Current Account Balance Forecast as Percentage of GDP Raised from 3.2% to 3.6% This Year

Next Year's Forecast Increased from 3.5% to 3.7%

Inflation Expected to Fall to 1.9% Next Year

In June, South Korea's current account balance recorded the third-largest surplus in history in six years and nine months, raising expectations that the surplus trend will continue in the second half of the year. Major global investment banks (IBs) have also raised their forecasts for South Korea's current account balance for this year and next. They predicted that next year's inflation rate will fall to 1.9%.

According to the Bank of Korea's announcement on the 7th, South Korea's current account balance (provisional) in June was $12.26 billion, marking the largest surplus in six years and nine months since September 2017 ($12.34 billion). The cumulative current account balance for the first half of the year was $37.73 billion, exceeding the Bank of Korea's initial forecast for the first half ($27.9 billion) by about $10 billion. Considering the Bank of Korea's annual current account forecast of $60 billion, about 60% of the target was already achieved in the first half.

The Bank of Korea expects the surplus trend to continue in the second half as well. Song Jae-chang, head of the Financial Statistics Department at the Bank of Korea's Economic Statistics Bureau, said at the June international balance of payments press briefing, "Considering the continued export growth due to the improvement in the global manufacturing economy and the inflow of investment income at a favorable level, the surplus trend is expected to continue for the time being." He added, "However, uncertainties remain high due to geopolitical risks such as the U.S. economy, potential slowdown in AI investment, major countries' monetary policy directions, the U.S. presidential election, and Middle East conflicts."

Major global investment banks (IBs) have also raised their expectations for South Korea's current account surplus this year and next.

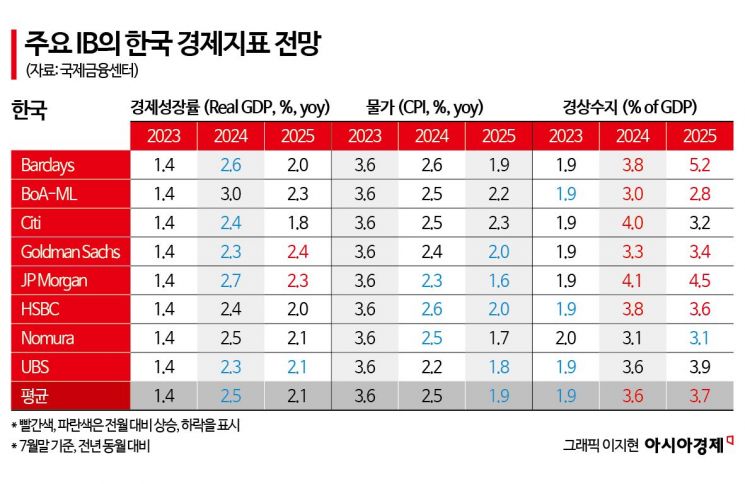

According to the International Finance Center, the average forecast of eight major overseas IBs for South Korea's current account balance as a percentage of GDP this year is 3.6%. This is 0.4 percentage points higher than the forecast at the end of June (3.2%). The forecast for next year's current account balance as a percentage of GDP was also raised by 0.2 percentage points to 3.7% from 3.5% at the end of June.

Specifically, six out of the eight banks raised their expectations for South Korea's current account balance this year. Citibank and JP Morgan raised their forecasts from 3.7% and 3.0% last month to 4.0% and 4.1%, respectively. Barclays raised its forecast from 3.5% to 3.8%, HSBC from 3.0% to 3.8%, Bank of America Merrill Lynch from 2.9% to 3.0%, and Goldman Sachs from 3.1% to 3.3%. Nomura and UBS maintained their previous forecasts at 3.1% and 3.6%, respectively.

For next year's current account balance, five out of the eight banks raised their forecasts. Barclays was the only one to forecast a surplus above 5%, raising its forecast from 4.7% to 5.2%. JP Morgan raised its forecast from 3.4% to 4.5%. HSBC raised its forecast from 3.2% to 3.6%, Goldman Sachs from 3.2% to 3.4%, and Bank of America Merrill Lynch from 2.7% to 2.8%. On the other hand, Nomura was the only bank to lower its forecast from 3.3% to 3.1%. Citibank and UBS maintained their previous forecasts at 3.2% and 3.9%, respectively.

Average Inflation Forecast by 8 IBs for Next Year in Korea Expected to Fall to 1.9%

Meanwhile, three of the eight IBs predicted that South Korea's inflation will slow down faster this year. JP Morgan, HSBC, and Nomura forecasted this year's consumer price index (CPI) inflation rates at 2.3%, 2.6%, and 2.5% year-on-year, respectively, lowering their forecasts from last month's 2.6%, 2.7%, and 2.6%. The other five banks maintained their previous forecasts.

For next year's inflation rate forecast, four of the eight banks lowered their expectations. Goldman Sachs, JP Morgan, HSBC, and UBS revised their CPI inflation forecasts for next year down to 2.0%, 1.6%, 2.0%, and 1.8%, respectively, from last month's 2.1%, 1.7%, 2.1%, and 1.9%.

On the other hand, South Korea's economic growth forecast for this year was revised downward. The average real GDP growth rate forecast by the eight investment banks was lowered by 0.2 percentage points to 2.5% as of the end of last month. This was attributed to a base effect caused by a surprising 1.3% GDP growth in the first quarter, followed by a contraction in the second quarter. Specifically, five of the eight banks lowered their forecasts. Barclays, Citibank, Goldman Sachs, JP Morgan, and UBS revised their forecasts to 2.6%, 2.4%, 2.3%, 2.7%, and 2.3%, respectively, down from last month's 2.7%, 2.5%, 2.5%, 2.8%, and 3.0%.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["I'd Rather Live as a Glamorous Fake Than as a Poor Real Me"...A Grotesque Success Story Shaking the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)