Stock Prices Rise for 3 Consecutive Days... Most Losses Recovered in Crash Market

Top Spot in Market Cap for Securities Stocks Reclaimed

Active Shareholder Return Policies and Strong Earnings Drive Stock Prices

Mirae Asset Securities is showing strong stock performance due to solid second-quarter results this year and an active shareholder return policy. The strong stock price rally has also helped the company reclaim the top spot in market capitalization among securities firms.

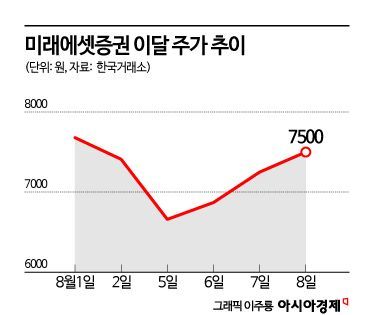

According to the Korea Exchange on the 9th, Mirae Asset Securities closed at 7,500 won, up 250 won (3.45%) from the previous session. The stock price has continued to rise for three consecutive days, nearly recovering the losses from the market crash on the 2nd and 5th. Despite the recent market downturn, Mirae Asset Securities’ stock price fell to the 6,000 won range on the 5th but successfully rebounded to regain the 7,500 won level.

Buoyed by the strong stock price, Mirae Asset Securities also reclaimed the number one position in market capitalization among securities firms. Previously, on the 1st, Mirae Asset Securities had lost the top spot to NH Investment & Securities. Although NH Investment & Securities also rose for three consecutive days recently, its gains were smaller than those of Mirae Asset Securities, resulting in the loss of the top position. As of the closing price on the 8th, Mirae Asset Securities’ market capitalization was 4.4649 trillion won, while NH Investment & Securities’ market capitalization was 4.3884 trillion won.

The strong stock performance of Mirae Asset Securities is attributed to solid second-quarter earnings and an active shareholder return policy. The day before, Mirae Asset Securities announced that its operating profit for the second quarter was 273.3 billion won, a 74.4% increase compared to the same period last year. This figure exceeded market expectations. According to financial information provider FnGuide, the consensus operating profit estimate (average of securities firms’ forecasts) for Mirae Asset Securities in the second quarter was 241.3 billion won. During the same period, sales increased by 18.8% to 4.7247 trillion won, and net profit rose by 42.8% to 201.2 billion won.

The cumulative operating profit for the first half of the year was 543.8 billion won, up 24.0%. On a consolidated basis, equity capital was 11.5 trillion won, pre-tax net profit was 509 billion won, and half-year net profit was 371.7 billion won.

Mirae Asset Securities explained, "Contrary to market concerns about the business environment in the second quarter, expectations of interest rate cuts in the second half of the year were reflected, resulting in stable performance in asset management (WM), platform businesses such as pensions, and overseas operations." The platform business recorded total customer deposits of 423 trillion won, including pension assets of 38 trillion won, overseas stock balances of 30 trillion won, and financial product sales balances of 194 trillion won. Overseas subsidiaries also strengthened their stable business operations, recording the industry’s highest pre-tax profit of 60 billion won in the first half. Regarding overseas operations, the New York branch recorded a 65.6% year-on-year growth in sales and trading (S&T), while the Vietnam and India branches grew by 26.5% and 245.6%, respectively, compared to the same period last year.

In particular, the rapid rise in global benchmark interest rates since 2022 led to value adjustments and revaluations of some investment assets, negatively impacting profitability. However, in the second quarter, valuation gains turned positive. Analyst Ahn Young-jun of Hana Securities said, "Due to rising market interest rates, the value of held assets declined, resulting in poor performance in 2022-2023, but future earnings are expected to improve. Most valuation losses from asset value declines have already been reflected in earnings over the past two years, interest rates have peaked and are now declining, and the overseas stock brokerage market, where Mirae Asset Securities has strengths, is showing strong performance, leading to expected earnings improvement."

Active shareholder return initiatives also supported the strong stock price. On the 7th, Mirae Asset Securities announced plans to repurchase and retire treasury shares to enhance shareholder value. The planned acquisition involves 10 million common shares, representing about 2.2% of the outstanding shares. The company intends to complete the purchase on the market within three months by November 7 and retire the 10 million shares after acquisition. This follows the repurchase and retirement of 10 million shares each in the first half of this year, marking an additional shareholder return effort. Mirae Asset Securities also plans to announce a value-up disclosure during the third quarter. A company representative stated, "We will continue to do our best to grow alongside our shareholders through consistent and predictable shareholder return policies."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.