Dimon "US Recession Probability 60%"

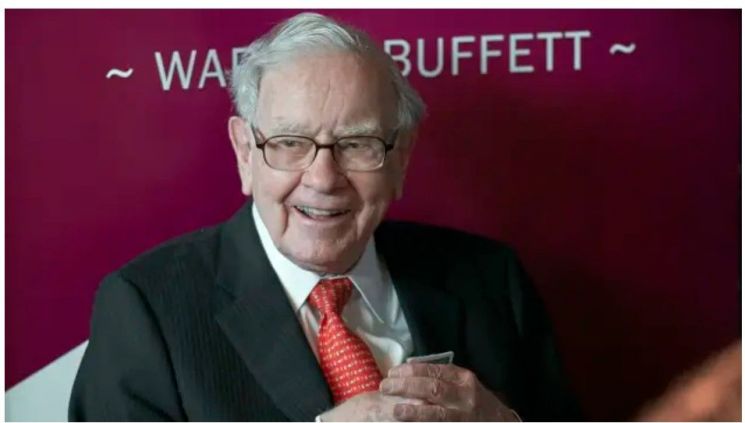

'Investment genius' Warren Buffett's Berkshire Hathaway (hereafter Berkshire) has been found to hold more U.S. short-term Treasury bonds than the U.S. central bank, the Federal Reserve (Fed). As Berkshire has recently sold stocks and increased its cash-equivalent assets, some speculate this could be a warning sign of a crisis.

On the 7th (local time), CNBC reported that an analysis of Berkshire's quarterly financial report showed that as of the end of Q2 this year, the company's holdings of U.S. short-term Treasury bonds amounted to $234.6 billion (approximately 323 trillion KRW). Short-term Treasuries refer to bonds with maturities of less than one year. They are highly liquid and relatively less affected during periods of increased market volatility.

Among these, including bonds with maturities under three months, the total cash and cash-equivalent assets held reached $42 billion (approximately 58 trillion KRW).

Berkshire Hathaway's $234.6 billion holdings in U.S. short-term Treasuries surpass the Fed's holdings in the Treasury market, where the Fed is considered a major player. As of the 31st of last month, the Fed's holdings of U.S. short-term Treasuries stood at $195.3 billion (approximately 269 trillion KRW). Including medium- and long-term bonds and inflation-linked bonds, the Fed's total Treasury holdings amount to $4.4 trillion (approximately 6054 trillion KRW).

CNBC suggested that Buffett likely earned substantial profits from U.S. Treasury investments over the past two years. If Buffett had invested $200 billion (approximately 275 trillion KRW) in three-month Treasuries with a 5% yield over the past two years, he would have earned an annual income of $10 billion (approximately 14 trillion KRW).

Buffett has previously stated that he would directly participate in U.S. short-term Treasury auctions in times of crisis. Recently, Berkshire halved its Apple shares and increased its cash holdings to a record high of $276.9 billion, drawing attention to the reasons behind this move. Amid recession concerns triggered by the July employment report shock, some interpret Berkshire's actions as a warning of an impending economic slowdown and bear market.

Meanwhile, Jamie Dimon, chairman of JP Morgan Chase and known as the 'Emperor of Wall Street,' reaffirmed his previous forecast that the U.S. economy is more likely to enter a recession than achieve a soft landing.

In an interview with CNBC on the same day, when asked whether he had changed his previous view that the market was too optimistic about recession risks, Dimon replied, "The probability is about the same as before." He stated that the likelihood of the U.S. economy successfully achieving a soft landing remains at 35-40%, emphasizing that the chance of a recession is higher than that of a soft landing. Dimon said, "There is a lot of uncertainty," adding, "As I have always pointed out, geopolitics, housing, deficits, spending, quantitative tightening, elections ? all of these are causing confusion in the market."

However, he diagnosed that although credit card delinquency rates are rising, the U.S. has not yet entered a recession.

Regarding future inflation prospects, he expressed some skepticism about whether the Federal Reserve can bring inflation back to its 2% target, reiterating that prices could rebound due to the transition to a green economy and defense spending.

Dimon further stated, "I am fully optimistic that we will be okay whether we experience a mild recession or a more severe one."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.