LG Household & Health Care's 'China' vs Amorepacific's 'Americas' Surge

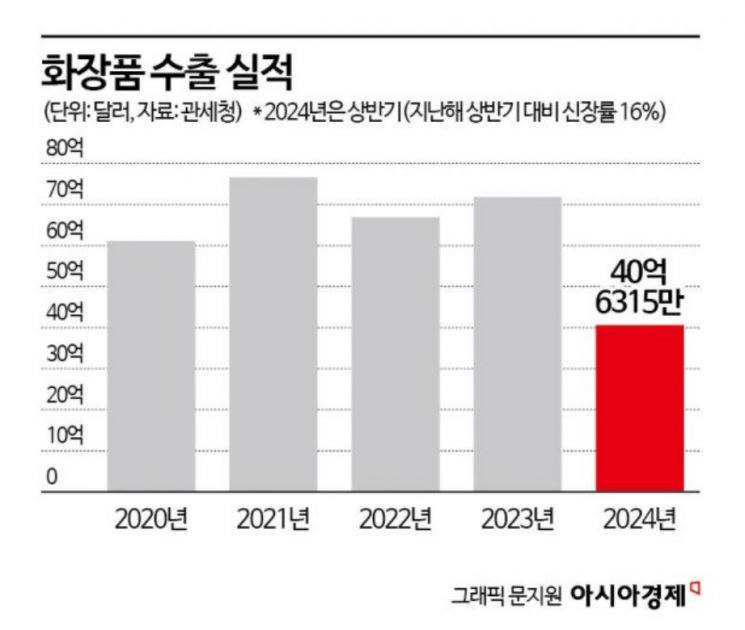

Cosmetics Exports Reach 6 Trillion KRW in H1...16% Increase YoY

Domestic Demand in China Weak, but Shipments to US and Southeast Asia Rise

ODM Companies Expected to Achieve Double-Digit Growth

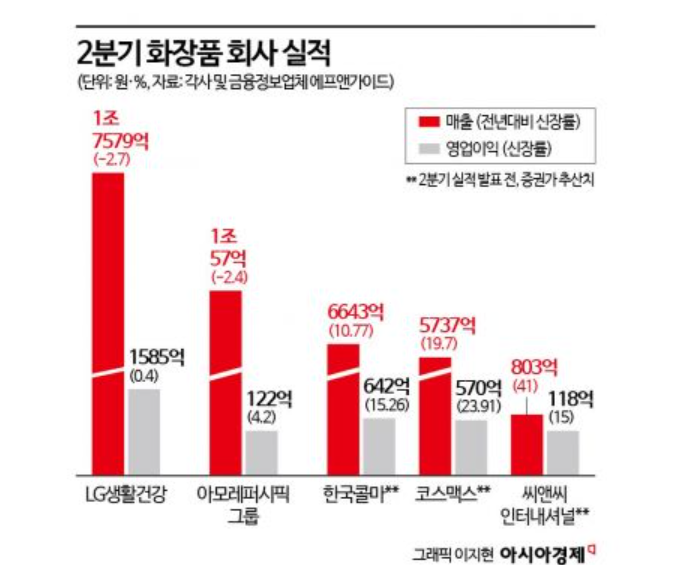

As K-Beauty creates a global sensation, domestic cosmetics companies are showing varying results for the second quarter of this year. Amorepacific Group and LG Household & Health Care have made strides in the U.S. and Chinese markets, respectively, laying the groundwork for a resurgence. Korean contract manufacturers Korea Kolmar and Cosmax, which produce indie brand cosmetics popular overseas, are expected to achieve record-high performances.

According to the Korea Customs Service on the 7th, cosmetics export performance in the first half of this year reached $4.06315 billion (approximately 6 trillion KRW), a 16% increase from $3.4918 billion (approximately 5 trillion KRW) in the same period last year. This represents an increase of about 1 trillion KRW.

By country, exports to China were the largest at $1.05067 billion, followed by the U.S. ($718.3 million), Japan ($390.6 million), Vietnam ($240,000), Hong Kong ($230,000), Russia ($316 million), Taiwan ($165.21 million), and Thailand ($146.54 million). Among these, the U.S. export growth rate reached 60%, followed by Taiwan (37%), Vietnam (19%), and Japan (18%). Exports to China decreased by 22% during the same period due to sluggish domestic consumption.

Korea Kolmar and Cosmax Expected to Benefit from K-Beauty

These export results are expected to benefit ODM companies manufacturing indie brand cosmetics. According to securities firms, Korea Kolmar is estimated to record sales of 664.3 billion KRW and operating profit of 64.2 billion KRW in the second quarter. This would be the highest quarterly performance, representing increases of 11% and 15% respectively compared to the same period last year. This is attributed to a significant increase in exports by domestic clients. The company has strengths in sun care products, and it is estimated that product orders have greatly increased thanks to the summer peak season effect. The Chinese subsidiary is expected to continue facing sluggish business conditions, while the North American and Canadian subsidiaries have yet to generate meaningful sales following business streamlining. Yeonwoo is expected to deliver solid results as it has expanded its portfolio from large cosmetics brands to indie brand clients.

Cosmax is expected to record sales of 573.7 billion KRW and operating profit of 57 billion KRW in the second quarter, representing increases of 20% and 24% respectively compared to the same period last year. Although the Chinese subsidiary likely experienced reduced profits due to deepening domestic sluggishness, high sales growth is expected from domestic and Southeast Asian subsidiaries. Domestic sales growth is driven by the rise of indie brands, while in Southeast Asia, a strong preference for Korean ODM companies is expected to increase their contribution to performance.

Meanwhile, ODM company CNC International, which has already announced its results, is expected to record sales of 80.3 billion KRW and operating profit of 11.8 billion KRW in the second quarter, increases of 41% and 15% respectively compared to the same period last year. CNC International specializes in color cosmetics and counts domestic and international brands such as Amorepacific, L'Or?al, Clio, and Dior among its clients. With the increase in overseas orders from indie brands, the Yongin factory is reportedly scheduled to be completed in August, three months ahead of the original plan.

Amorepacific Benefits from Cosrx Acquisition, LG Household & Health Care Targets China with 'The History of Whoo'

Large cosmetics companies that have already announced their results are laying the foundation for a rebound.

Amorepacific recorded sales of 1.0057 trillion KRW in the second quarter, a 2.4% decrease compared to the same period last year. However, operating profit increased by 4.2% to 12.2 billion KRW. This was thanks to subsidiaries Innisfree and O'Sulloc turning profitable and achieving profit growth of over 250% respectively, due to marketing cost efficiencies. However, the main affiliate Amorepacific recorded sales of 904.8 billion KRW, down 4.3% year-on-year, and operating profit sharply declined by 30% to 4.2 billion KRW. Considering market estimates of 1.0152 trillion KRW in sales and 69.5 billion KRW in operating profit, the results were somewhat disappointing.

Domestic business sluggishness and restructuring in the Greater China market appear to have negatively impacted performance. Amorepacific's domestic business sales were 511.9 billion KRW, down about 8% from last year. Sales of luxury cosmetics such as Sulwhasoo and Hera declined due to reduced duty-free sales, and daily beauty brands like Illiyoon and Labo H saw sharp sales drops as their portfolios were reorganized. Reflecting marketing costs and others, operating profit in the domestic segment decreased by 59%.

However, Amorepacific's overseas sales grew 2.5% year-on-year to 381.5 billion KRW. Although sales in Greater China fell by 44%, sales in other Asian regions, the Americas, and Europe, Middle East & Africa (EMEA) surged by 25% and 83% respectively. Particularly, sales in the Americas increased from 73.9 billion KRW to 121.8 billion KRW, reflecting the effect of the Cosrx acquisition. The EMEA region recorded sales of 37.3 billion KRW, a growth rate of 182%. Laneige officially launched in the UK beauty retail channel 'Boots,' and Cosrx expanded channels to new countries such as Sweden and Poland. An Amorepacific Group official stated, "We will structurally normalize the Chinese market and focus on nurturing global growth markets such as the U.S., UK, Japan, and India. We will also seek acquisition opportunities to strengthen our brand portfolio."

LG Household & Health Care recorded sales of 191.2 billion KRW in the Chinese market, a 5.5% increase year-on-year. While efforts to diversify sales by strengthening operations in North America and Japan are underway, results have yet to materialize. Sales in the North American market were 157.7 billion KRW, down 17% year-on-year, and sales in Japan also decreased by about 5% to 98.7 billion KRW.

Among LG Household & Health Care's cosmetics sales, 53% come from the luxury brand The History of Whoo. The History of Whoo is expected to have benefited from sales growth by launching the 4th generation Bicheop Ja Saeng Essence in the Chinese market in May. The 4th generation Bicheop Ja Saeng Essence features NAD+, an anti-aging ingredient developed over 10 years of research.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)