Kolon Industries can also expect an improvement in its business portfolio. Kolon Industries' Film and Electronic Materials Division posted a total loss of 157.3 billion KRW in 2022 (86.2 billion KRW) and last year (71.1 billion KRW). Kolon Industries plans to focus on its existing core businesses such as aramid while also exploring new growth engines like hydrogen, secondary batteries, and eco-friendly solutions.

A Kolon Industries official said, "Through the establishment of the JV for the deficit film division, we expect to strengthen the company's competitiveness and improve profitability going forward," adding, "We are applying a 'selection and concentration' management strategy across the company that strengthens existing businesses and continues investment in new growth sectors, and this JV is part of that." The official also stated, "There are currently no plans to adjust other business groups."

Domestic petrochemical companies are following a trend of divesting their core film businesses. SKC sold its PET film business, which was the company's origin, entirely to Hahn & Company, and LG Chem sold its IT film production plants in Cheongju and Ochang, Chungbuk, to a Chinese company in September last year. Hyosung Chemical closed its Daejeon plant, which manufactured nylon films, last year and moved some equipment to its Gumi plant.

The reduction of film businesses by petrochemical companies is due to deteriorating profitability caused by a downturn in the upstream IT industry and aggressive low-price competition from Chinese companies. Toray Advanced Materials and Hwaseung Chemical also produce PET films. However, a Toray Advanced Materials official stated, "There are no plans for business restructuring related to the film business."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)