Telecom Stocks That Protect Profits During Market Declines

Adding AI Growth to Earnings Stability

"Attractive from a Mid- to Long-Term Investment Perspective"

As market volatility increases, defensive stocks such as telecommunications stocks are gaining attention. It is analyzed that they will rise regardless of the overall index trend due to expected solid performance through the second half of the year. Additionally, expansion into business areas based on artificial intelligence (AI) is also anticipated.

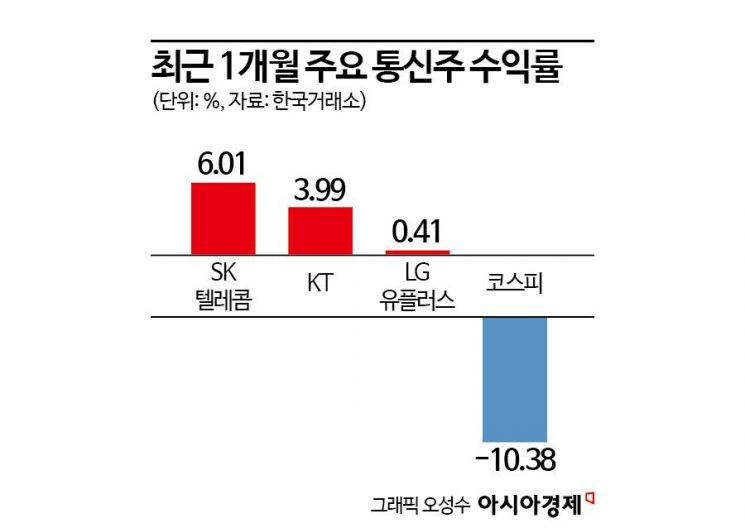

According to the Korea Exchange on the 8th, the KOSPI telecommunications industry index recorded 403.55 based on the previous day's closing price, rising 4.31% over the past month. This contrasts with the KOSPI, which plunged 10.38% during the same period. Looking at individual stocks, SK Telecom (6.01%), KT (3.99%), and LG Uplus (0.41%) show steady performance.

On the 6th, SK Telecom, a leading telecommunications company, announced consolidated second-quarter sales of 4.4224 trillion KRW and operating profit of 537.5 billion KRW for this year. These figures represent increases of 2.7% and 16.0%, respectively, compared to the same period last year. Aram Kim, a researcher at Shinhan Investment Corp., predicted, "Efforts to improve profitability have been proven through results, and there will be further upward revisions to market expectations for profits in the remaining second half." She added, "There are no observed risk factors, so it is very comfortable. It is worth buying without burden in the current phase of increased market volatility," and evaluated it as "sufficiently attractive from a mid- to long-term investment perspective."

Telecommunications stocks, which consistently deliver stable performance like this, are classified as defensive stocks that perform relatively well when the KOSPI is sluggish. Hoi-jae Kim, a researcher at Daishin Securities, said, "Telecommunications stocks can be strong in times of crisis," and "After the index experiences sharp fluctuations and then forms a downward trend, telecommunications stocks generally show strength." He added, "The defensive nature of telecommunications stocks is based on their steady annual profit improvement of about 10% since 2020," and "Since the scope of performance improvement is expected to be greater in the second half of this year, companies confirming favorable results will rise regardless of the index movement."

In addition to the stable profit structure of telecommunications companies, new growth engines based on AI services are also attracting attention. SK Telecom has set a goal to supply AI solutions to public, financial, and manufacturing sectors and achieve annual sales exceeding 60 billion KRW. KT plans to enhance business competitiveness with vertical AI and multiple large language models (LLM) effective in specific industrial sectors to provide customized services. LG Uplus is also strengthening its AI competitiveness by investing 10 billion KRW in a 100% stake in AI solution company FortyTwoMaru.

Jang-won Kim, a researcher at BNK Investment & Securities, said, "The telecommunications industry is adding growth potential through AI based on its existing revenue stability," and "AI will be a means to reduce internal costs and enhance business-to-business (B2B) competitiveness." He continued, "The AI era is a good opportunity for telecommunications operators to expand their business areas," and added, "It is time to change the previously neutral investment opinion on the telecommunications sector."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)