Consumer Insight 'Mobile Communication Planning Survey'

The subscription rate of Netflix, the undisputed No. 1 in the domestic online video service (OTT) market, is on a downward trend. Coupang Play and TVING have increased their loyal customers through specialized content such as sports broadcasts.

Consumer Insight, a telecommunications research institute, surveyed 3,355 smartphone users aged 14 and older for about four weeks starting in April about their OTT usage experience and satisfaction. Consumer Insight conducts biannual telecommunications planning surveys every year in the first and second halves.

Netflix Subscription Rate Declines for the Second Consecutive Time

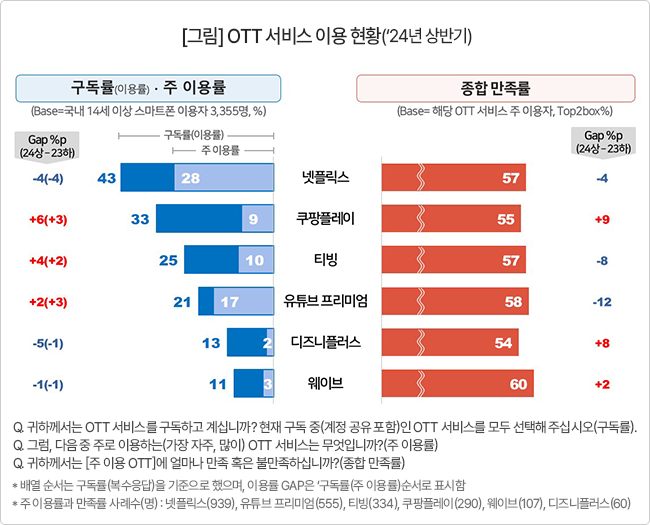

In the first half of this year’s survey, the subscription rates by OTT (multiple responses allowed) were Netflix at 43%, maintaining first place, followed by Coupang Play (33%), TVING (25%), YouTube Premium (21%), Disney Plus (13%), and Wavve (11%).

Although Netflix holds the undisputed top spot, it decreased by 4 percentage points compared to the second half of last year (47%). Following a 2 percentage point drop between the first and second halves of last year, it has been on a downward path for two consecutive periods.

In contrast, Coupang Play rose by 6 percentage points, and TVING increased by 4 percentage points. Coupang Play’s subscription rate was 26% in the second half of last year, trailing Netflix by 21 percentage points, but this time it narrowed the gap to 10 percentage points. During the same period, TVING also reduced the gap with Netflix from 27 percentage points to 18 percentage points.

The main usage rate (the proportion of most frequent and heavy users) was Netflix (28%), YouTube Premium (17%), TVING (10%), Coupang Play (9%), Wavve (3%), and Disney Plus (2%). Netflix dropped by 4 percentage points, while Coupang Play and YouTube Premium each rose by 3 percentage points, and TVING increased by 2 percentage points.

OTT Price Increases Affect Satisfaction

YouTube Premium, Netflix, and TVING all saw declines in overall satisfaction and satisfaction across detailed categories (content, usability, price/product composition/discount benefits).

Commonly, the largest drop was in the 'price/product composition/discount benefits' category. In particular, YouTube Premium plummeted by 13 percentage points in this category. This is presumed to be the aftermath of the 42.6% subscription fee increase in December last year (from 10,450 KRW to 14,900 KRW per month).

Considering that TVING raised its monthly subscription fee by 20% around the same time and Netflix restricted new Basic Membership subscriptions (9,500 KRW per month) along with reducing account sharing, the correlation between pricing changes and satisfaction appears high.

On the other hand, Coupang Play jumped 12 percentage points in price/product composition/discount benefits to become No. 1 (54%), and satisfaction with content (up 9 percentage points) and usability (up 3 percentage points) also increased. This is interpreted as the effect of the most affordable pricing plan (free with Coupang Wow Membership subscription at 4,990 KRW per month) combined with carefully nurtured exclusive sports broadcast content.

Since 2022, Coupang Play has expanded its broadcast coverage from professional soccer leagues such as the K League (Korea) and Bundesliga (Germany) to the Australian National Basketball League (NBL) and the National Football League (NFL) in the United States. TVING started exclusive broadcasting of the Korea Baseball Organization (KBO) in March.

For Coupang Play, the 58% increase in the Coupang Wow Membership monthly fee (from 4,990 KRW to 7,890 KRW) starting this month is a variable. A Consumer Insight official stated, "Although it is a form of free subscription when paying for the shopping membership fee, it is uncertain how cost-sensitive consumers will react."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)