Competing with 20 trillion CliaLab using LDT kit with 90% cost reduction

Preparing for scale competition through additional acquisition of CliaLab

Overseas sales in Q1 grew 100 times compared to the same period last year

As the number of COVID-19 variant infections rapidly increases worldwide, expectations for the overseas business division of in vitro diagnostics company LabGenomics are growing. Since last year, the company has been expanding investments in the U.S. market to secure new growth drivers and is now delivering tangible results.

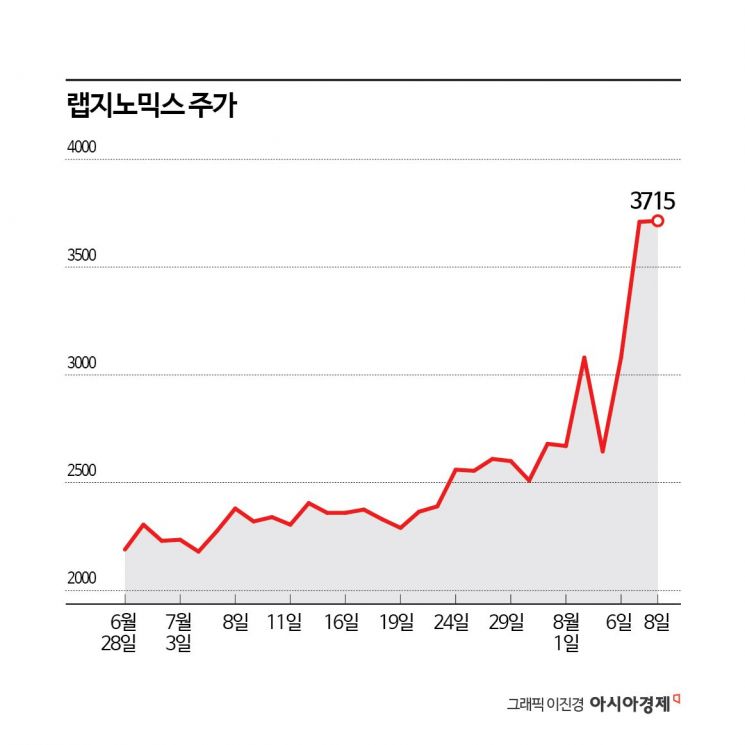

According to the financial investment industry on the 9th, LabGenomics' stock price has risen 38.6% this month. In comparison, the KOSDAQ index fell 7.2% during the same period, indicating a favorable return. This stock price trend is interpreted as reflecting expectations for strong earnings.

LabGenomics is an in vitro diagnostics company specializing in molecular diagnostics, next-generation sequencing (NGS), and personal genetic screening (PGS) services. During the COVID-19 pandemic, demand for polymerase chain reaction (PCR) tests surged, leading to rapid revenue growth.

Private equity firm Luha Private Equity (Luha PE), which acquired LabGenomics last year, has planned to increase the company's corporate value through overseas expansion. By acquiring a large U.S. CLIA lab (Clinical Laboratory Improvement Amendments-certified laboratory), they aim to supply not only their own products but also those of various domestic diagnostic companies, establishing a foothold for 'K-Diagnostics' in the U.S. market. Their goal is to stand shoulder to shoulder with industry leaders such as Labcorp and Quest Diagnostics in the U.S. CLIA lab market, which is worth approximately 70 trillion KRW. Labcorp and Quest Diagnostics are highly valued, with corporate valuations exceeding 20 trillion KRW.

In August last year, LabGenomics acquired 100% of the shares of QDX Pathology Service, a CLIA lab located in New Jersey, for 60 million USD. QDX provides diagnostic services related to gastrointestinal, respiratory, urology, and women's health in regions including New York, New Jersey, and California. With over 20 years of experience, QDX has contracts with major large insurance companies in the U.S. In the first quarter, overseas sales reached 12 billion KRW, growing approximately 100 times compared to the same period last year.

LabGenomics is improving QDX's profitability by producing lab-developed test (LDT) kits. A LabGenomics official stated, "We are developing a total of 13 kits for LDT conversion," adding, "The respiratory LDT kit, developed for the U.S. CLIA lab market and scheduled for its first shipment in September, costs less than 90% of the existing respiratory kits used in the U.S." This is seen as a catalyst for rapid growth based on price competitiveness amid the resurgence of COVID-19. LabGenomics expects that supplying respiratory kits capable of COVID testing, leveraging their technological capabilities, will increase both sales and profits.

Previously, in May 2020, LabGenomics received Emergency Use Authorization (EUA) from the U.S. Food and Drug Administration (FDA) for its COVID PCR kit. The COVID PCR kit is still authorized for use in the U.S. and can diagnose currently prevalent COVID variant viruses.

A LabGenomics representative said, "By internalizing externally procured kits as LDTs, costs decrease and profitability improves," adding, "We are the only domestic company operating a large CLIA lab and are building various strategic partnerships."

After successfully acquiring QDX, LabGenomics plans to acquire additional CLIA labs in the western and central regions of the U.S. The company aims to rapidly narrow the gap with leading competitors by expanding its scale and achieving economies of scale.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.