Economic Ministers' Meeting Announces 'Timef Incident Measures'

1.2 Trillion KRW Liquidity Support for Affected Sellers... Full Implementation This Week

Separate 100% Management of Gift Certificate Prepaid Funds

The government will shorten the settlement deadlines for e-commerce companies and mandate that sales proceeds be entrusted to reliable institutions such as banks to prevent a recurrence of the Tmon and Wemakeprice (Timep) incident. For small-scale merchants who suffered losses in this incident, liquidity support totaling 1.2 trillion won, including low-interest loans, will be actively implemented starting this week.

On the 7th, the government announced the "Additional Response Measures and Institutional Improvement Plans for the Tmon and Wemakeprice Unsettled Payment Incident" at the Economic Ministers' Meeting. This measure is a follow-up to the first response plan announced at the Timep incident task force (TF) meeting of related ministries on the 29th of last month, containing directions for institutional improvements to prevent recurrence and damage mitigation plans for consumers and sellers.

Shorter Settlement Deadlines for E-commerce than Large-scale Retailers

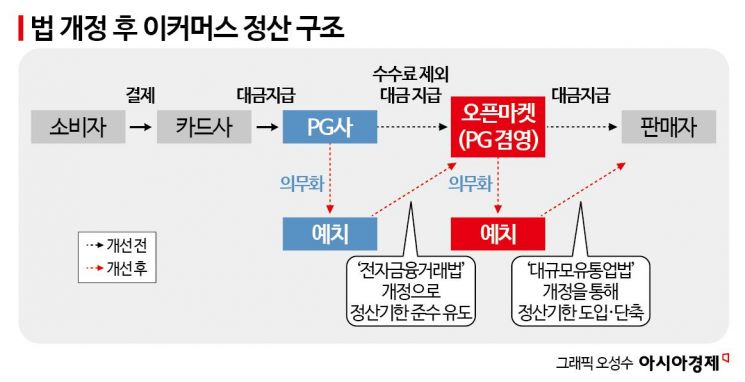

The government identified the root cause of this incident as the fact that e-commerce companies, whose main business is not finance, also act as payment agents, creating opportunities for fund misuse, as well as relatively long settlement cycles. Therefore, it decided to revise related laws such as the Large-scale Distribution Business Act and the Electronic Financial Transactions Act.

First, a shorter settlement deadline will be introduced for e-commerce companies compared to large-scale retailers. By amending the Large-scale Distribution Business Act, which falls under the jurisdiction of the Fair Trade Commission, the government will make it mandatory for e-commerce companies to set settlement deadlines, and impose corrective orders or fines on businesses that violate this.

Large corporate retailers such as E-Mart are currently required under the Large-scale Distribution Business Act to settle sales proceeds within 40 days from the end of the month in which the product was sold (60 days for direct purchases), but e-commerce companies such as Timep, Gmarket, and 11st (telecommunication sales intermediaries) had no such obligation.

A Fair Trade Commission official stated, "We will prepare a partial amendment to the Large-scale Distribution Business Act and submit it to the National Assembly within this month," adding, "The specific deadline will be decided by reflecting opinions from the industry and experts."

The Electronic Financial Transactions Act will be amended to strengthen the registration requirements for electronic payment gateway (PG) companies. If requirements are not met, grounds for sanctions such as corrective measures, suspension of business, or cancellation of registration will be established. Regarding gift certificates, which were identified as a trigger for the spread of damage in this incident, regulations on gift certificate issuers will be strengthened. According to the amended Electronic Financial Transactions Act, which will take effect on the 15th of next month, the exemption criteria for prepaid business registration will be tightened from "issuance balance under 3 billion won" to "issuance balance under 3 billion won and annual total issuance under 50 billion won." The government plans to introduce an obligation for separate management of 100% prepaid funds to ensure refund guarantees even in cases of prepaid business bankruptcy.

An obligation to separately manage sales proceeds will also be newly established. To prevent sales proceeds from being used for other purposes and causing damage to sellers and consumers, e-commerce companies will be required to manage funds through a third-party institution (account). Kang Gi-ryong, Director of Policy Coordination at the Ministry of Economy and Finance, explained, "E-commerce companies or PG companies will separately manage a certain percentage of sales proceeds through deposits, trusts, or payment guarantee insurance," adding, "The applicable targets and percentages will be determined through industry and expert meetings."

Refunds for General Product Buyers Within This Week

The government estimates that the delayed settlement amount related to the Timep incident is approximately 278.3 billion won (as of the 1st), and including transactions in June and July with settlement deadlines approaching, the total damage is expected to reach 1 trillion won. The government believes that about 80% of the total damage amount involves small losses under 10 million won.

Regarding general product damages estimated at a minimum of 6 billion won, refunds will be processed through credit card companies and PG companies within this week. For group dispute mediation related to travel and gift certificate damages, applications will be accepted and mediation procedures will begin within this week. However, since there is no legal basis to force companies to comply with mediation outcomes, and because the assets and claims of the two Timep companies are frozen due to rehabilitation procedures, it is expected to take considerable time before actual damage relief is achieved.

Liquidity support for affected companies will also be actively implemented starting this week. First, the Small Enterprise and Market Service (SEMAS) and the Korea SMEs and Startups Agency (KOSME) will provide 200 billion won in emergency management stabilization funds. KOSME will support up to 1 billion won per company (interest rate 3.4%), and SEMAS will support up to 150 million won (3.51%). Industrial Bank of Korea and Korea Credit Guarantee Fund will offer up to 300 billion won in guaranteed loans, providing funds up to 3 billion won per company at preferential interest rates of 3.9% to 4.5%. Local governments will also use their resources to provide 600 billion won in emergency management stabilization funds.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)